Concerns over rising interest rates and expected further rate increases have hit several stocks hard during the fourth quarter of 2018. Trends reversed 180 degrees in 2019 amid Powell’s pivot and optimistic expectations towards a trade deal with China. Hedge funds and institutional investors tracked by Insider Monkey usually invest a disproportionate amount of their portfolios in smaller cap stocks. We have been receiving indications that hedge funds were increasing their overall exposure in the third quarter and this is one of the factors behind the recent movements in major indices. In this article, we will take a closer look at hedge fund sentiment towards MSG Networks Inc (NYSE:MSGN).

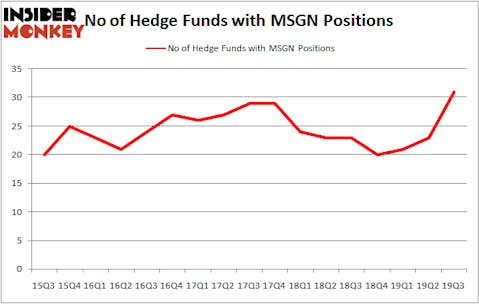

MSG Networks Inc (NYSE:MSGN) shareholders have witnessed an increase in activity from the world’s largest hedge funds lately. MSGN was in 31 hedge funds’ portfolios at the end of the third quarter of 2019. There were 23 hedge funds in our database with MSGN positions at the end of the previous quarter. Our calculations also showed that MSGN isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the eyes of most stock holders, hedge funds are perceived as unimportant, old investment tools of the past. While there are over 8000 funds trading at the moment, We look at the upper echelon of this group, around 750 funds. These hedge fund managers watch over most of the smart money’s total asset base, and by paying attention to their matchless investments, Insider Monkey has determined various investment strategies that have historically exceeded the broader indices. Insider Monkey’s flagship short hedge fund strategy outpaced the S&P 500 short ETFs by around 20 percentage points a year since its inception in May 2014. Our portfolio of short stocks lost 27.8% since February 2017 (through November 21st) even though the market was up more than 39% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. Let’s take a peek at the fresh hedge fund action surrounding MSG Networks Inc (NYSE:MSGN).

What have hedge funds been doing with MSG Networks Inc (NYSE:MSGN)?

Heading into the fourth quarter of 2019, a total of 31 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 35% from the second quarter of 2019. On the other hand, there were a total of 23 hedge funds with a bullish position in MSGN a year ago. With hedge funds’ capital changing hands, there exists a select group of noteworthy hedge fund managers who were boosting their stakes significantly (or already accumulated large positions).

Among these funds, Ariel Investments held the most valuable stake in MSG Networks Inc (NYSE:MSGN), which was worth $140.6 million at the end of the third quarter. On the second spot was GAMCO Investors which amassed $31.5 million worth of shares. Millennium Management, Renaissance Technologies, and Arrowstreet Capital were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Solas Capital Management allocated the biggest weight to MSG Networks Inc (NYSE:MSGN), around 5.55% of its portfolio. Ursa Fund Management is also relatively very bullish on the stock, earmarking 3.31 percent of its 13F equity portfolio to MSGN.

As one would reasonably expect, key hedge funds have been driving this bullishness. Ursa Fund Management, managed by Andrew Hahn, assembled the biggest position in MSG Networks Inc (NYSE:MSGN). Ursa Fund Management had $4.7 million invested in the company at the end of the quarter. Michael Gelband’s ExodusPoint Capital also made a $2.3 million investment in the stock during the quarter. The other funds with new positions in the stock are Donald Sussman’s Paloma Partners, Alec Litowitz and Ross Laser’s Magnetar Capital, and Parvinder Thiara’s Athanor Capital.

Let’s check out hedge fund activity in other stocks similar to MSG Networks Inc (NYSE:MSGN). These stocks are Bright Scholar Education Holdings Limited (NYSE:BEDU), Raven Industries, Inc. (NASDAQ:RAVN), RPC, Inc. (NYSE:RES), and Helix Energy Solutions Group Inc. (NYSE:HLX). This group of stocks’ market caps resemble MSGN’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BEDU | 9 | 116217 | 0 |

| RAVN | 11 | 92626 | -1 |

| RES | 12 | 66333 | -4 |

| HLX | 13 | 70293 | 2 |

| Average | 11.25 | 86367 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 11.25 hedge funds with bullish positions and the average amount invested in these stocks was $86 million. That figure was $268 million in MSGN’s case. Helix Energy Solutions Group Inc. (NYSE:HLX) is the most popular stock in this table. On the other hand Bright Scholar Education Holdings Limited (NYSE:BEDU) is the least popular one with only 9 bullish hedge fund positions. Compared to these stocks MSG Networks Inc (NYSE:MSGN) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Unfortunately MSGN wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on MSGN were disappointed as the stock returned 0.1% during the first two months of the fourth quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 70 percent of these stocks already outperformed the market in Q4.

Disclosure: None. This article was originally published at Insider Monkey.

Video: 5 Most Popular Stock Among Hedge Funds