A whopping number of 13F filings filed with U.S. Securities and Exchange Commission has been processed by Insider Monkey so that individual investors can look at the overall hedge fund sentiment towards the stocks included in their watchlists. These freshly-submitted public filings disclose money managers’ equity positions as of the end of the three-month period that ended September 30, so let’s proceed with the discussion of the hedge fund sentiment on Check Point Software Technologies Ltd. (NASDAQ:CHKP).

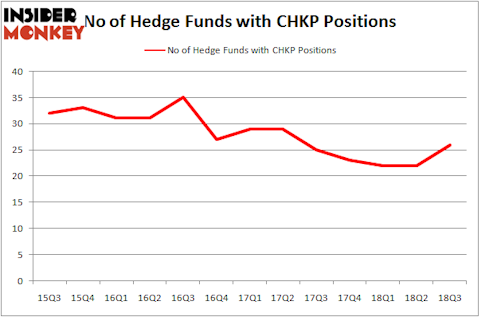

Check Point Software Technologies Ltd. (NASDAQ:CHKP) shareholders have witnessed an increase in hedge fund sentiment lately. Our calculations also showed that CHKP isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are numerous indicators stock traders employ to value their stock investments. A pair of the less known indicators are hedge fund and insider trading sentiment. Our researchers have shown that, historically, those who follow the best picks of the elite hedge fund managers can outperform the S&P 500 by a significant margin (see the details here).

We’re going to take a gander at the latest hedge fund action regarding Check Point Software Technologies Ltd. (NASDAQ:CHKP).

Hedge fund activity in Check Point Software Technologies Ltd. (NASDAQ:CHKP)

At Q3’s end, a total of 26 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 18% from one quarter earlier. By comparison, 23 hedge funds held shares or bullish call options in CHKP heading into this year. With the smart money’s capital changing hands, there exists a few notable hedge fund managers who were upping their holdings considerably (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital has the biggest position in Check Point Software Technologies Ltd. (NASDAQ:CHKP), worth close to $271.6 million, accounting for 0.6% of its total 13F portfolio. Coming in second is Alyeska Investment Group, managed by Anand Parekh, which holds a $188.7 million position; the fund has 2.2% of its 13F portfolio invested in the stock. Other professional money managers that are bullish consist of Noam Gottesman’s GLG Partners, John Overdeck and David Siegel’s Two Sigma Advisors and Ken Griffin’s Citadel Investment Group.

Now, some big names have jumped into Check Point Software Technologies Ltd. (NASDAQ:CHKP) headfirst. Bailard Inc, managed by Thomas Bailard, initiated the most outsized position in Check Point Software Technologies Ltd. (NASDAQ:CHKP). Bailard Inc had $7.5 million invested in the company at the end of the quarter. Lee Ainslie’s Maverick Capital also initiated a $7.1 million position during the quarter. The other funds with new positions in the stock are Dmitry Balyasny’s Balyasny Asset Management, D. E. Shaw’s D E Shaw, and Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Check Point Software Technologies Ltd. (NASDAQ:CHKP) but similarly valued. We will take a look at Fifth Third Bancorp (NASDAQ:FITB), Microchip Technology Incorporated (NASDAQ:MCHP), WPP plc (NYSE:WPP), and CA, Inc. (NASDAQ:CA). This group of stocks’ market caps resemble CHKP’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FITB | 24 | 444468 | -4 |

| MCHP | 23 | 885716 | -7 |

| WPP | 8 | 32596 | -1 |

| CA | 36 | 1554974 | 15 |

| Average | 22.75 | 729439 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 22.75 hedge funds with bullish positions and the average amount invested in these stocks was $729 million. That figure was $814 million in CHKP’s case. CA, Inc. (NASDAQ:CA) is the most popular stock in this table. On the other hand WPP plc (NYSE:WPP) is the least popular one with only 8 bullish hedge fund positions. Check Point Software Technologies Ltd. (NASDAQ:CHKP) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard CA might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.