Last year we predicted the arrival of the first US recession since 2009 and we told in advance that the market will decline by at least 20% in (Recession is Imminent: We Need A Travel Ban NOW). In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. In this article, we will take a closer look at hedge fund sentiment towards Under Armour Inc (NYSE:UA).

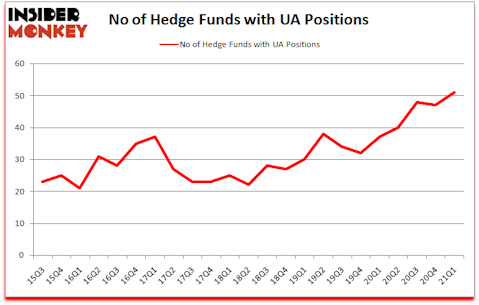

Under Armour Inc (NYSE:UA) investors should pay attention to an increase in activity from the world’s largest hedge funds lately. Under Armour Inc (NYSE:UA) was in 51 hedge funds’ portfolios at the end of the first quarter of 2021. The all time high for this statistic was 48. This means the bullish number of hedge fund positions in this stock currently sits at its all time high. Our calculations also showed that UA isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings).

In the 21st century investor’s toolkit there are several signals investors can use to assess stocks. Some of the most under-the-radar signals are hedge fund and insider trading activity. We have shown that, historically, those who follow the top picks of the elite investment managers can outperform the S&P 500 by a very impressive amount (see the details here). Also, our monthly newsletter’s portfolio of long stock picks returned 206.8% since March 2017 (through May 2021) and beat the S&P 500 Index by more than 115 percentage points. You can download a sample issue of this newsletter on our website .

Robert Pohly of Samlyn Capital

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, Federal Reserve has been creating trillions of dollars electronically to keep the interest rates near zero. We believe this will lead to inflation, which is why we are checking out this inflation play. We go through lists like 10 best gold stocks to buy to identify promising stocks. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. Keeping this in mind we’re going to review the recent hedge fund action regarding Under Armour Inc (NYSE:UA).

Do Hedge Funds Think UA Is A Good Stock To Buy Now?

At the end of the first quarter, a total of 51 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 9% from the previous quarter. On the other hand, there were a total of 37 hedge funds with a bullish position in UA a year ago. With hedge funds’ sentiment swirling, there exists a select group of key hedge fund managers who were upping their holdings substantially (or already accumulated large positions).

More specifically, Adage Capital Management was the largest shareholder of Under Armour Inc (NYSE:UA), with a stake worth $290.2 million reported as of the end of March. Trailing Adage Capital Management was D E Shaw, which amassed a stake valued at $170.9 million. Ako Capital, SRS Investment Management, and Arrowstreet Capital were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position One Fin Capital Management allocated the biggest weight to Under Armour Inc (NYSE:UA), around 3.15% of its 13F portfolio. CQS Cayman LP is also relatively very bullish on the stock, setting aside 2.9 percent of its 13F equity portfolio to UA.

As industrywide interest jumped, some big names were leading the bulls’ herd. SRS Investment Management, managed by Karthik Sarma, created the most outsized position in Under Armour Inc (NYSE:UA). SRS Investment Management had $99.4 million invested in the company at the end of the quarter. Robert Pohly’s Samlyn Capital also made a $30.5 million investment in the stock during the quarter. The other funds with new positions in the stock are Leonard Green’s Leonard Green & Partners, Parvinder Thiara’s Athanor Capital, and Steven Boyd’s Armistice Capital.

Let’s now review hedge fund activity in other stocks similar to Under Armour Inc (NYSE:UA). We will take a look at The Middleby Corporation (NASDAQ:MIDD), Amdocs Limited (NASDAQ:DOX), CRISPR Therapeutics AG (NASDAQ:CRSP), Maravai LifeSciences Holdings, Inc. (NASDAQ:MRVI), BridgeBio Pharma, Inc. (NASDAQ:BBIO), Pinnacle West Capital Corporation (NYSE:PNW), and AngloGold Ashanti Limited (NYSE:AU). This group of stocks’ market caps are closest to UA’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MIDD | 28 | 520500 | -2 |

| DOX | 32 | 716631 | 12 |

| CRSP | 27 | 1407504 | -7 |

| MRVI | 26 | 401044 | -8 |

| BBIO | 26 | 2899063 | 3 |

| PNW | 15 | 145574 | -9 |

| AU | 14 | 319512 | -3 |

| Average | 24 | 915690 | -2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 24 hedge funds with bullish positions and the average amount invested in these stocks was $916 million. That figure was $1910 million in UA’s case. Amdocs Limited (NASDAQ:DOX) is the most popular stock in this table. On the other hand AngloGold Ashanti Limited (NYSE:AU) is the least popular one with only 14 bullish hedge fund positions. Compared to these stocks Under Armour Inc (NYSE:UA) is more popular among hedge funds. Our overall hedge fund sentiment score for UA is 89. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 17.4% in 2021 through June 18th and still beat the market by 6.1 percentage points. Unfortunately UA wasn’t nearly as popular as these 5 stocks and hedge funds that were betting on UA were disappointed as the stock returned -6.2% since the end of the first quarter (through 6/18) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 5 most popular stocks among hedge funds as most of these stocks already outperformed the market since 2019.

Follow Under Armour Inc. (NYSE:UA)

Follow Under Armour Inc. (NYSE:UA)

Receive real-time insider trading and news alerts

Suggested Articles:

- How to Best Use Insider Monkey To Increase Your Returns

- 10 Best Advertising Stocks To Buy Now

- 12 Best Mining Stocks to Buy Now

Disclosure: None. This article was originally published at Insider Monkey.