Before we spend days researching a stock idea we’d like to take a look at how hedge funds and billionaire investors recently traded that stock. S&P 500 Index ETF (SPY) lost 2.6% in the first two months of the second quarter. Ten out of 11 industry groups in the S&P 500 Index lost value in May. The average return of a randomly picked stock in the index was even worse (-3.6%). This means you (or a monkey throwing a dart) have less than an even chance of beating the market by randomly picking a stock. On the other hand, the top 20 most popular S&P 500 stocks among hedge funds not only generated positive returns but also outperformed the index by about 3 percentage points through May 30th. In this article, we will take a look at what hedge funds think about Rosetta Stone Inc (NYSE:RST).

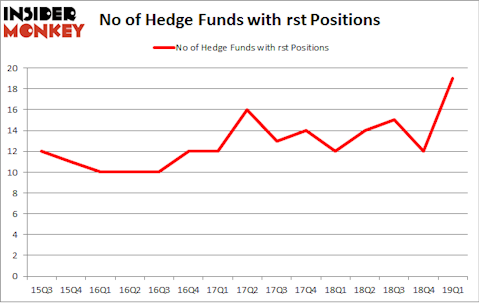

Rosetta Stone Inc (NYSE:RST) was in 19 hedge funds’ portfolios at the end of the first quarter of 2019. RST investors should be aware of an increase in activity from the world’s largest hedge funds in recent months. There were 12 hedge funds in our database with RST holdings at the end of the previous quarter. Our calculations also showed that rst isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 30.9% through May 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to view the new hedge fund action surrounding Rosetta Stone Inc (NYSE:RST).

Hedge fund activity in Rosetta Stone Inc (NYSE:RST)

Heading into the second quarter of 2019, a total of 19 of the hedge funds tracked by Insider Monkey were long this stock, a change of 58% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in RST over the last 15 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Jim Simons’s Renaissance Technologies has the most valuable position in Rosetta Stone Inc (NYSE:RST), worth close to $39.2 million, amounting to less than 0.1%% of its total 13F portfolio. The second most bullish fund manager is Osmium Partners, managed by John H Lewis, which holds a $35 million position; the fund has 29.6% of its 13F portfolio invested in the stock. Other professional money managers that hold long positions encompass John W. Rogers’s Ariel Investments, Israel Englander’s Millennium Management and Josh Goldberg’s G2 Investment Partners Management.

As one would reasonably expect, key hedge funds were leading the bulls’ herd. Diker Management, managed by Mark N. Diker, created the most valuable position in Rosetta Stone Inc (NYSE:RST). Diker Management had $3 million invested in the company at the end of the quarter. Matthew Hulsizer’s PEAK6 Capital Management also initiated a $1.9 million position during the quarter. The following funds were also among the new RST investors: Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, Roger Ibbotson’s Zebra Capital Management, and David Harding’s Winton Capital Management.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Rosetta Stone Inc (NYSE:RST) but similarly valued. We will take a look at e.l.f. Beauty, Inc. (NYSE:ELF), EZCORP Inc (NASDAQ:EZPW), Transenterix Inc (NYSE:TRXC), and pdvWireless Inc (NASDAQ:PDVW). This group of stocks’ market valuations resemble RST’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ELF | 18 | 117892 | 1 |

| EZPW | 20 | 116774 | 0 |

| TRXC | 13 | 10958 | 5 |

| PDVW | 13 | 252859 | 1 |

| Average | 16 | 124621 | 1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16 hedge funds with bullish positions and the average amount invested in these stocks was $125 million. That figure was $127 million in RST’s case. EZCORP Inc (NASDAQ:EZPW) is the most popular stock in this table. On the other hand Transenterix Inc (NYSE:TRXC) is the least popular one with only 13 bullish hedge fund positions. Rosetta Stone Inc (NYSE:RST) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on RST as the stock returned 13% during the same period and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.