The elite funds run by legendary investors such as Dan Loeb and David Tepper make hundreds of millions of dollars for themselves and their investors by spending enormous resources doing research on small cap stocks that big investment banks don’t follow. Because of their pay structures, they have strong incentive to do the research necessary to beat the market. That’s why we pay close attention to what they think in small cap stocks. In this article, we take a closer look at American Homes 4 Rent (NYSE:AMH) from the perspective of those elite funds.

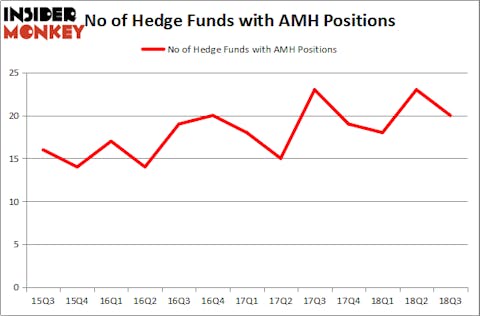

American Homes 4 Rent (NYSE:AMH) was in 20 hedge funds’ portfolios at the end of September. AMH has seen a decrease in activity from the world’s largest hedge funds of late. There were 23 hedge funds in our database with AMH positions at the end of the previous quarter. Our calculations also showed that AMH isn’t among the 30 most popular stocks among hedge funds.

In the 21st century investor’s toolkit there are a lot of signals market participants use to assess their stock investments. A pair of the most innovative signals are hedge fund and insider trading sentiment. We have shown that, historically, those who follow the top picks of the best money managers can trounce the broader indices by a significant margin (see the details here).

Let’s analyze the latest hedge fund action encompassing American Homes 4 Rent (NYSE:AMH).

How are hedge funds trading American Homes 4 Rent (NYSE:AMH)?

Heading into the fourth quarter of 2018, a total of 20 of the hedge funds tracked by Insider Monkey were long this stock, a change of -13% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards AMH over the last 13 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists an “upper tier” of notable hedge fund managers who were increasing their stakes meaningfully (or already accumulated large positions).

The largest stake in American Homes 4 Rent (NYSE:AMH) was held by Long Pond Capital, which reported holding $127.5 million worth of stock at the end of September. It was followed by Echo Street Capital Management with a $97.5 million position. Other investors bullish on the company included AEW Capital Management, Balyasny Asset Management, and Millennium Management.

Since American Homes 4 Rent (NYSE:AMH) has experienced bearish sentiment from the entirety of the hedge funds we track, logic holds that there exists a select few hedgies that slashed their full holdings heading into Q3. Intriguingly, Stuart J. Zimmer’s Zimmer Partners cut the biggest investment of all the hedgies followed by Insider Monkey, valued at about $22.2 million in stock. Eduardo Abush’s fund, Waterfront Capital Partners, also dumped its stock, about $21 million worth. These transactions are intriguing to say the least, as aggregate hedge fund interest was cut by 3 funds heading into Q3.

Let’s now take a look at hedge fund activity in other stocks similar to American Homes 4 Rent (NYSE:AMH). These stocks are Columbia Sportswear Company (NASDAQ:COLM), The Trade Desk, Inc. (NASDAQ:TTD), Charles River Laboratories International Inc. (NYSE:CRL), and Arrow Electronics, Inc. (NYSE:ARW). This group of stocks’ market values resemble AMH’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| COLM | 23 | 180220 | 0 |

| TTD | 14 | 232878 | 1 |

| CRL | 20 | 736924 | 0 |

| ARW | 23 | 509427 | 6 |

| Average | 20 | 414862 | 1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 20 hedge funds with bullish positions and the average amount invested in these stocks was $415 million. That figure was $587 million in AMH’s case. 0 is the most popular stock in this table. On the other hand The Trade Desk, Inc. (NASDAQ:TTD) is the least popular one with only 14 bullish hedge fund positions. American Homes 4 Rent (NYSE:AMH) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard COLM might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.