Does Harris Corporation (NYSE:HRS) represent a good buying opportunity at the moment? Let’s quickly check the hedge fund interest towards the company. Hedge fund firms constantly search out bright intellectuals and highly-experienced employees and throw away millions of dollars on satellite photos and other research activities, so it is no wonder why they tend to generate millions in profits each year. It is also true that some hedge fund players fail inconceivably on some occasions, but net net their stock picks have been generating superior risk-adjusted returns on average over the years.

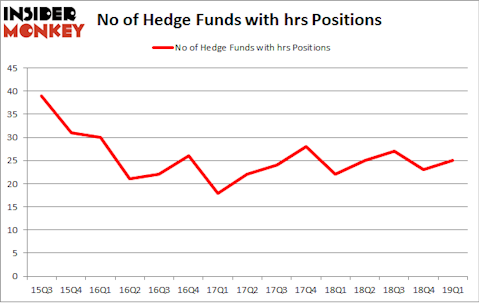

Harris Corporation (NYSE:HRS) has seen an increase in hedge fund sentiment lately. Our calculations also showed that hrs isn’t among the 30 most popular stocks among hedge funds.

In the eyes of most investors, hedge funds are viewed as underperforming, outdated investment tools of years past. While there are greater than 8000 funds with their doors open today, Our experts hone in on the aristocrats of this club, around 750 funds. These investment experts watch over most of the hedge fund industry’s total asset base, and by following their unrivaled picks, Insider Monkey has formulated many investment strategies that have historically outrun the broader indices. Insider Monkey’s flagship hedge fund strategy outstripped the S&P 500 index by around 5 percentage points per annum since its inception in May 2014 through the end of May. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 30.9% since February 2017 (through May 30th) even though the market was up nearly 24% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 11.9% in less than a couple of weeks whereas our long picks outperformed the market by 2 percentage points in this volatile 2 week period.

Let’s check out the key hedge fund action encompassing Harris Corporation (NYSE:HRS).

What have hedge funds been doing with Harris Corporation (NYSE:HRS)?

At the end of the first quarter, a total of 25 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 9% from the fourth quarter of 2018. By comparison, 22 hedge funds held shares or bullish call options in HRS a year ago. With hedge funds’ sentiment swirling, there exists a select group of key hedge fund managers who were boosting their stakes substantially (or already accumulated large positions).

The largest stake in Harris Corporation (NYSE:HRS) was held by Citadel Investment Group, which reported holding $380.7 million worth of stock at the end of March. It was followed by Holocene Advisors with a $108.8 million position. Other investors bullish on the company included Point72 Asset Management, Millennium Management, and Renaissance Technologies.

Now, key money managers were breaking ground themselves. SAYA Management, managed by Anand More, assembled the most valuable position in Harris Corporation (NYSE:HRS). SAYA Management had $24 million invested in the company at the end of the quarter. Louis Bacon’s Moore Global Investments also initiated a $5 million position during the quarter. The following funds were also among the new HRS investors: Josh Donfeld and David Rogers’s Castle Hook Partners, John Brandmeyer’s Cognios Capital, and Matthew Hulsizer’s PEAK6 Capital Management.

Let’s now take a look at hedge fund activity in other stocks similar to Harris Corporation (NYSE:HRS). We will take a look at American Water Works Company, Inc. (NYSE:AWK), Pembina Pipeline Corp (NYSE:PBA), Splunk Inc (NASDAQ:SPLK), and Freeport-McMoRan Inc. (NYSE:FCX). This group of stocks’ market valuations match HRS’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AWK | 28 | 609712 | 0 |

| PBA | 15 | 102666 | 1 |

| SPLK | 29 | 317583 | 4 |

| FCX | 42 | 1413867 | -1 |

| Average | 28.5 | 610957 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 28.5 hedge funds with bullish positions and the average amount invested in these stocks was $611 million. That figure was $784 million in HRS’s case. Freeport-McMoRan Inc. (NYSE:FCX) is the most popular stock in this table. On the other hand Pembina Pipeline Corp (NYSE:PBA) is the least popular one with only 15 bullish hedge fund positions. Harris Corporation (NYSE:HRS) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. A small number of hedge funds were also right about betting on HRS as the stock returned 17.4% during the same time frame and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.