Is Clipper Realty Inc. (NYSE:CLPR) a good stock to buy right now? We at Insider Monkey like to examine what billionaires and hedge funds think of a company before doing days of research on it. Given their 2 and 20 payment structure, hedge funds have more resources than the average investor. The funds have access to expert networks and get tips from industry insiders. They also have numerous Ivy League graduates and MBAs. Like everyone else, hedge funds perform miserably at times, but their consensus picks have historically outperformed the market after risk adjustments.

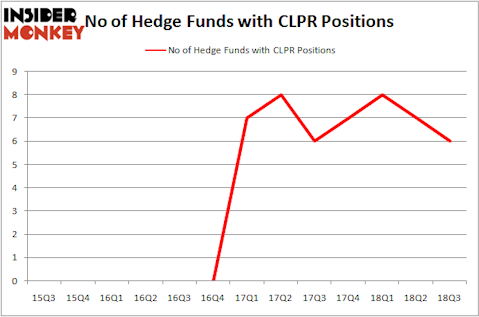

Is Clipper Realty Inc. (NYSE:CLPR) a bargain? Hedge funds are taking a bearish view. The number of bullish hedge fund bets were trimmed by 1 lately. Our calculations also showed that CLPR isn’t among the 30 most popular stocks among hedge funds.

If you’d ask most investors, hedge funds are viewed as unimportant, old investment vehicles of the past. While there are greater than 8,000 funds with their doors open today, Our experts look at the upper echelon of this club, around 700 funds. It is estimated that this group of investors shepherd bulk of the smart money’s total asset base, and by observing their highest performing equity investments, Insider Monkey has identified numerous investment strategies that have historically outpaced the S&P 500 index. Insider Monkey’s flagship hedge fund strategy outstripped the S&P 500 index by 6 percentage points annually since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

We’re going to view the recent hedge fund action surrounding Clipper Realty Inc. (NYSE:CLPR).

Hedge fund activity in Clipper Realty Inc. (NYSE:CLPR)

At Q3’s end, a total of 6 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -14% from the second quarter of 2018. By comparison, 7 hedge funds held shares or bullish call options in CLPR heading into this year. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Derek C. Schrier’s Indaba Capital Management has the largest position in Clipper Realty Inc. (NYSE:CLPR), worth close to $23.6 million, comprising 7.1% of its total 13F portfolio. Coming in second is Forward Management, led by J. Alan Reid, Jr., holding a $12.9 million position; 2.2% of its 13F portfolio is allocated to the stock. Remaining members of the smart money that hold long positions comprise Paul J. Isaac’s Arbiter Partners Capital Management, Peter S. Park’s Park West Asset Management and Jim Simons’s Renaissance Technologies.

Seeing as Clipper Realty Inc. (NYSE:CLPR) has witnessed falling interest from hedge fund managers, logic holds that there is a sect of hedgies that slashed their entire stakes in the third quarter. It’s worth mentioning that David Einhorn’s Greenlight Capital cut the largest position of the 700 funds watched by Insider Monkey, totaling an estimated $6.2 million in stock. Bruce Berkowitz’s fund, Fairholme (FAIRX), also said goodbye to its stock, about $2.4 million worth. These moves are interesting, as aggregate hedge fund interest dropped by 1 funds in the third quarter.

Let’s go over hedge fund activity in other stocks similar to Clipper Realty Inc. (NYSE:CLPR). We will take a look at TransGlobe Energy Corporation (NASDAQ:TGA), Vitamin Shoppe Inc (NYSE:VSI), Neon Therapeutics, Inc. (NASDAQ:NTGN), and Pulse Biosciences, Inc (NASDAQ:PLSE). All of these stocks’ market caps are closest to CLPR’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TGA | 4 | 11705 | 1 |

| VSI | 15 | 81897 | 2 |

| NTGN | 7 | 21414 | -6 |

| PLSE | 3 | 1203 | 1 |

| Average | 7.25 | 29055 | -0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 7.25 hedge funds with bullish positions and the average amount invested in these stocks was $29 million. That figure was $55 million in CLPR’s case. Vitamin Shoppe Inc (NYSE:VSI) is the most popular stock in this table. On the other hand Pulse Biosciences, Inc (NASDAQ:PLSE) is the least popular one with only 3 bullish hedge fund positions. Clipper Realty Inc. (NYSE:CLPR) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard VSI might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.