Hedge funds and other investment firms that we track manage billions of dollars of their wealthy clients’ money, and needless to say, they are painstakingly thorough when analyzing where to invest this money, as their own wealth also depends on it. Regardless of the various methods used by elite investors like David Tepper and David Abrams, the resources they expend are second-to-none. This is especially valuable when it comes to small-cap stocks, which is where they generate their strongest outperformance, as their resources give them a huge edge when it comes to studying these stocks compared to the average investor, which is why we intently follow their activity in the small-cap space.

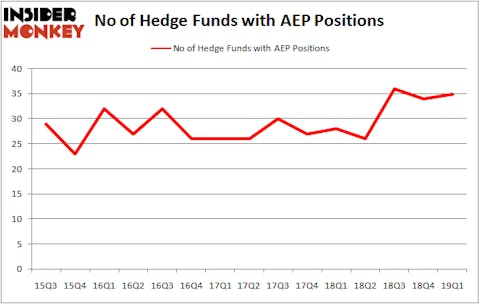

American Electric Power Company, Inc. (NYSE:AEP) was in 35 hedge funds’ portfolios at the end of the first quarter of 2019. AEP investors should pay attention to an increase in hedge fund sentiment lately. There were 34 hedge funds in our database with AEP holdings at the end of the previous quarter. Our calculations also showed that AEP isn’t among the 30 most popular stocks among hedge funds.

In the 21st century investor’s toolkit there are dozens of tools stock market investors put to use to analyze their stock investments. Some of the most underrated tools are hedge fund and insider trading activity. Our researchers have shown that, historically, those who follow the best picks of the top investment managers can outpace their index-focused peers by a healthy margin (see the details here).

We’re going to view the key hedge fund action surrounding American Electric Power Company, Inc. (NYSE:AEP).

How are hedge funds trading American Electric Power Company, Inc. (NYSE:AEP)?

Heading into the second quarter of 2019, a total of 35 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 3% from the previous quarter. On the other hand, there were a total of 28 hedge funds with a bullish position in AEP a year ago. With hedgies’ sentiment swirling, there exists an “upper tier” of key hedge fund managers who were upping their stakes significantly (or already accumulated large positions).

The largest stake in American Electric Power Company, Inc. (NYSE:AEP) was held by Renaissance Technologies, which reported holding $416 million worth of stock at the end of March. It was followed by Citadel Investment Group with a $286.1 million position. Other investors bullish on the company included AQR Capital Management, Adage Capital Management, and D E Shaw.

Now, some big names were leading the bulls’ herd. Point72 Asset Management, managed by Steve Cohen, initiated the most outsized position in American Electric Power Company, Inc. (NYSE:AEP). Point72 Asset Management had $20.9 million invested in the company at the end of the quarter. Michael Platt and William Reeves’s BlueCrest Capital Mgmt. also made a $7.4 million investment in the stock during the quarter. The other funds with new positions in the stock are Bernard Lambilliotte’s Ecofin Ltd, Daniel S. Och’s OZ Management, and Howard Marks’s Oaktree Capital Management.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as American Electric Power Company, Inc. (NYSE:AEP) but similarly valued. We will take a look at Kimberly Clark Corporation (NYSE:KMB), Marriott International Inc (NASDAQ:MAR), Dell Technologies Inc. (NYSE:DELL), and The Progressive Corporation (NYSE:PGR). This group of stocks’ market valuations match AEP’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| KMB | 36 | 860286 | -1 |

| MAR | 25 | 2046505 | -7 |

| DELL | 37 | 1816635 | -6 |

| PGR | 44 | 1917725 | -4 |

| Average | 35.5 | 1660288 | -4.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 35.5 hedge funds with bullish positions and the average amount invested in these stocks was $1660 million. That figure was $1229 million in AEP’s case. The Progressive Corporation (NYSE:PGR) is the most popular stock in this table. On the other hand Marriott International Inc (NASDAQ:MAR) is the least popular one with only 25 bullish hedge fund positions. American Electric Power Company, Inc. (NYSE:AEP) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. A small number of hedge funds were also right about betting on AEP as the stock returned 2.7% during the same time frame and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.