The 700+ hedge funds and famous money managers tracked by Insider Monkey have already compiled and submitted their 13F filings for the first quarter, which unveil their equity positions as of March 31. We went through these filings, fixed typos and other more significant errors and identified the changes in hedge fund portfolios. Our extensive review of these public filings is finally over, so this article is set to reveal the smart money sentiment towards The Hanover Insurance Group, Inc. (NYSE:THG).

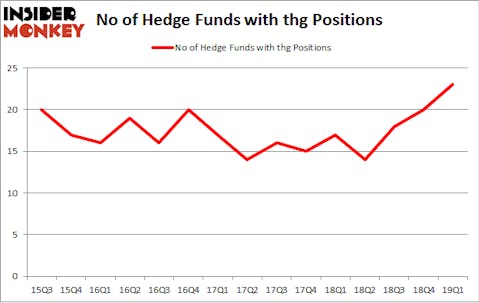

The Hanover Insurance Group, Inc. (NYSE:THG) shareholders have witnessed an increase in enthusiasm from smart money in recent months. Our calculations also showed that thg isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 30.9% through May 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s take a peek at the new hedge fund action encompassing The Hanover Insurance Group, Inc. (NYSE:THG).

How are hedge funds trading The Hanover Insurance Group, Inc. (NYSE:THG)?

At Q1’s end, a total of 23 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 15% from the fourth quarter of 2018. On the other hand, there were a total of 17 hedge funds with a bullish position in THG a year ago. With the smart money’s positions undergoing their usual ebb and flow, there exists an “upper tier” of noteworthy hedge fund managers who were adding to their stakes meaningfully (or already accumulated large positions).

Among these funds, Citadel Investment Group held the most valuable stake in The Hanover Insurance Group, Inc. (NYSE:THG), which was worth $66.9 million at the end of the first quarter. On the second spot was Renaissance Technologies which amassed $50.8 million worth of shares. Moreover, AQR Capital Management, Pzena Investment Management, and Gillson Capital were also bullish on The Hanover Insurance Group, Inc. (NYSE:THG), allocating a large percentage of their portfolios to this stock.

As industrywide interest jumped, specific money managers were breaking ground themselves. Stevens Capital Management, managed by Matthew Tewksbury, initiated the largest position in The Hanover Insurance Group, Inc. (NYSE:THG). Stevens Capital Management had $3 million invested in the company at the end of the quarter. Anand Parekh’s Alyeska Investment Group also made a $1.1 million investment in the stock during the quarter. The following funds were also among the new THG investors: Mike Vranos’s Ellington, David Costen Haley’s HBK Investments, and Paul Tudor Jones’s Tudor Investment Corp.

Let’s also examine hedge fund activity in other stocks similar to The Hanover Insurance Group, Inc. (NYSE:THG). These stocks are AECOM (NYSE:ACM), Healthequity Inc (NASDAQ:HQY), TFS Financial Corporation (NASDAQ:TFSL), and PacWest Bancorp (NASDAQ:PACW). This group of stocks’ market values are similar to THG’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ACM | 21 | 378709 | 3 |

| HQY | 22 | 134839 | 4 |

| TFSL | 7 | 143387 | 0 |

| PACW | 21 | 237543 | 0 |

| Average | 17.75 | 223620 | 1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17.75 hedge funds with bullish positions and the average amount invested in these stocks was $224 million. That figure was $300 million in THG’s case. Healthequity Inc (NASDAQ:HQY) is the most popular stock in this table. On the other hand TFS Financial Corporation (NASDAQ:TFSL) is the least popular one with only 7 bullish hedge fund positions. Compared to these stocks The Hanover Insurance Group, Inc. (NYSE:THG) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on THG as the stock returned 6.4% during the same period and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.