Hedge Funds and other institutional investors have just completed filing their 13Fs with the Securities and Exchange Commission, revealing their equity portfolios as of the end of March. At Insider Monkey, we follow nearly 750 active hedge funds and notable investors and by analyzing their 13F filings, we can determine the stocks that they are collectively bullish on. One of their picks is 3D Systems Corporation (NYSE:DDD), so let’s take a closer look at the sentiment that surrounds it in the current quarter.

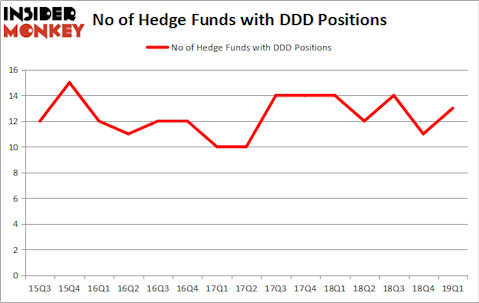

Is 3D Systems Corporation (NYSE:DDD) a bargain? Prominent investors are buying. The number of bullish hedge fund bets advanced by 2 recently. Our calculations also showed that DDD isn’t among the 30 most popular stocks among hedge funds. DDD was in 13 hedge funds’ portfolios at the end of the first quarter of 2019. There were 11 hedge funds in our database with DDD holdings at the end of the previous quarter.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 30.9% through May 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to view the recent hedge fund action surrounding 3D Systems Corporation (NYSE:DDD).

How have hedgies been trading 3D Systems Corporation (NYSE:DDD)?

Heading into the second quarter of 2019, a total of 13 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 18% from the fourth quarter of 2018. The graph below displays the number of hedge funds with bullish position in DDD over the last 15 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, D. E. Shaw’s D E Shaw has the biggest position in 3D Systems Corporation (NYSE:DDD), worth close to $28 million, corresponding to less than 0.1%% of its total 13F portfolio. The second most bullish fund manager is Coatue Management, managed by Philippe Laffont, which holds a $10.3 million position; the fund has 0.1% of its 13F portfolio invested in the stock. Other professional money managers with similar optimism consist of Chuck Royce’s Royce & Associates, Jim Simons’s Renaissance Technologies and Ken Griffin’s Citadel Investment Group.

With a general bullishness amongst the heavyweights, some big names have jumped into 3D Systems Corporation (NYSE:DDD) headfirst. Coatue Management, managed by Philippe Laffont, initiated the most outsized position in 3D Systems Corporation (NYSE:DDD). Coatue Management had $10.3 million invested in the company at the end of the quarter. Thomas E. Claugus’s GMT Capital also initiated a $2.6 million position during the quarter. The other funds with brand new DDD positions are Matthew Hulsizer’s PEAK6 Capital Management, Philip Hempleman’s Ardsley Partners, and Joseph Mathias’s Concourse Capital Management.

Let’s also examine hedge fund activity in other stocks similar to 3D Systems Corporation (NYSE:DDD). We will take a look at Twin River Worldwide Holdings Inc. (NYSE:TRWH), Brookdale Senior Living, Inc. (NYSE:BKD), Tabula Rasa HealthCare, Inc. (NASDAQ:TRHC), and Presidio, Inc. (NASDAQ:PSDO). This group of stocks’ market values are closest to DDD’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TRWH | 10 | 311993 | 10 |

| BKD | 27 | 362928 | 1 |

| TRHC | 7 | 22718 | -5 |

| PSDO | 25 | 57575 | 19 |

| Average | 17.25 | 188804 | 6.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17.25 hedge funds with bullish positions and the average amount invested in these stocks was $189 million. That figure was $62 million in DDD’s case. Brookdale Senior Living, Inc. (NYSE:BKD) is the most popular stock in this table. On the other hand Tabula Rasa HealthCare, Inc. (NASDAQ:TRHC) is the least popular one with only 7 bullish hedge fund positions. 3D Systems Corporation (NYSE:DDD) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately DDD wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); DDD investors were disappointed as the stock returned -22.5% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.