Is Oasis Midstream Partners LP (NYSE:OMP) a good place to invest some of your money right now? We can gain invaluable insight to help us answer that question by studying the investment trends of top investors, who employ world-class Ivy League graduates, who are given immense resources and industry contacts to put their financial expertise to work. The top picks of these firms have historically outperformed the market when we account for known risk factors, making them very valuable investment ideas.

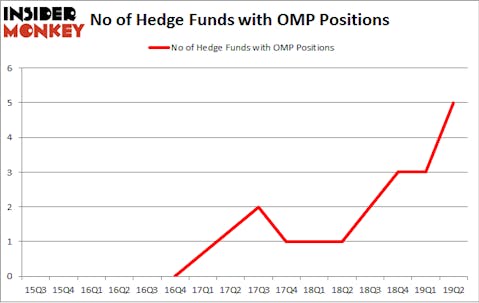

Oasis Midstream Partners LP (NYSE:OMP) was in 5 hedge funds’ portfolios at the end of June. OMP investors should pay attention to an increase in hedge fund interest of late. There were 3 hedge funds in our database with OMP positions at the end of the previous quarter. Our calculations also showed that OMP isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s view the recent hedge fund action regarding Oasis Midstream Partners LP (NYSE:OMP).

How are hedge funds trading Oasis Midstream Partners LP (NYSE:OMP)?

Heading into the third quarter of 2019, a total of 5 of the hedge funds tracked by Insider Monkey were long this stock, a change of 67% from the first quarter of 2019. Below, you can check out the change in hedge fund sentiment towards OMP over the last 16 quarters. With the smart money’s sentiment swirling, there exists an “upper tier” of notable hedge fund managers who were increasing their stakes substantially (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Perella Weinberg Partners has the largest position in Oasis Midstream Partners LP (NYSE:OMP), worth close to $7 million, corresponding to 0.3% of its total 13F portfolio. The second largest stake is held by Paul Marshall and Ian Wace of Marshall Wace LLP, with a $4.1 million position; less than 0.1%% of its 13F portfolio is allocated to the company. Remaining professional money managers that are bullish encompass Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, Renaissance Technologies and Emanuel J. Friedman’s EJF Capital.

As industrywide interest jumped, key money managers were leading the bulls’ herd. Perella Weinberg Partners, initiated the biggest position in Oasis Midstream Partners LP (NYSE:OMP). Perella Weinberg Partners had $7 million invested in the company at the end of the quarter. Emanuel J. Friedman’s EJF Capital also made a $0.2 million investment in the stock during the quarter.

Let’s also examine hedge fund activity in other stocks similar to Oasis Midstream Partners LP (NYSE:OMP). These stocks are Falcon Minerals Corporation (NASDAQ:FLMN), P.H. Glatfelter Company (NYSE:GLT), e.l.f. Beauty, Inc. (NYSE:ELF), and AK Steel Holding Corporation (NYSE:AKS). All of these stocks’ market caps are closest to OMP’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FLMN | 22 | 119468 | 5 |

| GLT | 6 | 16606 | -4 |

| ELF | 18 | 198724 | 0 |

| AKS | 14 | 25987 | 1 |

| Average | 15 | 90196 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15 hedge funds with bullish positions and the average amount invested in these stocks was $90 million. That figure was $16 million in OMP’s case. Falcon Minerals Corporation (NASDAQ:FLMN) is the most popular stock in this table. On the other hand P.H. Glatfelter Company (NYSE:GLT) is the least popular one with only 6 bullish hedge fund positions. Compared to these stocks Oasis Midstream Partners LP (NYSE:OMP) is even less popular than GLT. Hedge funds dodged a bullet by taking a bearish stance towards OMP. Our calculations showed that the top 20 most popular hedge fund stocks returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately OMP wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was very bearish); OMP investors were disappointed as the stock returned -23.4% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far in 2019.

Disclosure: None. This article was originally published at Insider Monkey.