After several tireless days we have finished crunching the numbers from nearly 900 13F filings issued by the elite hedge funds and other investment firms that we track at Insider Monkey, which disclosed those firms’ equity portfolios as of September 30th. The results of that effort will be put on display in this article, as we share valuable insight into the smart money sentiment towards Kulicke and Soffa Industries Inc. (NASDAQ:KLIC).

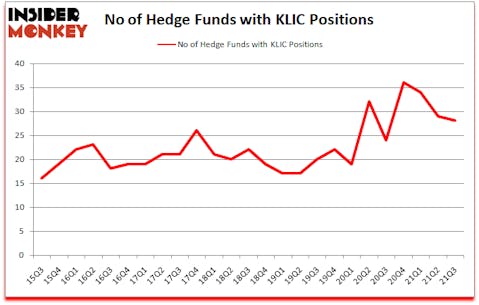

Kulicke and Soffa Industries Inc. (NASDAQ:KLIC) was in 28 hedge funds’ portfolios at the end of the third quarter of 2021. The all time high for this statistic is 36. KLIC shareholders have witnessed a decrease in activity from the world’s largest hedge funds recently. There were 29 hedge funds in our database with KLIC positions at the end of the second quarter. Our calculations also showed that KLIC isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings).

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, lithium prices have more than doubled over the past year, so we go through lists like the 10 best EV stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. Keeping this in mind let’s check out the new hedge fund action regarding Kulicke and Soffa Industries Inc. (NASDAQ:KLIC).

Michael Gelband of ExodusPoint Capital

Do Hedge Funds Think KLIC Is A Good Stock To Buy Now?

At third quarter’s end, a total of 28 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -3% from the second quarter of 2021. The graph below displays the number of hedge funds with bullish position in KLIC over the last 25 quarters. With hedgies’ capital changing hands, there exists a select group of key hedge fund managers who were upping their holdings considerably (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Royce & Associates, managed by Chuck Royce, holds the biggest position in Kulicke and Soffa Industries Inc. (NASDAQ:KLIC). Royce & Associates has a $128.4 million position in the stock, comprising 1% of its 13F portfolio. The second largest stake is held by Fisher Asset Management, managed by Ken Fisher, which holds a $33.4 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Remaining professional money managers with similar optimism encompass Renaissance Technologies, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital and Steven Baughman’s Divisar Capital. In terms of the portfolio weights assigned to each position Divisar Capital allocated the biggest weight to Kulicke and Soffa Industries Inc. (NASDAQ:KLIC), around 7.52% of its 13F portfolio. SW Investment Management is also relatively very bullish on the stock, dishing out 5.8 percent of its 13F equity portfolio to KLIC.

Seeing as Kulicke and Soffa Industries Inc. (NASDAQ:KLIC) has experienced declining sentiment from hedge fund managers, logic holds that there lies a certain “tier” of hedge funds who sold off their positions entirely in the third quarter. It’s worth mentioning that Seth Wunder’s Black-and-White Capital dumped the biggest investment of the “upper crust” of funds monitored by Insider Monkey, comprising an estimated $13.2 million in stock, and Leung Chi Kit’s Kadensa Capital was right behind this move, as the fund dropped about $3.9 million worth. These transactions are important to note, as total hedge fund interest was cut by 1 funds in the third quarter.

Let’s now take a look at hedge fund activity in other stocks similar to Kulicke and Soffa Industries Inc. (NASDAQ:KLIC). These stocks are Oscar Health, Inc. (NYSE:OSCR), ACI Worldwide Inc (NASDAQ:ACIW), Brookfield Business Partners L.P. (NYSE:BBU), B2Gold Corp (NYSE:BTG), Haemonetics Corporation (NYSE:HAE), CMC Materials, Inc. (NASDAQ:CCMP), and BigCommerce Holdings, Inc. (NASDAQ:BIGC). This group of stocks’ market valuations resemble KLIC’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| OSCR | 17 | 947585 | 1 |

| ACIW | 28 | 570658 | 2 |

| BBU | 3 | 3988 | -1 |

| BTG | 16 | 176379 | 1 |

| HAE | 29 | 442772 | -1 |

| CCMP | 22 | 191132 | 0 |

| BIGC | 21 | 616202 | 0 |

| Average | 19.4 | 421245 | 0.3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 19.4 hedge funds with bullish positions and the average amount invested in these stocks was $421 million. That figure was $322 million in KLIC’s case. Haemonetics Corporation (NYSE:HAE) is the most popular stock in this table. On the other hand Brookfield Business Partners L.P. (NYSE:BBU) is the least popular one with only 3 bullish hedge fund positions. Kulicke and Soffa Industries Inc. (NASDAQ:KLIC) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for KLIC is 75.4. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 31.1% in 2021 through December 9th and still beat the market by 5.1 percentage points. Hedge funds were also right about betting on KLIC as the stock returned 17.2% since the end of Q3 (through 12/9) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Kulicke & Soffa Industries Inc (NASDAQ:KLIC)

Follow Kulicke & Soffa Industries Inc (NASDAQ:KLIC)

Receive real-time insider trading and news alerts

Suggested Articles:

- 10 Best Stocks To Buy For 2021

- 20 Most Deadliest and Dangerous Snakes In the World

- 15 Biggest Islands On Earth

Disclosure: None. This article was originally published at Insider Monkey.