We know that hedge funds generate strong, risk-adjusted returns over the long run, therefore imitating the picks that they are collectively bullish on can be a profitable strategy for retail investors. With billions of dollars in assets, smart money investors have to conduct complex analyses, spend many resources and use tools that are not always available for the general crowd. This doesn’t mean that they don’t have occasional colossal losses; they do (like Peltz’s recent General Electric losses). However, it is still a good idea to keep an eye on hedge fund activity. With this in mind, as the current round of 13F filings has just ended, let’s examine the smart money sentiment towards Veracyte Inc (NASDAQ:VCYT).

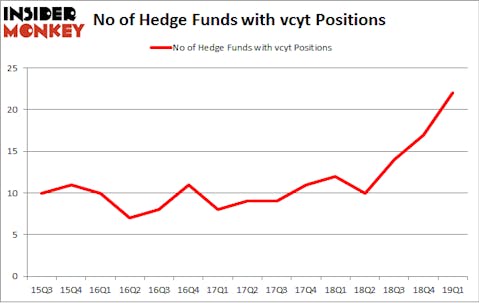

Veracyte Inc (NASDAQ:VCYT) shareholders have witnessed an increase in hedge fund interest in recent months. Our calculations also showed that vcyt isn’t among the 30 most popular stocks among hedge funds.

At the moment there are a large number of tools stock traders employ to size up stocks. Two of the most innovative tools are hedge fund and insider trading moves. Our experts have shown that, historically, those who follow the best picks of the top investment managers can outclass their index-focused peers by a very impressive margin (see the details here).

Let’s take a peek at the fresh hedge fund action regarding Veracyte Inc (NASDAQ:VCYT).

Hedge fund activity in Veracyte Inc (NASDAQ:VCYT)

At the end of the first quarter, a total of 22 of the hedge funds tracked by Insider Monkey were long this stock, a change of 29% from the fourth quarter of 2018. On the other hand, there were a total of 12 hedge funds with a bullish position in VCYT a year ago. With hedge funds’ sentiment swirling, there exists a select group of notable hedge fund managers who were increasing their stakes meaningfully (or already accumulated large positions).

Among these funds, Cannell Capital held the most valuable stake in Veracyte Inc (NASDAQ:VCYT), which was worth $31.7 million at the end of the first quarter. On the second spot was Millennium Management which amassed $20.5 million worth of shares. Moreover, Renaissance Technologies, Laurion Capital Management, and D E Shaw were also bullish on Veracyte Inc (NASDAQ:VCYT), allocating a large percentage of their portfolios to this stock.

As aggregate interest increased, specific money managers were leading the bulls’ herd. Laurion Capital Management, managed by Benjamin A. Smith, initiated the biggest position in Veracyte Inc (NASDAQ:VCYT). Laurion Capital Management had $8.9 million invested in the company at the end of the quarter. Steve Cohen’s Point72 Asset Management also initiated a $7 million position during the quarter. The other funds with brand new VCYT positions are Cliff Asness’s AQR Capital Management, Joseph Edelman’s Perceptive Advisors, and Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Veracyte Inc (NASDAQ:VCYT) but similarly valued. We will take a look at Luminex Corporation (NASDAQ:LMNX), Cango Inc. (NYSE:CANG), Kraton Corporation (NYSE:KRA), and Oil States International, Inc. (NYSE:OIS). This group of stocks’ market values match VCYT’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LMNX | 21 | 159503 | 2 |

| CANG | 2 | 681 | 0 |

| KRA | 19 | 97961 | 2 |

| OIS | 14 | 34336 | 4 |

| Average | 14 | 73120 | 2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14 hedge funds with bullish positions and the average amount invested in these stocks was $73 million. That figure was $130 million in VCYT’s case. Luminex Corporation (NASDAQ:LMNX) is the most popular stock in this table. On the other hand Cango Inc. (NYSE:CANG) is the least popular one with only 2 bullish hedge fund positions. Compared to these stocks Veracyte Inc (NASDAQ:VCYT) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on VCYT, though not to the same extent, as the stock returned 0% during the same period and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.