“Market volatility has picked up again over the past few weeks. Headlines highlight risks regarding interest rates, the Fed, China, house prices, auto sales, trade wars, and more. Uncertainty abounds. But doesn’t it always? I have no view on whether the recent volatility will continue for a while, or whether the market will be back at all-time highs before we know it. I remain focused on preserving and growing our capital, and continue to believe that the best way to do so is via a value-driven, concentrated, patient approach. I shun consensus holdings, rich valuations, and market fads, in favor of solid, yet frequently off-the-beaten-path, businesses run by excellent, aligned management teams, purchased at deep discounts to intrinsic value,” are the words of Maran Capital’s Dan Roller. His stock picks have been beating the S&P 500 Index handily. We pay attention to what hedge funds are doing in a particular stock before considering a potential investment because it works for us. So let’s take a glance at the smart money sentiment towards GreenTree Hospitality Group Ltd. (NYSE:GHG) and see how it was affected.

GreenTree Hospitality Group Ltd. (NYSE:GHG) shares haven’t seen a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 11 hedge funds’ portfolios at the end of the third quarter of 2018. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Group 1 Automotive, Inc. (NYSE:GPI), Hollysys Automation Technologies Ltd (NASDAQ:HOLI), and to gather more data points.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s review the recent hedge fund action encompassing GreenTree Hospitality Group Ltd. (NYSE:GHG).

Hedge fund activity in GreenTree Hospitality Group Ltd. (NYSE:GHG)

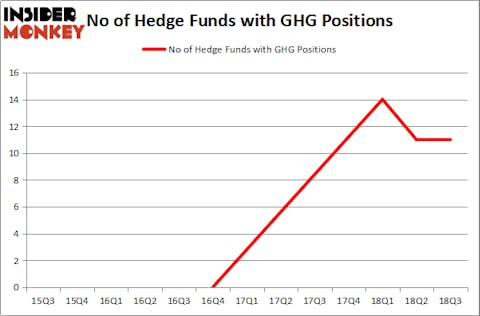

At Q3’s end, a total of 11 of the hedge funds tracked by Insider Monkey were long this stock, no change from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in GHG over the last 13 quarters. With hedgies’ positions undergoing their usual ebb and flow, there exists an “upper tier” of noteworthy hedge fund managers who were adding to their stakes meaningfully (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Daniel Patrick Gibson’s Sylebra Capital Management has the largest position in GreenTree Hospitality Group Ltd. (NYSE:GHG), worth close to $8.3 million, corresponding to 0.5% of its total 13F portfolio. Coming in second is Guardian Point Capital, led by Tim David, holding a $3.8 million position; 1.5% of its 13F portfolio is allocated to the company. Remaining peers that are bullish contain Richard Driehaus’s Driehaus Capital, Sander Gerber’s Hudson Bay Capital Management and Michael R. Weisberg’s Crestwood Capital Management.

Judging by the fact that GreenTree Hospitality Group Ltd. (NYSE:GHG) has faced declining sentiment from hedge fund managers, logic holds that there were a few money managers that elected to cut their full holdings by the end of the third quarter. Interestingly, Anand Parekh’s Alyeska Investment Group cut the largest stake of the “upper crust” of funds monitored by Insider Monkey, totaling close to $11.1 million in stock. Lei Zhang’s fund, Hillhouse Capital Management, also said goodbye to its stock, about $7.7 million worth. These transactions are intriguing to say the least, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as GreenTree Hospitality Group Ltd. (NYSE:GHG) but similarly valued. We will take a look at Group 1 Automotive, Inc. (NYSE:GPI), Hollysys Automation Technologies Ltd (NASDAQ:HOLI), NextGen Healthcare, Inc. (NASDAQ:NXGN), and Northern Oil & Gas, Inc. (NYSEAMEX:NOG). This group of stocks’ market values resemble GHG’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GPI | 21 | 159990 | 6 |

| HOLI | 16 | 90830 | -2 |

| NXGN | 13 | 29759 | 13 |

| NOG | 17 | 150684 | 2 |

| Average | 16.75 | 107816 | 4.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.75 hedge funds with bullish positions and the average amount invested in these stocks was $108 million. That figure was $26 million in GHG’s case. Group 1 Automotive, Inc. (NYSE:GPI) is the most popular stock in this table. On the other hand 0 is the least popular one with only 13 bullish hedge fund positions. Compared to these stocks GreenTree Hospitality Group Ltd. (NYSE:GHG) is even less popular than NXGN. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: None. This article was originally published at Insider Monkey.