Although the masses and most of the financial media blame hedge funds for their exorbitant fee structure and disappointing performance, these investors have proved to have great stock picking abilities over the years (that’s why their assets under management continue to swell). We believe hedge fund sentiment should serve as a crucial tool of an individual investor’s stock selection process, as it may offer great insights of how the brightest minds of the finance industry feel about specific stocks. After all, these people have access to smartest analysts and expensive data/information sources that individual investors can’t match. So should one consider investing in American Campus Communities, Inc. (NYSE:ACC)? The smart money sentiment can provide an answer to this question.

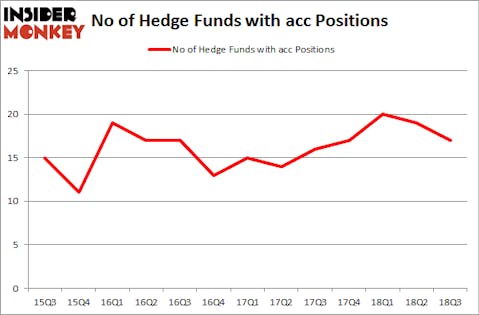

American Campus Communities, Inc. (NYSE:ACC) was in 17 hedge funds’ portfolios at the end of the third quarter of 2018. ACC shareholders have witnessed a decrease in support from the world’s most elite money managers lately. There were 19 hedge funds in our database with ACC positions at the end of the previous quarter. Our calculations also showed that acc isn’t among the 30 most popular stocks among hedge funds.

To most investors, hedge funds are assumed to be unimportant, old investment tools of years past. While there are more than 8,000 funds trading at the moment, We choose to focus on the leaders of this club, about 700 funds. These money managers watch over bulk of the smart money’s total asset base, and by watching their first-class picks, Insider Monkey has determined many investment strategies that have historically outperformed the S&P 500 index. Insider Monkey’s flagship hedge fund strategy outstripped the S&P 500 index by 6 percentage points annually since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

We’re going to take a peek at the fresh hedge fund action encompassing American Campus Communities, Inc. (NYSE:ACC).

How are hedge funds trading American Campus Communities, Inc. (NYSE:ACC)?

Heading into the fourth quarter of 2018, a total of 17 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -11% from the second quarter of 2018. On the other hand, there were a total of 17 hedge funds with a bullish position in ACC at the beginning of this year. With the smart money’s sentiment swirling, there exists an “upper tier” of noteworthy hedge fund managers who were boosting their stakes substantially (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Jeffrey Furber’s AEW Capital Management has the biggest position in American Campus Communities, Inc. (NYSE:ACC), worth close to $94.5 million, corresponding to 2.6% of its total 13F portfolio. On AEW Capital Management’s heels is Ric Dillon of Diamond Hill Capital, with a $87.8 million position; 0.4% of its 13F portfolio is allocated to the stock. Some other professional money managers with similar optimism consist of Greg Poole’s Echo Street Capital Management, Ken Griffin’s Citadel Investment Group and Jim Simons’s Renaissance Technologies.

Due to the fact that American Campus Communities, Inc. (NYSE:ACC) has witnessed bearish sentiment from the aggregate hedge fund industry, it’s easy to see that there exists a select few hedge funds that decided to sell off their positions entirely by the end of the third quarter. Intriguingly, Paul Marshall and Ian Wace’s Marshall Wace LLP sold off the largest position of the 700 funds followed by Insider Monkey, worth about $6.7 million in stock, and Richard Driehaus’s Driehaus Capital was right behind this move, as the fund dumped about $2.3 million worth. These transactions are intriguing to say the least, as aggregate hedge fund interest dropped by 2 funds by the end of the third quarter.

Let’s now review hedge fund activity in other stocks similar to American Campus Communities, Inc. (NYSE:ACC). These stocks are Gardner Denver Holdings, Inc. (NYSE:GDI), Antero Resources Corp (NYSE:AR), First Horizon National Corporation (NYSE:FHN), and Integra Lifesciences Holdings Corp (NASDAQ:IART). All of these stocks’ market caps match ACC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GDI | 24 | 371587 | -3 |

| AR | 20 | 1780131 | 4 |

| FHN | 19 | 182996 | -4 |

| IART | 14 | 188907 | -3 |

| Average | 19.25 | 630905 | -1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 19.25 hedge funds with bullish positions and the average amount invested in these stocks was $631 million. That figure was $280 million in ACC’s case. Gardner Denver Holdings, Inc. (NYSE:GDI) is the most popular stock in this table. On the other hand Integra Lifesciences Holdings Corp (NASDAQ:IART) is the least popular one with only 14 bullish hedge fund positions. American Campus Communities, Inc. (NYSE:ACC) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard GDI might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.