After several tireless days we have finished crunching the numbers from the more than 700 13F filings issued by the elite hedge funds and other investment firms that we track at Insider Monkey, which disclosed those firms’ equity portfolios as of September 30. The results of that effort will be put on display in this article, as we share valuable insight into the smart money sentiment towards Crescent Point Energy Corp (NYSE:CPG).

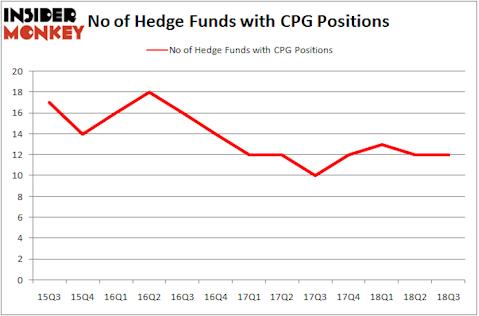

Crescent Point Energy Corp (NYSE:CPG) shares haven’t seen a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 12 hedge funds’ portfolios at the end of September. At the end of this article we will also compare CPG to other stocks including CVR Energy, Inc. (NYSE:CVI), Performance Food Group Company (NYSE:PFGC), and John Wiley & Sons Inc (NYSE:JW) to get a better sense of its popularity.

In today’s marketplace there are a large number of indicators market participants have at their disposal to evaluate publicly traded companies. Two of the best indicators are hedge fund and insider trading signals. Our researchers have shown that, historically, those who follow the top picks of the best hedge fund managers can trounce the S&P 500 by a solid margin (see the details here).

We’re going to take a glance at the new hedge fund action regarding Crescent Point Energy Corp (NYSE:CPG).

How have hedgies been trading Crescent Point Energy Corp (NYSE:CPG)?

At the end of the third quarter, a total of 12 of the hedge funds tracked by Insider Monkey were bullish on this stock, representing no change from the previous quarter. By comparison, 12 hedge funds held shares or bullish call options in CPG heading into this year. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Crescent Point Energy Corp (NYSE:CPG) was held by Encompass Capital Advisors, which reported holding $33.8 million worth of stock at the end of September. It was followed by Arrowstreet Capital with a $10.5 million position. Other investors bullish on the company included Citadel Investment Group, Millennium Management, and AQR Capital Management.

Because Crescent Point Energy Corp (NYSE:CPG) has faced a decline in interest from hedge fund managers, it’s easy to see that there exists a select few hedge funds that slashed their positions entirely by the end of the third quarter. At the top of the heap, Peter Muller’s PDT Partners cut the biggest investment of the 700 funds tracked by Insider Monkey, valued at about $4.2 million in stock. Jim Simons’s fund, Renaissance Technologies, also dumped its stock, about $2.8 million worth. These moves are important to note, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s also examine hedge fund activity in other stocks similar to Crescent Point Energy Corp (NYSE:CPG). We will take a look at CVR Energy, Inc. (NYSE:CVI), Performance Food Group Company (NYSE:PFGC), John Wiley & Sons Inc (NYSE:JW), and Alteryx, Inc. (NYSE:AYX). This group of stocks’ market caps match CPG’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CVI | 21 | 3056087 | 3 |

| PFGC | 23 | 225495 | 5 |

| JW | 15 | 138842 | -7 |

| AYX | 26 | 681553 | 8 |

| Average | 21.25 | 1025494 | 2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 21.25 hedge funds with bullish positions and the average amount invested in these stocks was $1.03 billion. That figure was $62 million in CPG’s case. Alteryx, Inc. (NYSE:AYX) is the most popular stock in this table. On the other hand John Wiley & Sons Inc (NYSE:JW) is the least popular one with only 15 bullish hedge fund positions. Compared to these stocks Crescent Point Energy Corp (NYSE:CPG) is even less popular than JW. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: None. This article was originally published at Insider Monkey.