Amid an overall bull market, many stocks that smart money investors were collectively bullish on surged during the first quarter. Among them, Facebook and Microsoft ranked among the top 3 picks and these stocks gained 40% and 25% respectively. Our research shows that most of the stocks that smart money likes historically generate strong risk-adjusted returns. That’s why we weren’t surprised when hedge funds’ top 20 large-cap stock picks generated a return of 18.7% during the first 5 months of 2019 and outperformed the broader market benchmark by 6.6 percentage points.This is why following the smart money sentiment is a useful tool at identifying the next stock to invest in.

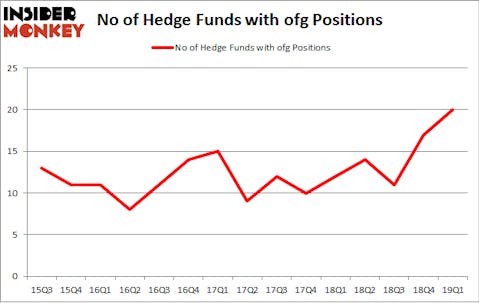

OFG Bancorp (NYSE:OFG) investors should be aware of an increase in hedge fund sentiment of late. Our calculations also showed that ofg isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 30.9% through May 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Matthew Hulsizer of PEAK6 Capital

Let’s analyze the fresh hedge fund action regarding OFG Bancorp (NYSE:OFG).

How have hedgies been trading OFG Bancorp (NYSE:OFG)?

At Q1’s end, a total of 20 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 18% from one quarter earlier. On the other hand, there were a total of 12 hedge funds with a bullish position in OFG a year ago. With hedge funds’ sentiment swirling, there exists a few notable hedge fund managers who were boosting their holdings significantly (or already accumulated large positions).

Among these funds, Arrowstreet Capital held the most valuable stake in OFG Bancorp (NYSE:OFG), which was worth $15.6 million at the end of the first quarter. On the second spot was AQR Capital Management which amassed $9.6 million worth of shares. Moreover, PEAK6 Capital Management, GLG Partners, and Renaissance Technologies were also bullish on OFG Bancorp (NYSE:OFG), allocating a large percentage of their portfolios to this stock.

As aggregate interest increased, some big names have jumped into OFG Bancorp (NYSE:OFG) headfirst. Balyasny Asset Management, managed by Dmitry Balyasny, established the biggest position in OFG Bancorp (NYSE:OFG). Balyasny Asset Management had $5.4 million invested in the company at the end of the quarter. Richard Driehaus’s Driehaus Capital also made a $4.2 million investment in the stock during the quarter. The following funds were also among the new OFG investors: Paul Marshall and Ian Wace’s Marshall Wace LLP, Peter Muller’s PDT Partners, and Minhua Zhang’s Weld Capital Management.

Let’s go over hedge fund activity in other stocks similar to OFG Bancorp (NYSE:OFG). These stocks are Victory Capital Holdings, Inc. (NASDAQ:VCTR), Stewart Information Services Corp (NYSE:STC), Goosehead Insurance, Inc. (NASDAQ:GSHD), and Harmony Gold Mining Company Limited (NYSE:HMY). This group of stocks’ market valuations are closest to OFG’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| VCTR | 13 | 61732 | 3 |

| STC | 17 | 139746 | 3 |

| GSHD | 4 | 8254 | 1 |

| HMY | 9 | 24948 | 2 |

| Average | 10.75 | 58670 | 2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 10.75 hedge funds with bullish positions and the average amount invested in these stocks was $59 million. That figure was $74 million in OFG’s case. Stewart Information Services Corp (NYSE:STC) is the most popular stock in this table. On the other hand Goosehead Insurance, Inc. (NASDAQ:GSHD) is the least popular one with only 4 bullish hedge fund positions. Compared to these stocks OFG Bancorp (NYSE:OFG) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately OFG wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on OFG were disappointed as the stock returned -3.7% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market in Q2.

Disclosure: None. This article was originally published at Insider Monkey.