Hedge funds and other investment firms run by legendary investors like Israel Englander and Ray Dalio are entrusted to manage billions of dollars of accredited investors’ money because they are without peer in the resources they use to identify the best investments for their chosen investment horizon. Moreover, they are more willing to invest a greater amount of their resources in small-cap stocks than big brokerage houses, and this is often where they generate their outperformance, which is why we pay particular attention to their best ideas in this space.

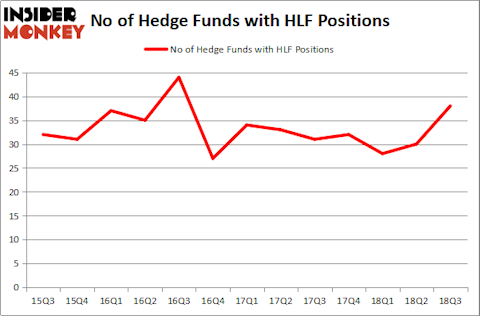

Is Herbalife Nutrition Ltd. (NYSE:HLF) going to take off soon? Prominent investors are betting on the stock. The number of long hedge fund bets rose by 8 recently. Our calculations also showed that HLF isn’t among the 30 most popular stocks among hedge funds. HLF was in 38 hedge funds’ portfolios at the end of the third quarter of 2018. There were 30 hedge funds in our database with HLF positions at the end of the previous quarter.

To the average investor there are a large number of signals stock traders employ to assess stocks. Two of the most underrated signals are hedge fund and insider trading indicators. Our researchers have shown that, historically, those who follow the top picks of the elite fund managers can outperform the S&P 500 by a healthy margin (see the details here).

We’re going to take a peek at the new hedge fund action regarding Herbalife Nutrition Ltd. (NYSE:HLF).

How are hedge funds trading Herbalife Nutrition Ltd. (NYSE:HLF)?

At the end of the third quarter, a total of 38 of the hedge funds tracked by Insider Monkey were long this stock, a change of 27% from the second quarter of 2018. On the other hand, there were a total of 32 hedge funds with a bullish position in HLF at the beginning of this year. With the smart money’s positions undergoing their usual ebb and flow, there exists a few notable hedge fund managers who were boosting their holdings significantly (or already accumulated large positions).

The largest stake in Herbalife Nutrition Ltd. (NYSE:HLF) was held by Icahn Capital LP, which reported holding $1.92 billion worth of stock at the end of September. It was followed by Renaissance Technologies with a $414.6 million position. Other investors bullish on the company included D E Shaw, Deccan Value Advisors, and Route One Investment Company.

As one would reasonably expect, key money managers have been driving this bullishness. Interval Partners, managed by Gregg Moskowitz, initiated the most valuable position in Herbalife Nutrition Ltd. (NYSE:HLF). Interval Partners had $16.4 million invested in the company at the end of the quarter. Eric Chen’s Antipodean Advisors also initiated a $10.8 million position during the quarter. The other funds with brand new HLF positions are Peter Algert and Kevin Coldiron’s Algert Coldiron Investors, Paul Marshall and Ian Wace’s Marshall Wace LLP, and Ben Levine, Andrew Manuel and Stefan Renold’s LMR Partners.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Herbalife Nutrition Ltd. (NYSE:HLF) but similarly valued. These stocks are Zayo Group Holdings Inc (NYSE:ZAYO), Formula One Group (NASDAQ:FWONA), Gol Linhas Aereas Inteligentes SA (NYSE:GOL), and AerCap Holdings N.V. (NYSE:AER). This group of stocks’ market values are similar to HLF’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ZAYO | 55 | 1994980 | 8 |

| FWONA | 21 | 310365 | -2 |

| GOL | 4 | 51989 | -2 |

| AER | 22 | 1113940 | -2 |

| Average | 25.5 | 867819 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 25.5 hedge funds with bullish positions and the average amount invested in these stocks was $868 million. That figure was $3.76 billion in HLF’s case. Zayo Group Holdings Inc (NYSE:ZAYO) is the most popular stock in this table. On the other hand Gol Linhas Aereas Inteligentes SA (NYSE:GOL) is the least popular one with only 4 bullish hedge fund positions. Herbalife Nutrition Ltd. (NYSE:HLF) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard ZAYO might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.