How do you pick the next stock to invest in? One way would be to spend days of research browsing through thousands of publicly traded companies. However, an easier way is to look at the stocks that smart money investors are collectively bullish on. Hedge funds and other institutional investors usually invest large amounts of capital and have to conduct due diligence while choosing their next pick. They don’t always get it right, but, on average, their stock picks historically generated strong returns after adjusting for known risk factors. With this in mind, let’s take a look at the recent hedge fund activity surrounding The RealReal, Inc. (NASDAQ:REAL).

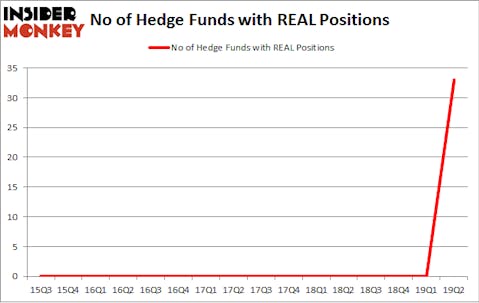

The RealReal, Inc. (NASDAQ:REAL) was in 33 hedge funds’ portfolios at the end of the second quarter of 2019. REAL has experienced an increase in support from the world’s most elite money managers in recent months. There were 0 hedge funds in our database with REAL positions at the end of the previous quarter. Our calculations also showed that REAL isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the eyes of most market participants, hedge funds are viewed as underperforming, outdated financial tools of years past. While there are over 8000 funds with their doors open today, Our experts look at the upper echelon of this group, about 750 funds. These money managers direct bulk of the smart money’s total asset base, and by paying attention to their first-class investments, Insider Monkey has deciphered numerous investment strategies that have historically outstripped the broader indices. Insider Monkey’s flagship hedge fund strategy exceeded the S&P 500 index by around 5 percentage points per annum since its inception in May 2014. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 25.7% since February 2017 (through September 30th) even though the market was up more than 33% during the same period. We just shared a list of 10 short targets in our latest quarterly update .

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to review the fresh hedge fund action regarding The RealReal, Inc. (NASDAQ:REAL).

Hedge fund activity in The RealReal, Inc. (NASDAQ:REAL)

Heading into the third quarter of 2019, a total of 33 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 33 from the previous quarter. Below, you can check out the change in hedge fund sentiment towards REAL over the last 16 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Citadel Investment Group held the most valuable stake in The RealReal, Inc. (NASDAQ:REAL), which was worth $10.5 million at the end of the second quarter. On the second spot was Light Street Capital which amassed $10.1 million worth of shares. Moreover, Jericho Capital Asset Management, Millennium Management, and HBK Investments were also bullish on The RealReal, Inc. (NASDAQ:REAL), allocating a large percentage of their portfolios to this stock.

As one would reasonably expect, key money managers were breaking ground themselves. Citadel Investment Group, managed by Ken Griffin, created the largest position in The RealReal, Inc. (NASDAQ:REAL). Citadel Investment Group had $10.5 million invested in the company at the end of the quarter. Glen Kacher’s Light Street Capital also made a $10.1 million investment in the stock during the quarter. The other funds with new positions in the stock are Josh Resnick’s Jericho Capital Asset Management, Israel Englander’s Millennium Management, and David Costen Haley’s HBK Investments.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as The RealReal, Inc. (NASDAQ:REAL) but similarly valued. These stocks are Werner Enterprises, Inc. (NASDAQ:WERN), BEST Inc. (NYSE:BEST), JELD-WEN Holding, Inc. (NYSE:JELD), and Artisan Partners Asset Management Inc (NYSE:APAM). This group of stocks’ market caps are closest to REAL’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| WERN | 15 | 111134 | -1 |

| BEST | 13 | 49071 | -3 |

| JELD | 16 | 366014 | -5 |

| APAM | 15 | 202840 | -1 |

| Average | 14.75 | 182265 | -2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14.75 hedge funds with bullish positions and the average amount invested in these stocks was $182 million. That figure was $102 million in REAL’s case. JELD-WEN Holding, Inc. (NYSE:JELD) is the most popular stock in this table. On the other hand BEST Inc. (NYSE:BEST) is the least popular one with only 13 bullish hedge fund positions. Compared to these stocks The RealReal, Inc. (NASDAQ:REAL) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately REAL wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on REAL were disappointed as the stock returned -22.6% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market in Q3.

Disclosure: None. This article was originally published at Insider Monkey.