Insider Monkey has processed numerous 13F filings of hedge funds and famous investors to create an extensive database of hedge fund holdings. The 13F filings show the hedge funds and investors’ positions as of the end of the third quarter. You can find write-ups about an individual hedge fund’s trades on several financial news websites. However, in this article we will take a look at their collective moves and analyze what the smart money thinks of Allstate Corp (NYSE:ALL) based on that data.

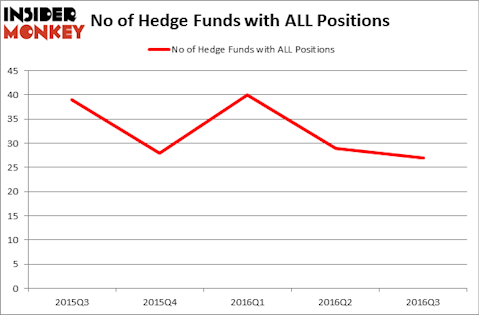

Is Allstate Corp (NYSE:ALL) worth your attention right now? Prominent investors are turning less bullish. The number of long hedge fund positions retreated by 2 in recent months. ALL was in 27 hedge funds’ portfolios at the end of September. There were 29 hedge funds in our database with ALL positions at the end of the previous quarter. At the end of this article we will also compare ALL to other stocks including Alexion Pharmaceuticals, Inc. (NASDAQ:ALXN), O’Reilly Automotive Inc (NASDAQ:ORLY), and Applied Materials, Inc. (NASDAQ:AMAT) to get a better sense of its popularity.

Follow Allstate Corp (NYSE:ALL)

Follow Allstate Corp (NYSE:ALL)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

ilikestudio/Shutterstock.com

How are hedge funds trading Allstate Corp (NYSE:ALL)?

Heading into the fourth quarter of 2016, a total of 27 of the hedge funds tracked by Insider Monkey were long this stock, a 7% drop from the second quarter of 2016, on the back of an even steeper drop in Q2. With hedgies’ sentiment swirling, there exists a select group of key hedge fund managers who were increasing their stakes substantially (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Cliff Asness’ AQR Capital Management has the most valuable position in Allstate Corp (NYSE:ALL), worth close to $356.1 million. Coming in second is Appaloosa Management LP, managed by David Tepper, which holds a $215.8 million position; the fund has 4.9% of its 13F portfolio invested in the stock. Some other professional money managers with similar optimism consist of D E Shaw, Richard S. Pzena’s Pzena Investment Management and Robert Pohly’s Samlyn Capital.