There are several ways to beat the market, and investing in small cap stocks has historically been one of them. We like to improve the odds of beating the market further by examining what famous hedge fund operators such as Carl Icahn and George Soros think. Those hedge fund operators make billions of dollars each year by hiring the best and the brightest to do research on stocks, including small cap stocks that big brokerage houses simply don’t cover. Because of Carl Icahn and other elite funds’ exemplary historical records, we pay attention to their small cap picks. In this article, we use hedge fund filing data to analyze InfraREIT Inc (NYSE:HIFR).

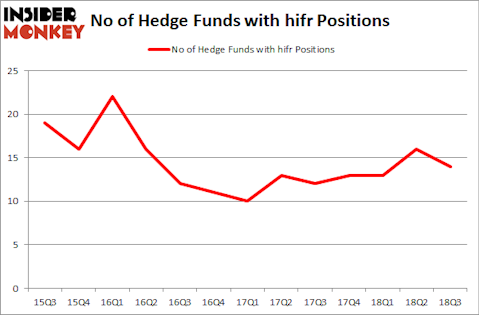

InfraREIT Inc (NYSE:HIFR) was in 14 hedge funds’ portfolios at the end of the third quarter of 2018. HIFR has seen a decrease in activity from the world’s largest hedge funds lately. There were 16 hedge funds in our database with HIFR holdings at the end of the previous quarter. Our calculations also showed that hifr isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 6.3% year to date (through December 3rd) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 18 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s take a look at the recent hedge fund action surrounding InfraREIT Inc (NYSE:HIFR).

What does the smart money think about InfraREIT Inc (NYSE:HIFR)?

At Q3’s end, a total of 14 of the hedge funds tracked by Insider Monkey were long this stock, a change of -13% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards HIFR over the last 13 quarters. With the smart money’s sentiment swirling, there exists an “upper tier” of noteworthy hedge fund managers who were boosting their holdings considerably (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Phill Gross and Robert Atchinson’s Adage Capital Management has the largest position in InfraREIT Inc (NYSE:HIFR), worth close to $67 million, amounting to 0.1% of its total 13F portfolio. The second most bullish fund manager is Millennium Management, led by Israel Englander, holding a $9.4 million position; less than 0.1%% of its 13F portfolio is allocated to the company. Other professional money managers with similar optimism encompass Dmitry Balyasny’s Balyasny Asset Management, Noam Gottesman’s GLG Partners and D. E. Shaw’s D E Shaw.

Seeing as InfraREIT Inc (NYSE:HIFR) has experienced a decline in interest from the entirety of the hedge funds we track, it’s safe to say that there was a specific group of hedgies that elected to cut their entire stakes by the end of the third quarter. Intriguingly, ZilvinasáMecelis’s Covalis Capital dropped the largest stake of all the hedgies monitored by Insider Monkey, worth an estimated $1.6 million in stock. Peter Rathjens, Bruce Clarke and John Campbell’s fund, Arrowstreet Capital, also said goodbye to its stock, about $1.4 million worth. These bearish behaviors are interesting, as aggregate hedge fund interest fell by 2 funds by the end of the third quarter.

Let’s now take a look at hedge fund activity in other stocks similar to InfraREIT Inc (NYSE:HIFR). We will take a look at Kenon Holdings Ltd. (NYSE:KEN), Consolidated Communications Holdings Inc (NASDAQ:CNSL), WideOpenWest, Inc. (NYSE:WOW), and Ambac Financial Group, Inc. (NASDAQ:AMBC). This group of stocks’ market valuations match HIFR’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| KEN | 1 | 1562 | 0 |

| CNSL | 10 | 8677 | -1 |

| WOW | 11 | 41409 | -1 |

| AMBC | 21 | 180511 | 2 |

| Average | 10.75 | 58040 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 10.75 hedge funds with bullish positions and the average amount invested in these stocks was $58 million. That figure was $113 million in HIFR’s case. Ambac Financial Group, Inc. (NASDAQ:AMBC) is the most popular stock in this table. On the other hand Kenon Holdings Ltd. (NYSE:KEN) is the least popular one with only 1 bullish hedge fund positions. InfraREIT Inc (NYSE:HIFR) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard, AMBC might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.