Will the new coronavirus cause a recession in US in the next 6 months? On February 27th, we put the probability at 75% and we predicted that the market will decline by at least 20% in (Recession is Imminent: We Need A Travel Ban NOW). In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. In this article, we will take a closer look at hedge fund sentiment towards People’s United Financial, Inc. (NASDAQ:PBCT).

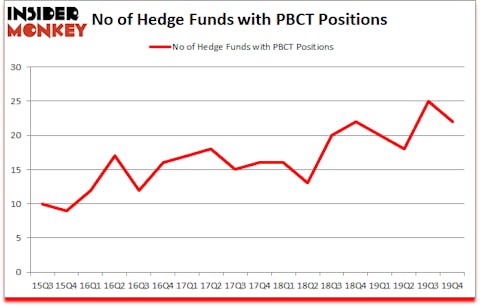

Is People’s United Financial, Inc. (NASDAQ:PBCT) going to take off soon? The best stock pickers are becoming less hopeful. The number of long hedge fund bets dropped by 3 recently. Our calculations also showed that PBCT isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video at the end of this article for Q3 rankings).

If you’d ask most market participants, hedge funds are viewed as underperforming, outdated investment tools of years past. While there are over 8000 funds in operation at the moment, We hone in on the aristocrats of this club, around 850 funds. Most estimates calculate that this group of people command the lion’s share of the smart money’s total asset base, and by monitoring their highest performing equity investments, Insider Monkey has discovered a few investment strategies that have historically outstripped the broader indices. Insider Monkey’s flagship short hedge fund strategy outrun the S&P 500 short ETFs by around 20 percentage points per annum since its inception in March 2017. Our portfolio of short stocks lost 35.3% since February 2017 (through March 3rd) even though the market was up more than 35% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

Joel Greenblatt of Gotham Asset Management

We leave no stone unturned when looking for the next great investment idea. For example we recently identified a stock that trades 25% below the net cash on its balance sheet. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences, and go through short-term trade recommendations like this one. We even check out the recommendations of services with hard to believe track records. Our best call in 2020 was shorting the market when S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. Keeping this in mind we’re going to take a gander at the recent hedge fund action surrounding People’s United Financial, Inc. (NASDAQ:PBCT).

How have hedgies been trading People’s United Financial, Inc. (NASDAQ:PBCT)?

At Q4’s end, a total of 22 of the hedge funds tracked by Insider Monkey were long this stock, a change of -12% from one quarter earlier. On the other hand, there were a total of 22 hedge funds with a bullish position in PBCT a year ago. With hedge funds’ capital changing hands, there exists an “upper tier” of notable hedge fund managers who were upping their holdings considerably (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Cliff Asness’s AQR Capital Management has the number one position in People’s United Financial, Inc. (NASDAQ:PBCT), worth close to $34.3 million, corresponding to less than 0.1%% of its total 13F portfolio. The second largest stake is held by Citadel Investment Group, managed by Ken Griffin, which holds a $19.4 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Some other hedge funds and institutional investors that hold long positions comprise Dmitry Balyasny’s Balyasny Asset Management, Daniel Johnson’s Gillson Capital and Paul Magidson, Jonathan Cohen. And Ostrom Enders’s Castine Capital Management. In terms of the portfolio weights assigned to each position Castine Capital Management allocated the biggest weight to People’s United Financial, Inc. (NASDAQ:PBCT), around 3.01% of its 13F portfolio. Gillson Capital is also relatively very bullish on the stock, dishing out 1.6 percent of its 13F equity portfolio to PBCT.

Due to the fact that People’s United Financial, Inc. (NASDAQ:PBCT) has experienced a decline in interest from the entirety of the hedge funds we track, it’s safe to say that there lies a certain “tier” of money managers who sold off their full holdings in the third quarter. At the top of the heap, Qing Li’s Sciencast Management sold off the biggest position of the 750 funds watched by Insider Monkey, comprising about $2.2 million in stock, and John Overdeck and David Siegel’s Two Sigma Advisors was right behind this move, as the fund sold off about $2 million worth. These transactions are intriguing to say the least, as total hedge fund interest fell by 3 funds in the third quarter.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as People’s United Financial, Inc. (NASDAQ:PBCT) but similarly valued. We will take a look at Signature Bank (NASDAQ:SBNY), AMERCO (NASDAQ:UHAL), Autoliv Inc. (NYSE:ALV), and SL Green Realty Corp (NYSE:SLG). All of these stocks’ market caps are similar to PBCT’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SBNY | 21 | 461716 | -15 |

| UHAL | 17 | 400076 | 7 |

| ALV | 21 | 729536 | 5 |

| SLG | 27 | 447307 | -2 |

| Average | 21.5 | 509659 | -1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 21.5 hedge funds with bullish positions and the average amount invested in these stocks was $510 million. That figure was $126 million in PBCT’s case. SL Green Realty Corp (NYSE:SLG) is the most popular stock in this table. On the other hand AMERCO (NASDAQ:UHAL) is the least popular one with only 17 bullish hedge fund positions. People’s United Financial, Inc. (NASDAQ:PBCT) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks lost 22.3% in 2020 through March 16th but beat the market by 3.2 percentage points. Unfortunately PBCT wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on PBCT were disappointed as the stock returned -29.2% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.