A whopping number of 13F filings filed with U.S. Securities and Exchange Commission has been processed by Insider Monkey so that individual investors can look at the overall hedge fund sentiment towards the stocks included in their watchlists. These freshly-submitted public filings disclose money managers’ equity positions as of the end of the three-month period that ended September 30, so let’s proceed with the discussion of the hedge fund sentiment on Peapack-Gladstone Financial Corp (NASDAQ:PGC).

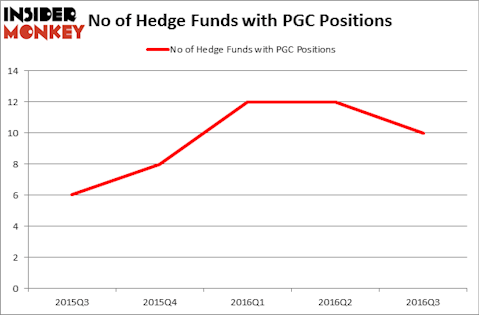

Is Peapack-Gladstone Financial Corp (NASDAQ:PGC) a first-rate stock to buy now? Investors who are in the know are actually turning less bullish. The number of long hedge fund bets that are revealed through 13F filings fell by 2 recently. PGC was in 10 hedge funds’ portfolios at the end of September. There were 12 hedge funds in our database with PGC holdings at the end of June. At the end of this article we will also compare PGC to other stocks including China Cord Blood Corp (NYSE:CO), Atlantic Capital Bancshares Inc (NASDAQ:ACBI), and Regenxbio Inc (NASDAQ:RGNX) to get a better sense of its popularity.

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

qvist/Shutterstock.com

How have hedgies been trading Peapack-Gladstone Financial Corp (NASDAQ:PGC)?

Heading into the fourth quarter of 2016, a total of 10 of the hedge funds tracked by Insider Monkey held long positions in this stock, a 17% drop from one quarter earlier. The graph below displays the number of hedge funds with bullish positions in PGC over the last 5 quarters, which are still up by 25% this year. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Matthew Lindenbaum’s Basswood Capital has the number one position in Peapack-Gladstone Financial Corp (NASDAQ:PGC), worth close to $24.7 million, amounting to 1.2% of its total 13F portfolio. Coming in second is Emanuel J. Friedman of EJF Capital which holds a $16.8 million position; the fund has 1.4% of its 13F portfolio invested in the stock. Other professional money managers that are bullish include Chuck Royce’s Royce & Associates, Robert I. Usdan and Wayne K. Goldstein’s Endicott Management, and Renaissance Technologies, one of the largest hedge funds in the world. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Seeing as Peapack-Gladstone Financial Corp (NASDAQ:PGC) has experienced declining sentiment from the entirety of the hedge funds we track, it’s easy to see that there exists a select few funds who sold off their full holdings in the third quarter. It’s worth mentioning that Lawrence Seidman’s Seidman Investment Partnership dumped the biggest position of the “upper crust” of funds studied by Insider Monkey, comprising close to $0.3 million in stock. Joshua Nash’s fund, Ulysses Management, also cut its stock, about $0.1 million worth.

Let’s check out hedge fund activity in other stocks similar to Peapack-Gladstone Financial Corp (NASDAQ:PGC). We will take a look at China Cord Blood Corp (NYSE:CO), Atlantic Capital Bancshares Inc (NASDAQ:ACBI), Regenxbio Inc (NASDAQ:RGNX), and U.S. Lime & Minerals Inc. (NASDAQ:USLM). All of these stocks’ market caps are closest to PGC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CO | 5 | 15329 | 0 |

| ACBI | 8 | 37441 | 0 |

| RGNX | 13 | 80918 | 2 |

| USLM | 4 | 18637 | -1 |

As you can see these stocks had an average of 7 hedge funds with bullish positions and the average amount invested in these stocks was $38 million. That figure was $78 million in PGC’s case. Regenxbio Inc (NASDAQ:RGNX) is the most popular stock in this table. On the other hand U.S. Lime & Minerals Inc. (NASDAQ:USLM) is the least popular one with only 4 bullish hedge fund positions. Peapack-Gladstone Financial Corp (NASDAQ:PGC) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard RGNX might be a better candidate to consider taking a long position in.

Disclosure: None