Is Bank of N.T. Butterfield & Son Limited (The) (NYSE:NTB) a good stock to buy right now? We at Insider Monkey like to examine what billionaires and hedge funds think of a company before doing days of research on it. Given their 2 and 20 payment structure, hedge funds have more resources than the average investor. The funds have access to expert networks and get tips from industry insiders. They also have numerous Ivy League graduates and MBAs. Like everyone else, hedge funds perform miserably at times, but their consensus picks have historically outperformed the market after risk adjustments.

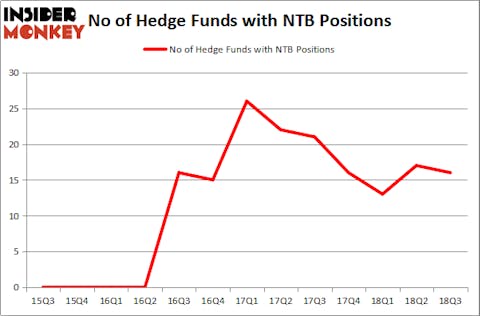

Bank of N.T. Butterfield & Son Limited (The) (NYSE:NTB) shareholders have witnessed a decrease in hedge fund interest in recent months. NTB was in 16 hedge funds’ portfolios at the end of the third quarter of 2018. There were 17 hedge funds in our database with NTB holdings at the end of the previous quarter. Our calculations also showed that NTB isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 6.3% year to date (through December 3rd) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 18 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to take a peek at the key hedge fund action regarding Bank of N.T. Butterfield & Son Limited (The) (NYSE:NTB).

Hedge fund activity in Bank of N.T. Butterfield & Son Limited (The) (NYSE:NTB)

At the end of the third quarter, a total of 16 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -6% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in NTB over the last 13 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Southpoint Capital Advisors was the largest shareholder of Bank of N.T. Butterfield & Son Limited (The) (NYSE:NTB), with a stake worth $88.2 million reported as of the end of September. Trailing Southpoint Capital Advisors was Millennium Management, which amassed a stake valued at $45.5 million. Alyeska Investment Group, Two Sigma Advisors, and Castine Capital Management were also very fond of the stock, giving the stock large weights in their portfolios.

Due to the fact that Bank of N.T. Butterfield & Son Limited (The) (NYSE:NTB) has faced bearish sentiment from the aggregate hedge fund industry, it’s safe to say that there is a sect of fund managers who were dropping their full holdings last quarter. Intriguingly, Ken Griffin’s Citadel Investment Group dumped the largest position of all the hedgies watched by Insider Monkey, valued at close to $2.4 million in stock. Glenn Russell Dubin’s fund, Highbridge Capital Management, also dumped its stock, about $1.7 million worth. These transactions are important to note, as total hedge fund interest was cut by 1 funds last quarter.

Let’s now review hedge fund activity in other stocks similar to Bank of N.T. Butterfield & Son Limited (The) (NYSE:NTB). These stocks are Denbury Resources Inc. (NYSE:DNR), Columbia Banking System Inc (NASDAQ:COLB), Cyberark Software Ltd (NASDAQ:CYBR), and Ironwood Pharmaceuticals, Inc. (NASDAQ:IRWD). This group of stocks’ market valuations resemble NTB’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| DNR | 21 | 286316 | 3 |

| COLB | 11 | 132802 | 2 |

| CYBR | 24 | 407866 | 7 |

| IRWD | 17 | 316714 | 1 |

| Average | 18.25 | 285925 | 3.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18.25 hedge funds with bullish positions and the average amount invested in these stocks was $286 million. That figure was $243 million in NTB’s case. Cyberark Software Ltd (NASDAQ:CYBR) is the most popular stock in this table. On the other hand Columbia Banking System Inc (NASDAQ:COLB) is the least popular one with only 11 bullish hedge fund positions. Bank of N.T. Butterfield & Son Limited (The) (NYSE:NTB) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard CYBR might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.