Does Allscripts Healthcare Solutions Inc (NASDAQ:MDRX) represent a good buying opportunity at the moment? Let’s quickly check the hedge fund interest towards the company. Hedge fund firms constantly search out bright intellectuals and highly-experienced employees and throw away millions of dollars on satellite photos and other research activities, so it is no wonder why they tend to generate millions in profits each year. It is also true that some hedge fund players fail inconceivably on some occasions, but net net their stock picks have been generating superior risk-adjusted returns on average over the years.

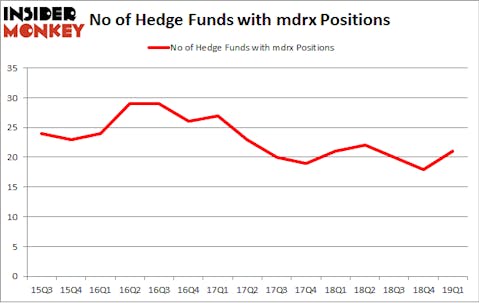

Is Allscripts Healthcare Solutions Inc (NASDAQ:MDRX) a bargain? The best stock pickers are betting on the stock. The number of bullish hedge fund positions advanced by 3 in recent months. Our calculations also showed that mdrx isn’t among the 30 most popular stocks among hedge funds.

In the 21st century investor’s toolkit there are numerous gauges stock market investors have at their disposal to evaluate stocks. A couple of the less known gauges are hedge fund and insider trading interest. Our experts have shown that, historically, those who follow the best picks of the top fund managers can outpace the market by a very impressive amount (see the details here).

We’re going to check out the new hedge fund action encompassing Allscripts Healthcare Solutions Inc (NASDAQ:MDRX).

Hedge fund activity in Allscripts Healthcare Solutions Inc (NASDAQ:MDRX)

At Q1’s end, a total of 21 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 17% from the previous quarter. By comparison, 21 hedge funds held shares or bullish call options in MDRX a year ago. With hedgies’ capital changing hands, there exists a few noteworthy hedge fund managers who were boosting their stakes considerably (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Ken Fisher’s Fisher Asset Management has the biggest position in Allscripts Healthcare Solutions Inc (NASDAQ:MDRX), worth close to $48.3 million, comprising 0.1% of its total 13F portfolio. The second largest stake is held by D. E. Shaw of D E Shaw, with a $42.2 million position; 0.1% of its 13F portfolio is allocated to the company. Remaining peers with similar optimism encompass Justin John Ferayorni’s Tamarack Capital Management, Israel Englander’s Millennium Management and Noam Gottesman’s GLG Partners.

As industrywide interest jumped, specific money managers were leading the bulls’ herd. Gotham Asset Management, managed by Joel Greenblatt, assembled the most outsized position in Allscripts Healthcare Solutions Inc (NASDAQ:MDRX). Gotham Asset Management had $4.9 million invested in the company at the end of the quarter. Steve Cohen’s Point72 Asset Management also initiated a $1.1 million position during the quarter. The other funds with new positions in the stock are Minhua Zhang’s Weld Capital Management, Mike Vranos’s Ellington, and Brandon Haley’s Holocene Advisors.

Let’s also examine hedge fund activity in other stocks similar to Allscripts Healthcare Solutions Inc (NASDAQ:MDRX). These stocks are Hostess Brands, Inc. (NASDAQ:TWNK), MSG Networks Inc (NYSE:MSGN), Atrion Corporation (NASDAQ:ATRI), and Kaman Corporation (NYSE:KAMN). All of these stocks’ market caps are similar to MDRX’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TWNK | 24 | 132667 | 4 |

| MSGN | 21 | 261088 | 1 |

| ATRI | 8 | 92684 | -2 |

| KAMN | 12 | 223634 | 0 |

| Average | 16.25 | 177518 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.25 hedge funds with bullish positions and the average amount invested in these stocks was $178 million. That figure was $200 million in MDRX’s case. Hostess Brands, Inc. (NASDAQ:TWNK) is the most popular stock in this table. On the other hand Atrion Corporation (NASDAQ:ATRI) is the least popular one with only 8 bullish hedge fund positions. Allscripts Healthcare Solutions Inc (NASDAQ:MDRX) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on MDRX as the stock returned 5.9% during the same period and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.