World-class money managers like Ken Griffin and Barry Rosenstein only invest their wealthy clients’ money after undertaking a rigorous examination of any potential stock. They are particularly successful in this regard when it comes to small-cap stocks, which their peerless research gives them a big information advantage on when it comes to judging their worth. It’s not surprising then that they generate their biggest returns from these stocks and invest more of their money in these stocks on average than other investors. It’s also not surprising then that we pay close attention to these picks ourselves and have built a market-beating investment strategy around them.

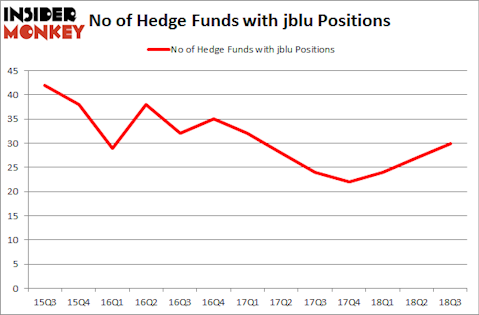

JetBlue Airways Corporation (NASDAQ:JBLU) was in 30 hedge funds’ portfolios at the end of the third quarter of 2018. JBLU investors should be aware of an increase in enthusiasm from smart money lately. There were 27 hedge funds in our database with JBLU holdings at the end of the previous quarter. Our calculations also showed that jblu isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 6.3% year to date (through December 3rd) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 18 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s take a glance at the fresh hedge fund action encompassing JetBlue Airways Corporation (NASDAQ:JBLU).

How are hedge funds trading JetBlue Airways Corporation (NASDAQ:JBLU)?

At the end of the third quarter, a total of 30 of the hedge funds tracked by Insider Monkey were long this stock, a change of 11% from the previous quarter. The graph below displays the number of hedge funds with bullish position in JBLU over the last 13 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, AQR Capital Management, managed by Cliff Asness, holds the number one position in JetBlue Airways Corporation (NASDAQ:JBLU). AQR Capital Management has a $139.8 million position in the stock, comprising 0.1% of its 13F portfolio. Sitting at the No. 2 spot is Jim Simons of Renaissance Technologies, with a $62.3 million position; the fund has 0.1% of its 13F portfolio invested in the stock. Some other professional money managers that hold long positions include Paul Reeder and Edward Shapiro’s PAR Capital Management, Keith Meister’s Corvex Capital and Hari Hariharan’s NWI Management.

As one would reasonably expect, key money managers were leading the bulls’ herd. Stelliam Investment Management, managed by Ross Margolies, assembled the most outsized position in JetBlue Airways Corporation (NASDAQ:JBLU). Stelliam Investment Management had $22.5 million invested in the company at the end of the quarter. Ross Margolies’s Stelliam Investment Management also made a $13.7 million investment in the stock during the quarter. The following funds were also among the new JBLU investors: Mike Masters’s Masters Capital Management, Lee Ainslie’s Maverick Capital, and Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital.

Let’s now take a look at hedge fund activity in other stocks similar to JetBlue Airways Corporation (NASDAQ:JBLU). We will take a look at New Residential Investment Corp (NYSE:NRZ), USG Corporation (NYSE:USG), Curtiss-Wright Corp. (NYSE:CW), and Centennial Resource Development, Inc. (NASDAQ:CDEV). This group of stocks’ market valuations are closest to JBLU’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NRZ | 16 | 115070 | -3 |

| USG | 21 | 2111110 | 0 |

| CW | 22 | 362531 | 1 |

| CDEV | 21 | 418805 | 2 |

| Average | 20 | 751879 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 20 hedge funds with bullish positions and the average amount invested in these stocks was $752 million. That figure was $560 million in JBLU’s case. Curtiss-Wright Corp. (NYSE:CW) is the most popular stock in this table. On the other hand New Residential Investment Corp (NYSE:NRZ) is the least popular one with only 16 bullish hedge fund positions. Compared to these stocks JetBlue Airways Corporation (NASDAQ:JBLU) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.