Insider Monkey has processed numerous 13F filings of hedge funds and famous investors to create an extensive database of hedge fund holdings. The 13F filings show the hedge funds and investors’ positions as of the end of the third quarter. You can find write-ups about an individual hedge fund’s trades on numerous financial news websites. However, in this article we will take a look at their collective moves and analyze what the smart money thinks of Avery Dennison Corporation (NYSE:AVY) based on that data.

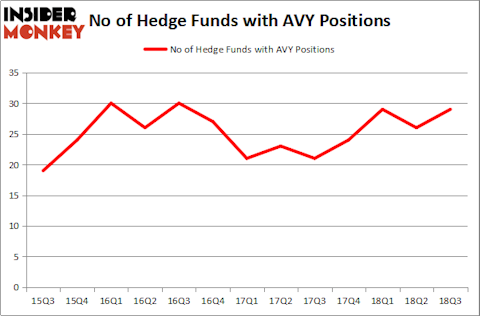

Avery Dennison Corporation (NYSE:AVY) investors should pay attention to an increase in hedge fund sentiment in recent months. AVY was in 29 hedge funds’ portfolios at the end of the third quarter of 2018. There were 26 hedge funds in our database with AVY holdings at the end of the previous quarter. Our calculations also showed that AVY isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a lot of gauges stock traders put to use to size up publicly traded companies. A duo of the most useful gauges are hedge fund and insider trading interest. We have shown that, historically, those who follow the best picks of the top investment managers can trounce the market by a significant amount (see the details here).

Let’s analyze the recent hedge fund action encompassing Avery Dennison Corporation (NYSE:AVY).

How have hedgies been trading Avery Dennison Corporation (NYSE:AVY)?

At Q3’s end, a total of 29 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 12% from the second quarter of 2018. Below, you can check out the change in hedge fund sentiment towards AVY over the last 13 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Avery Dennison Corporation (NYSE:AVY) was held by Citadel Investment Group, which reported holding $111.1 million worth of stock at the end of September. It was followed by Adage Capital Management with a $78.9 million position. Other investors bullish on the company included AQR Capital Management, Point72 Asset Management, and Millennium Management.

As industrywide interest jumped, specific money managers were leading the bulls’ herd. Echo Street Capital Management, managed by Greg Poole, established the largest position in Avery Dennison Corporation (NYSE:AVY). Echo Street Capital Management had $18.4 million invested in the company at the end of the quarter. Jeffrey Talpins’s Element Capital Management also initiated a $2.9 million position during the quarter. The other funds with new positions in the stock are Roger Ibbotson’s Zebra Capital Management, Brandon Haley’s Holocene Advisors, and George Zweig, Shane Haas and Ravi Chander’s Signition LP.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Avery Dennison Corporation (NYSE:AVY) but similarly valued. These stocks are Tyler Technologies, Inc. (NYSE:TYL), Shaw Communications Inc (NYSE:SJR), Coty Inc (NYSE:COTY), and Invesco Ltd. (NYSE:IVZ). All of these stocks’ market caps are similar to AVY’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TYL | 22 | 752257 | 2 |

| SJR | 16 | 200046 | 3 |

| COTY | 24 | 286361 | 10 |

| IVZ | 27 | 283714 | 8 |

| Average | 22.25 | 380595 | 5.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 22.25 hedge funds with bullish positions and the average amount invested in these stocks was $380.60 billion. That figure was $463 million in AVY’s case. Invesco Ltd. (NYSE:IVZ) is the most popular stock in this table. On the other hand Shaw Communications Inc (NYSE:SJR) is the least popular one with only 16 bullish hedge fund positions. Compared to these stocks Avery Dennison Corporation (NYSE:AVY) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.