In this article we will check out the progression of hedge fund sentiment towards Essex Property Trust Inc (NYSE:ESS) and determine whether it is a good investment right now. We at Insider Monkey like to examine what billionaires and hedge funds think of a company before spending days of research on it. Given their 2 and 20 payment structure, hedge funds have more incentives and resources than the average investor. The funds have access to expert networks and get tips from industry insiders. They also employ numerous Ivy League graduates and MBAs. Like everyone else, hedge funds perform miserably at times, but their consensus picks have historically outperformed the market after risk adjustments.

Essex Property Trust Inc (NYSE:ESS) shares haven’t seen a lot of action during the second quarter. Overall, hedge fund sentiment was unchanged. The stock was in 21 hedge funds’ portfolios at the end of the third quarter of 2021. Our calculations also showed that ESS isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings). At the end of this article we will also compare ESS to other stocks including MGM Resorts International (NYSE:MGM), Trimble Inc. (NASDAQ:TRMB), and KeyCorp (NYSE:KEY) to get a better sense of its popularity.

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, lithium prices have more than doubled over the past year, so we go through lists like the 10 best EV stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. Keeping this in mind we’re going to check out the recent hedge fund action encompassing Essex Property Trust Inc (NYSE:ESS).

Do Hedge Funds Think ESS Is A Good Stock To Buy Now?

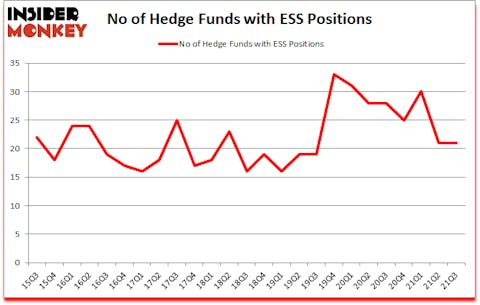

At Q3’s end, a total of 21 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from the previous quarter. The graph below displays the number of hedge funds with bullish position in ESS over the last 25 quarters. With hedge funds’ sentiment swirling, there exists a few key hedge fund managers who were upping their stakes substantially (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Millennium Management, managed by Israel Englander, holds the largest position in Essex Property Trust Inc (NYSE:ESS). Millennium Management has a $58 million position in the stock, comprising less than 0.1%% of its 13F portfolio. The second largest stake is held by Waterfront Capital Partners, led by Eduardo Abush, holding a $49.8 million position; the fund has 3.5% of its 13F portfolio invested in the stock. Other members of the smart money that hold long positions comprise Greg Poole’s Echo Street Capital Management, Ryan Tolkin (CIO)’s Schonfeld Strategic Advisors and Anand Parekh’s Alyeska Investment Group. In terms of the portfolio weights assigned to each position Waterfront Capital Partners allocated the biggest weight to Essex Property Trust Inc (NYSE:ESS), around 3.51% of its 13F portfolio. Gillson Capital is also relatively very bullish on the stock, setting aside 1.35 percent of its 13F equity portfolio to ESS.

Since Essex Property Trust Inc (NYSE:ESS) has experienced falling interest from the smart money, we can see that there were a few money managers that slashed their positions entirely in the third quarter. It’s worth mentioning that Renaissance Technologies cut the biggest stake of the 750 funds monitored by Insider Monkey, worth an estimated $18.7 million in stock. Matthew Crandall Gilman’s fund, Hill Winds Capital, also dumped its stock, about $4.8 million worth. These moves are intriguing to say the least, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Essex Property Trust Inc (NYSE:ESS) but similarly valued. We will take a look at MGM Resorts International (NYSE:MGM), Trimble Inc. (NASDAQ:TRMB), KeyCorp (NYSE:KEY), Fresenius Medical Care AG & Co. KGaA (NYSE:FMS), Baker Hughes Company (NASDAQ:BKR), W.W. Grainger, Inc. (NYSE:GWW), and Live Nation Entertainment, Inc. (NYSE:LYV). All of these stocks’ market caps are closest to ESS’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MGM | 50 | 2740827 | -9 |

| TRMB | 34 | 1814792 | 7 |

| KEY | 36 | 399496 | -4 |

| FMS | 4 | 231694 | -1 |

| BKR | 37 | 1013933 | -3 |

| GWW | 28 | 306060 | -1 |

| LYV | 47 | 1308167 | 7 |

| Average | 33.7 | 1116424 | -0.6 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 33.7 hedge funds with bullish positions and the average amount invested in these stocks was $1116 million. That figure was $264 million in ESS’s case. MGM Resorts International (NYSE:MGM) is the most popular stock in this table. On the other hand Fresenius Medical Care AG & Co. (NYSE:FMS) is the least popular one with only 4 bullish hedge fund positions. Essex Property Trust Inc (NYSE:ESS) is not the least popular stock in this group but hedge fund interest is still below average. Our overall hedge fund sentiment score for ESS is 42.6. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 29.6% in 2021 and still beat the market by 3.6 percentage points. A small number of hedge funds were also right about betting on ESS as the stock returned 10.8% since the end of the third quarter (through 12/31) and outperformed the market by an even larger margin.

Follow Essex Property Trust Inc. (NYSE:ESS)

Follow Essex Property Trust Inc. (NYSE:ESS)

Receive real-time insider trading and news alerts

Suggested Articles:

- 10 Best Sporting Goods Stocks To Buy Now

- 10 Best Undervalued Stocks to Buy Now

- 30 Most Expensive Cities in the US to Rent a House

Disclosure: None. This article was originally published at Insider Monkey.