Insider Monkey has processed numerous 13F filings of hedge funds and famous investors to create an extensive database of hedge fund holdings. The 13F filings show the hedge funds’ and investors’ positions as of the end of the fourth quarter. You can find write-ups about an individual hedge fund’s trades on numerous financial news websites. However, in this article we will take a look at their collective moves and analyze what the smart money thinks of Tactile Systems Technology, Inc. (NASDAQ:TCMD) based on that data.

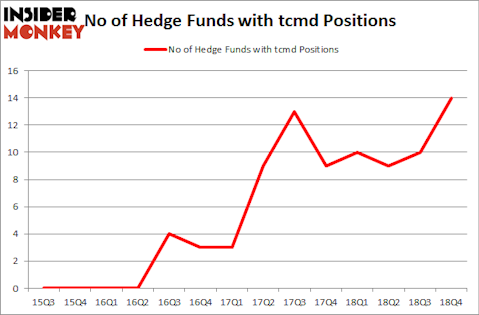

Is Tactile Systems Technology, Inc. (NASDAQ:TCMD) undervalued? Money managers are buying. The number of long hedge fund positions went up by 4 in recent months. Our calculations also showed that tcmd isn’t among the 30 most popular stocks among hedge funds.

In today’s marketplace there are a lot of indicators investors employ to value publicly traded companies. Two of the most underrated indicators are hedge fund and insider trading interest. We have shown that, historically, those who follow the best picks of the top investment managers can beat their index-focused peers by a solid margin (see the details here).

We’re going to review the latest hedge fund action regarding Tactile Systems Technology, Inc. (NASDAQ:TCMD).

How have hedgies been trading Tactile Systems Technology, Inc. (NASDAQ:TCMD)?

Heading into the first quarter of 2019, a total of 14 of the hedge funds tracked by Insider Monkey were long this stock, a change of 40% from the previous quarter. On the other hand, there were a total of 10 hedge funds with a bullish position in TCMD a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Tactile Systems Technology, Inc. (NASDAQ:TCMD) was held by Driehaus Capital, which reported holding $20.2 million worth of stock at the end of December. It was followed by Citadel Investment Group with a $6.7 million position. Other investors bullish on the company included Millennium Management, Renaissance Technologies, and Royce & Associates.

As industrywide interest jumped, key money managers were leading the bulls’ herd. Renaissance Technologies, managed by Jim Simons, created the largest position in Tactile Systems Technology, Inc. (NASDAQ:TCMD). Renaissance Technologies had $1.8 million invested in the company at the end of the quarter. David Costen Haley’s HBK Investments also initiated a $0.5 million position during the quarter. The other funds with brand new TCMD positions are Paul Marshall and Ian Wace’s Marshall Wace LLP and Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital.

Let’s now take a look at hedge fund activity in other stocks similar to Tactile Systems Technology, Inc. (NASDAQ:TCMD). We will take a look at Canadian Solar Inc. (NASDAQ:CSIQ), State Bank Financial Corp (NASDAQ:STBZ), Geopark Ltd (NYSE:GPRK), and Homology Medicines, Inc. (NASDAQ:FIXX). This group of stocks’ market caps are closest to TCMD’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CSIQ | 11 | 96306 | -4 |

| STBZ | 17 | 120356 | -4 |

| GPRK | 13 | 66659 | 3 |

| FIXX | 8 | 163781 | 2 |

| Average | 12.25 | 111776 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12.25 hedge funds with bullish positions and the average amount invested in these stocks was $112 million. That figure was $40 million in TCMD’s case. State Bank Financial Corp (NASDAQ:STBZ) is the most popular stock in this table. On the other hand Homology Medicines, Inc. (NASDAQ:FIXX) is the least popular one with only 8 bullish hedge fund positions. Tactile Systems Technology, Inc. (NASDAQ:TCMD) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately TCMD wasn’t nearly as popular as these 15 stock and hedge funds that were betting on TCMD were disappointed as the stock returned 7.2% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.