Many investors, including Paul Tudor Jones or Stan Druckenmiller, have been saying before the Q4 market crash that the stock market is overvalued due to a low interest rate environment that leads to companies swapping their equity for debt and focusing mostly on short-term performance such as beating the quarterly earnings estimates. In the first quarter, most investors recovered all of their Q4 losses as sentiment shifted and optimism dominated the US China trade negotiations. Nevertheless, many of the stocks that delivered strong returns in the first quarter still sport strong fundamentals and their gains were more related to the general market sentiment rather than their individual performance and hedge funds kept their bullish stance. In this article we will find out how hedge fund sentiment to Citigroup Inc. (NYSE:C) changed recently.

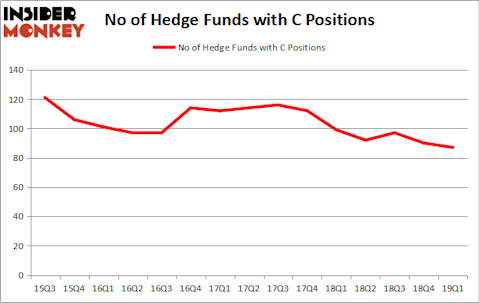

Is Citigroup Inc. (NYSE:C) the right investment to pursue these days? The smart money is turning less bullish. The number of bullish hedge fund positions were trimmed by 3 in recent months. However, our calculations also showed that C ranked 18th among the 30 most popular stocks among hedge funds.

Today there are several metrics stock market investors use to appraise their holdings. Some of the most innovative metrics are hedge fund and insider trading indicators. Our researchers have shown that, historically, those who follow the best picks of the best hedge fund managers can outperform the broader indices by a healthy amount (see the details here).

Let’s take a gander at the new hedge fund action encompassing Citigroup Inc. (NYSE:C).

What does the smart money think about Citigroup Inc. (NYSE:C)?

Heading into the second quarter of 2019, a total of 87 of the hedge funds tracked by Insider Monkey were long this stock, a change of -3% from one quarter earlier. By comparison, 99 hedge funds held shares or bullish call options in C a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, ValueAct Capital held the most valuable stake in Citigroup Inc. (NYSE:C), which was worth $1961.5 million at the end of the first quarter. On the second spot was Eagle Capital Management which amassed $1666.6 million worth of shares. Moreover, Greenhaven Associates, Diamond Hill Capital, and Pzena Investment Management were also bullish on Citigroup Inc. (NYSE:C), allocating a large percentage of their portfolios to this stock.

Because Citigroup Inc. (NYSE:C) has experienced declining sentiment from hedge fund managers, we can see that there lies a certain “tier” of hedgies that decided to sell off their entire stakes heading into Q3. At the top of the heap, Robert Pohly’s Samlyn Capital sold off the biggest position of the “upper crust” of funds tracked by Insider Monkey, valued at about $52.5 million in stock. Late Irving Kahn’s fund, Kahn Brothers, also dumped its stock, about $49.3 million worth. These bearish behaviors are intriguing to say the least, as total hedge fund interest was cut by 3 funds heading into Q3.

Let’s go over hedge fund activity in other stocks similar to Citigroup Inc. (NYSE:C). These stocks are McDonald’s Corporation (NYSE:MCD), TOTAL S.A. (NYSE:TOT), Abbott Laboratories (NYSE:ABT), and BHP Group (NYSE:BHP). This group of stocks’ market caps resemble C’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MCD | 54 | 3120539 | 6 |

| TOT | 13 | 971886 | 4 |

| ABT | 50 | 1859812 | -1 |

| BHP | 15 | 637521 | 0 |

| Average | 33 | 1647440 | 2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 33 hedge funds with bullish positions and the average amount invested in these stocks was $1647 million. That figure was $9190 million in C’s case. McDonald’s Corporation (NYSE:MCD) is the most popular stock in this table. On the other hand TOTAL S.A. (NYSE:TOT) is the least popular one with only 13 bullish hedge fund positions. Compared to these stocks Citigroup Inc. (NYSE:C) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on C as the stock returned 2.9% during the same period and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.