Looking for stocks with high upside potential? Just follow the big players within the hedge fund industry. Why should you do so? Let’s take a brief look at what statistics have to say about hedge funds’ stock picking abilities to illustrate. The Standard and Poor’s 500 Index returned approximately 5.7% in the 12 months ending October 26 (including dividend payments). Conversely, hedge funds’ 30 preferred S&P 500 stocks (as of June 2014) generated a return of 15.1% during the same 12-month period, with 53% of these stock picks outperforming the broader market benchmark. Coincidence? It might happen to be so, but it is unlikely. Our research covering the last 18 years indicates that hedge funds’ stock picks generate superior risk-adjusted returns. That’s why we believe it is wise to check hedge fund activity before you invest your time or your savings on a stock like Capitol Investment Corp. IV (NYSE:CIC).

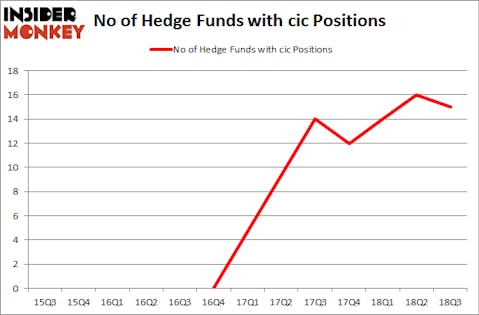

Is Capitol Investment Corp. IV (NYSE:CIC) the right pick for your portfolio? The best stock pickers are taking a pessimistic view. The number of long hedge fund positions shrunk by 1 recently. Our calculations also showed that cic isn’t among the 30 most popular stocks among hedge funds. CIC was in 15 hedge funds’ portfolios at the end of September. There were 16 hedge funds in our database with CIC positions at the end of the previous quarter.

At the moment there are a large number of formulas investors have at their disposal to value stocks. Some of the less known formulas are hedge fund and insider trading signals. Our researchers have shown that, historically, those who follow the top picks of the top investment managers can outpace their index-focused peers by a very impressive amount (see the details here).

We’re going to analyze the new hedge fund action regarding Capitol Investment Corp. IV (NYSE:CIC).

Hedge fund activity in Capitol Investment Corp. IV (NYSE:CIC)

At Q3’s end, a total of 15 of the hedge funds tracked by Insider Monkey were long this stock, a change of -6% from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in CIC over the last 13 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists a select group of key hedge fund managers who were upping their holdings substantially (or already accumulated large positions).

More specifically, Alyeska Investment Group was the largest shareholder of Capitol Investment Corp. IV (NYSE:CIC), with a stake worth $17.8 million reported as of the end of September. Trailing Alyeska Investment Group was Fir Tree, which amassed a stake valued at $17.8 million. Arrowgrass Capital Partners, Angelo Gordon & Co, and Governors Lane were also very fond of the stock, giving the stock large weights in their portfolios.

Because Capitol Investment Corp. IV (NYSE:CIC) has faced bearish sentiment from the aggregate hedge fund industry, it’s safe to say that there exists a select few money managers who were dropping their full holdings heading into Q3. At the top of the heap, John M. Angelo and Michael L. Gordon’s Angelo Gordon & Co cut the largest position of the 700 funds tracked by Insider Monkey, comprising an estimated $16.9 million in stock, and Glenn Russell Dubin’s Highbridge Capital Management was right behind this move, as the fund said goodbye to about $13.4 million worth. These transactions are important to note, as total hedge fund interest fell by 1 funds heading into Q3.

Let’s go over hedge fund activity in other stocks similar to Capitol Investment Corp. IV (NYSE:CIC). These stocks are Greenlight Capital Re, Ltd. (NASDAQ:GLRE), Haverty Furniture Companies, Inc. (NYSE:HVT), Just Energy Group, Inc. (NYSE:JE), and Old Second Bancorp Inc. (NASDAQ:OSBC). This group of stocks’ market caps resemble CIC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GLRE | 7 | 7148 | 0 |

| HVT | 10 | 79009 | 1 |

| JE | 12 | 14045 | 1 |

| OSBC | 11 | 33757 | 3 |

| Average | 10 | 33490 | 1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 10 hedge funds with bullish positions and the average amount invested in these stocks was $33 million. That figure was $163 million in CIC’s case. Just Energy Group, Inc. (NYSE:JE) is the most popular stock in this table. On the other hand Greenlight Capital Re, Ltd. (NASDAQ:GLRE) is the least popular one with only 7 bullish hedge fund positions. Compared to these stocks Capitol Investment Corp. IV (NYSE:CIC) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.