Is Luxoft Holding Inc (NYSE:LXFT) a good equity to bet on right now? We like to check what the smart money thinks first before doing extensive research. Although there have been several high profile failed hedge fund picks, the consensus picks among hedge fund investors have historically outperformed the market after adjusting for known risk attributes. It’s not surprising given that hedge funds have access to better information and more resources to predict the winners in the stock market.

Luxoft Holding Inc (NYSE:LXFT) investors should be aware of an increase in support from the world’s most elite money managers of late. Our calculations also showed that lxft isn’t among the 30 most popular stocks among hedge funds.

In today’s marketplace there are a multitude of formulas stock traders can use to appraise their holdings. A pair of the best formulas are hedge fund and insider trading sentiment. We have shown that, historically, those who follow the top picks of the elite investment managers can outclass the broader indices by a significant margin (see the details here).

We’re going to analyze the fresh hedge fund action encompassing Luxoft Holding Inc (NYSE:LXFT).

What have hedge funds been doing with Luxoft Holding Inc (NYSE:LXFT)?

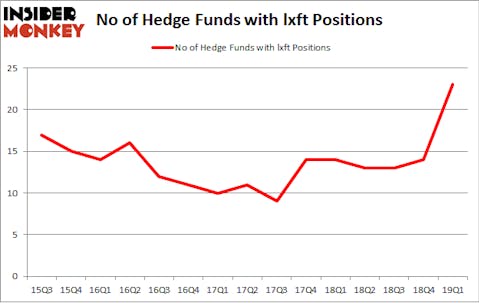

At the end of the first quarter, a total of 23 of the hedge funds tracked by Insider Monkey were long this stock, a change of 64% from the previous quarter. The graph below displays the number of hedge funds with bullish position in LXFT over the last 15 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists an “upper tier” of key hedge fund managers who were upping their holdings significantly (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Alec Litowitz and Ross Laser’s Magnetar Capital has the biggest position in Luxoft Holding Inc (NYSE:LXFT), worth close to $75.3 million, corresponding to 1.9% of its total 13F portfolio. Coming in second is Alpine Associates, managed by Robert Emil Zoellner, which holds a $74.3 million position; the fund has 2.4% of its 13F portfolio invested in the stock. Remaining hedge funds and institutional investors with similar optimism comprise John Orrico’s Water Island Capital, John Bader’s Halcyon Asset Management and Phill Gross and Robert Atchinson’s Adage Capital Management.

As one would reasonably expect, key hedge funds were breaking ground themselves. Magnetar Capital, managed by Alec Litowitz and Ross Laser, established the most outsized position in Luxoft Holding Inc (NYSE:LXFT). Magnetar Capital had $75.3 million invested in the company at the end of the quarter. Robert Emil Zoellner’s Alpine Associates also made a $74.3 million investment in the stock during the quarter. The following funds were also among the new LXFT investors: John Orrico’s Water Island Capital, John Bader’s Halcyon Asset Management, and Phill Gross and Robert Atchinson’s Adage Capital Management.

Let’s go over hedge fund activity in other stocks similar to Luxoft Holding Inc (NYSE:LXFT). We will take a look at Cohen & Steers, Inc. (NYSE:CNS), Newmark Group, Inc. (NASDAQ:NMRK), Travelport Worldwide Ltd (NYSE:TVPT), and Cott Corporation (NYSE:COT). This group of stocks’ market valuations match LXFT’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CNS | 9 | 62135 | 1 |

| NMRK | 24 | 119754 | 3 |

| TVPT | 19 | 409408 | -5 |

| COT | 28 | 500500 | 0 |

| Average | 20 | 272949 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 20 hedge funds with bullish positions and the average amount invested in these stocks was $273 million. That figure was $390 million in LXFT’s case. Cott Corporation (NYSE:COT) is the most popular stock in this table. On the other hand Cohen & Steers, Inc. (NYSE:CNS) is the least popular one with only 9 bullish hedge fund positions. Luxoft Holding Inc (NYSE:LXFT) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately LXFT wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on LXFT were disappointed as the stock returned -1.4% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.