Before putting in our own effort and resources into finding a good investment, we can quickly utilize hedge fund expertise to give us a quick glimpse of whether that stock could make for a good addition to our portfolios. The odds are not exactly stacked in investors’ favor when it comes to beating the market, as evidenced by the fact that less than 49% of the stocks in the S&P 500 did so during the 12-month period ending October 30. The stats were even worse in recent years when most of the advances in the market were due to large gains by FAANG stocks. However, one bright side for individual investors was the strong performance of hedge funds’ top consensus picks. This year hedge funds’ top 30 stock picks outperformed the S&P 500 Index by 4 percentage points through the middle of November. Thus, we can see that the tireless research and efforts of hedge funds to identify winning stocks can work to our advantage when we know how to use the data. While not all of their picks will be winners, our odds are much better following their best stock picks than trying to go it alone.

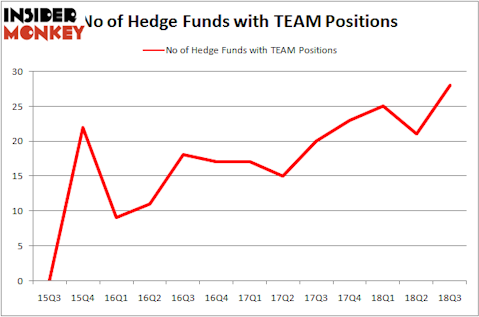

Is Atlassian Corporation Plc (NASDAQ:TEAM) a buy, sell, or hold? Investors who are in the know are taking a bullish view. The number of bullish hedge fund bets advanced by 7 in recent months, and Atlassian Corporation Plc was in 28 hedge funds’ portfolios at the end of the third quarter of 2018. Nevertheless, that number of bullish investors wasn’t enough for it to become one of the 30 most popular stocks among hedge funds in Q3 of 2018. Take a look at the list if you are interested to know which stocks have attracted the most attention from investors in the third quarter. Even though, Atlassian Corporation Plc (NASDAQ:TEAM) wasn’t among the most popular public companies in recent months hedge fund interest for it is increasing, and hence we will thoroughly examine it in this article to determine if the stock could be a good addition to your portfolio.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 17.4% year to date and outperformed the market by more than 14 percentage points this year. This strategy also outperformed the market by 3 percentage points in the fourth quarter despite the market volatility (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Here is what Tao Value, an anonymous elite value investing club, which is long the stock, thinks about Atlassian Corporation Plc (NASDAQ:TEAM), as recently reported in its Q3 Letter:

“Atlassian (TEAM) is among the best enterprise SaaS businesses, with Free Cash Flow margin + revenue growth rate still well above 60% (a metric over 40% is deemed a good SaaS business by industry). As a long-time user, I know well about the quality and stickiness of its products. The challenge for TEAM is to keep its growth (potentially out to non-IT functions) as well as capital allocation. One interesting observation for the capital allocation is that they spent quite a lot of resource on building Stride, a new generation of collaboration IM product, just to suddenly scrap it. Interestingly, Atlassian was able to sell Stride along with its legacy Hipchat product in a partnership deal to Slack, a highly adored collaboration software business by the industry. This deal not only landed Atlassian a “small but symbolically important” equity investment in Slack but also formed product alliance with Slack which is a very positive thing. As mentioned before, our starting position was very small, but it got more material as its price already quadrupled from our initial purchase.”

Continuing with our analysis, we will now take a look at the key hedge fund action surrounding Atlassian Corporation Plc (NASDAQ:TEAM).

What does the smart money think about Atlassian Corporation Plc (NASDAQ:TEAM)?

At the end of the third quarter, a total of 28 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 33% from the second quarter of 2018. Below, you can check out the change in hedge fund sentiment towards TEAM over the last 13 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Tybourne Capital Management was the largest shareholder of Atlassian Corporation Plc (NASDAQ:TEAM), with a stake worth $308.5 million reported as of the end of September. Trailing Tybourne Capital Management was Renaissance Technologies, which amassed a stake valued at $210.5 million. Foxhaven Asset Management, Two Sigma Advisors, and Arrowstreet Capital were also very fond of the stock, giving the stock large weights in their portfolios.

Now, some big names have been driving this bullishness. Holocene Advisors, managed by Brandon Haley, initiated the most valuable position in Atlassian Corporation Plc (NASDAQ:TEAM). Holocene Advisors had $40.1 million invested in the company at the end of the quarter. Phill Gross and Robert Atchinson’s Adage Capital Management also initiated a $9.6 million position during the quarter. The other funds with brand new TEAM positions are David Costen Haley’s HBK Investments, D. E. Shaw’s D E Shaw, and Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital.

Let’s go over hedge fund activity in other stocks similar to Atlassian Corporation Plc (NASDAQ:TEAM). These stocks are KKR & Co. Inc. (NYSE:KKR), Agilent Technologies Inc. (NYSE:A), Stanley Black & Decker, Inc. (NYSE:SWK), and Liberty Global plc (NASDAQ:LBTYA). All of these stocks’ market caps resemble TEAM’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| KKR | 31 | 2764720 | 7 |

| A | 40 | 2814048 | -5 |

| SWK | 27 | 421148 | -5 |

| LBTYA | 39 | 1702341 | 5 |

As you can see these stocks had an average of 34 hedge funds with bullish positions and the average amount invested in these stocks was $1.93 billion. That figure was $1.08 billion in TEAM’s case. Agilent Technologies Inc. (NYSE:A) is the most popular stock in this table. On the other hand Stanley Black & Decker, Inc. (NYSE:SWK) is the least popular one with only 27 bullish hedge fund positions. Atlassian Corporation Plc (NASDAQ:TEAM) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard A might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.