Is Marine Products Corp. (NYSE:MPX) a good bet right now? We like to analyze hedge fund sentiment before doing days of in-depth research. We do so because hedge funds and other elite investors have numerous Ivy League graduates, expert network advisers, and supply chain tipsters working or consulting for them. There is not a shortage of news stories covering failed hedge fund investments and it is a fact that hedge funds’ picks don’t beat the market 100% of the time, but their consensus picks have historically done very well and have outperformed the market after adjusting for risk.

Marine Products Corp. (NYSE:MPX) shareholders have witnessed an increase in activity from the world’s largest hedge funds recently. Our calculations also showed that MPX isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 20.7% year to date (through March 12th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 32 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to take a peek at the latest hedge fund action regarding Marine Products Corp. (NYSE:MPX).

How have hedgies been trading Marine Products Corp. (NYSE:MPX)?

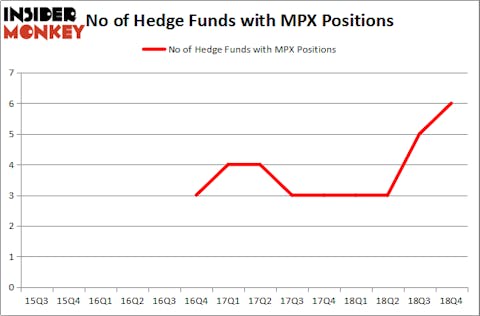

At the end of the fourth quarter, a total of 6 of the hedge funds tracked by Insider Monkey were long this stock, a change of 20% from the previous quarter. The graph below displays the number of hedge funds with bullish position in MPX over the last 14 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists a select group of notable hedge fund managers who were boosting their stakes significantly (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, GAMCO Investors, managed by Mario Gabelli, holds the largest position in Marine Products Corp. (NYSE:MPX). GAMCO Investors has a $15.6 million position in the stock, comprising 0.1% of its 13F portfolio. The second largest stake is held by Renaissance Technologies, led by Jim Simons, holding a $4.3 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Some other members of the smart money with similar optimism contain Matthew Hulsizer’s PEAK6 Capital Management, Peter Algert and Kevin Coldiron’s Algert Coldiron Investors and Roger Ibbotson’s Zebra Capital Management.

Consequently, specific money managers have been driving this bullishness. Zebra Capital Management, managed by Roger Ibbotson, established the biggest position in Marine Products Corp. (NYSE:MPX). Zebra Capital Management had $0.3 million invested in the company at the end of the quarter. Ken Griffin’s Citadel Investment Group also initiated a $0.2 million position during the quarter.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Marine Products Corp. (NYSE:MPX) but similarly valued. These stocks are Schnitzer Steel Industries, Inc. (NASDAQ:SCHN), Fortuna Silver Mines Inc. (NYSE:FSM), Comtech Telecommunications Corp. (NASDAQ:CMTL), and Aurinia Pharmaceuticals Inc (NASDAQ:AUPH). This group of stocks’ market values resemble MPX’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SCHN | 18 | 41036 | -1 |

| FSM | 15 | 42158 | 4 |

| CMTL | 14 | 97683 | 0 |

| AUPH | 8 | 36467 | 2 |

| Average | 13.75 | 54336 | 1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13.75 hedge funds with bullish positions and the average amount invested in these stocks was $54 million. That figure was $21 million in MPX’s case. Schnitzer Steel Industries, Inc. (NASDAQ:SCHN) is the most popular stock in this table. On the other hand Aurinia Pharmaceuticals Inc (NASDAQ:AUPH) is the least popular one with only 8 bullish hedge fund positions. Compared to these stocks Marine Products Corp. (NYSE:MPX) is even less popular than AUPH. Hedge funds dodged a bullet by taking a bearish stance towards MPX. Our calculations showed that the top 15 most popular hedge fund stocks returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately MPX wasn’t nearly as popular as these 15 stock (hedge fund sentiment was very bearish); MPX investors were disappointed as the stock returned -17% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.