Before we spend countless hours researching a company, we like to analyze what insiders, hedge funds and billionaire investors think of the stock first. This is a necessary first step in our investment process because our research has shown that the elite investors’ consensus returns have been exceptional. In the following paragraphs, we find out what the billionaire investors and hedge funds think of Seelos Therapeutics, Inc. (NASDAQ:SEEL).

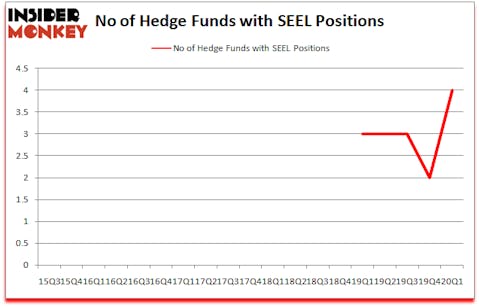

Seelos Therapeutics, Inc. (NASDAQ:SEEL) has seen an increase in enthusiasm from smart money in recent months. SEEL was in 4 hedge funds’ portfolios at the end of the first quarter of 2020. There were 2 hedge funds in our database with SEEL holdings at the end of the previous quarter. Our calculations also showed that SEEL isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

In today’s marketplace there are a lot of tools investors can use to value stocks. A duo of the less known tools are hedge fund and insider trading interest. Our experts have shown that, historically, those who follow the top picks of the best fund managers can outclass the S&P 500 by a very impressive amount (see the details here).

Ken Griffin of Citadel Investment Group

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, 2020’s unprecedented market conditions provide us with the highest number of trading opportunities in a decade. So we are checking out stocks recommended/scorned by legendary Bill Miller. We interview hedge fund managers and ask them about their best ideas. If you want to find out the best healthcare stock to buy right now, you can watch our latest hedge fund manager interview here. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. Our best call in 2020 was shorting the market when the S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. With all of this in mind we’re going to take a glance at the recent hedge fund action regarding Seelos Therapeutics, Inc. (NASDAQ:SEEL).

Hedge fund activity in Seelos Therapeutics, Inc. (NASDAQ:SEEL)

At Q1’s end, a total of 4 of the hedge funds tracked by Insider Monkey were long this stock, a change of 100% from the previous quarter. By comparison, 3 hedge funds held shares or bullish call options in SEEL a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Renaissance Technologies has the largest position in Seelos Therapeutics, Inc. (NASDAQ:SEEL), worth close to $0.5 million, amounting to less than 0.1%% of its total 13F portfolio. The second largest stake is held by Sabby Capital, managed by Hal Mintz, which holds a $0.2 million position; 0.1% of its 13F portfolio is allocated to the stock. Some other members of the smart money that are bullish encompass Philip Hempleman’s Ardsley Partners, Ken Griffin’s Citadel Investment Group and . In terms of the portfolio weights assigned to each position Sabby Capital allocated the biggest weight to Seelos Therapeutics, Inc. (NASDAQ:SEEL), around 0.1% of its 13F portfolio. Ardsley Partners is also relatively very bullish on the stock, earmarking 0.01 percent of its 13F equity portfolio to SEEL.

Consequently, some big names were leading the bulls’ herd. Sabby Capital, managed by Hal Mintz, created the largest position in Seelos Therapeutics, Inc. (NASDAQ:SEEL). Sabby Capital had $0.2 million invested in the company at the end of the quarter. Ken Griffin’s Citadel Investment Group also initiated a $0 million position during the quarter.

Let’s go over hedge fund activity in other stocks similar to Seelos Therapeutics, Inc. (NASDAQ:SEEL). These stocks are Dawson Geophysical Company (NASDAQ:DWSN), Cinedigm Corp (NASDAQ:CIDM), ProPhase Labs Inc (NASDAQ:PRPH), and Reed’s, Inc. (NASDAQ:REED). This group of stocks’ market valuations resemble SEEL’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| DWSN | 6 | 2479 | -1 |

| CIDM | 1 | 375 | -1 |

| PRPH | 1 | 368 | 0 |

| REED | 6 | 744 | 2 |

| Average | 3.5 | 992 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 3.5 hedge funds with bullish positions and the average amount invested in these stocks was $1 million. That figure was $1 million in SEEL’s case. Dawson Geophysical Company (NASDAQ:DWSN) is the most popular stock in this table. On the other hand Cinedigm Corp (NASDAQ:CIDM) is the least popular one with only 1 bullish hedge fund positions. Seelos Therapeutics, Inc. (NASDAQ:SEEL) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 8.3% in 2020 through the end of May but still beat the market by 13.2 percentage points. Hedge funds were also right about betting on SEEL as the stock returned 151% in Q2 (through the end of May) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Seelos Therapeutics Inc. (NASDAQ:SEEL)

Follow Seelos Therapeutics Inc. (NASDAQ:SEEL)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.