Coronavirus is probably the #1 concern in investors’ minds right now. It should be. We estimate that COVID-19 will kill around 5 million people worldwide and there is a 3.3% probability that Donald Trump will die from the new coronavirus (read the details). In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. We at Insider Monkey have gone over 835 13F filings that hedge funds and prominent investors are required to file by the SEC The 13F filings show the funds’ and investors’ portfolio positions as of December 31st. In this article, we look at what those funds think of Danaher Corporation (NYSE:DHR) based on that data.

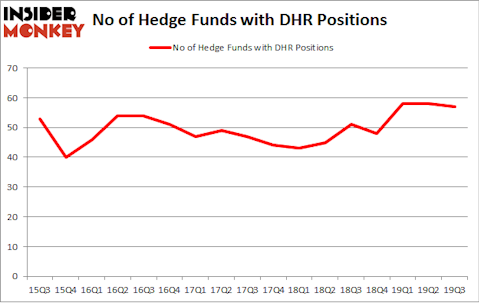

Danaher Corporation (NYSE:DHR) investors should be aware of a decrease in hedge fund sentiment in recent months. DHR was in 61 hedge funds’ portfolios at the end of the fourth quarter of 2019. There were 62 hedge funds in our database with DHR positions at the end of the previous quarter. Our calculations also showed that DHR isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video below for Q3 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research was able to identify in advance a select group of hedge fund holdings that outperformed the S&P 500 ETFs by more than 41 percentage points since March 2017 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 35.3% through March 3rd. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Dan Loeb of Third Point

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences, and and go through short-term trade recommendations like this one. We even check out the recommendations of services with hard to believe track records. In January, we recommended a long position in one of the most shorted stocks in the market, and that stock returned more than 50% despite the large losses in the market since our recommendation. Now let’s take a peek at the latest hedge fund action regarding Danaher Corporation (NYSE:DHR).

What have hedge funds been doing with Danaher Corporation (NYSE:DHR)?

At the end of the foruth quarter, a total of 61 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -2% from the third quarter of 2019. On the other hand, there were a total of 48 hedge funds with a bullish position in DHR a year ago. With hedge funds’ positions undergoing their usual ebb and flow, there exists a few noteworthy hedge fund managers who were boosting their holdings significantly (or already accumulated large positions).

The largest stake in Danaher Corporation (NYSE:DHR) was held by Third Point, which reported holding $569.4 million worth of stock at the end of September. It was followed by AQR Capital Management with a $298.3 million position. Other investors bullish on the company included Akre Capital Management, Impax Asset Management, and Adage Capital Management. In terms of the portfolio weights assigned to each position Third Point allocated the biggest weight to Danaher Corporation (NYSE:DHR), around 6.55% of its 13F portfolio. Eversept Partners is also relatively very bullish on the stock, earmarking 5.87 percent of its 13F equity portfolio to DHR.

Due to the fact that Danaher Corporation (NYSE:DHR) has witnessed a decline in interest from the entirety of the hedge funds we track, we can see that there were a few fund managers that slashed their full holdings by the end of the third quarter. Intriguingly, Israel Englander’s Millennium Management cut the biggest investment of the 750 funds tracked by Insider Monkey, totaling close to $114.9 million in stock. Doug Silverman and Alexander Klabin’s fund, Senator Investment Group, also sold off its stock, about $86.7 million worth. These transactions are intriguing to say the least, as aggregate hedge fund interest fell by 1 funds by the end of the third quarter.

Let’s now review hedge fund activity in other stocks similar to Danaher Corporation (NYSE:DHR). We will take a look at Charter Communications, Inc. (NASDAQ:CHTR), Starbucks Corporation (NASDAQ:SBUX), Diageo plc (NYSE:DEO), and Toronto-Dominion Bank (NYSE:TD). All of these stocks’ market caps are similar to DHR’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CHTR | 65 | 9013923 | -5 |

| SBUX | 66 | 5063838 | 7 |

| DEO | 17 | 794917 | -5 |

| TD | 17 | 312660 | 0 |

| Average | 41.25 | 3796335 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 41.25 hedge funds with bullish positions and the average amount invested in these stocks was $3796 million. That figure was $2354 million in DHR’s case. Starbucks Corporation (NASDAQ:SBUX) is the most popular stock in this table. On the other hand Diageo plc (NYSE:DEO) is the least popular one with only 17 bullish hedge fund positions. Danaher Corporation (NYSE:DHR) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks also gained 0.1% in 2020 through March 2nd and beat the market by 4.1 percentage points. Hedge funds were also right about betting on DHR, though not to the same extent, as the stock returned -1.8% during the first two months of 2020 (through March 2nd) and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.