We can judge whether Lincoln National Corporation (NYSE:LNC) is a good investment right now by following the lead of some of the best investors in the world and piggybacking their ideas. There’s no better way to get these firms’ immense resources and analytical capabilities working for us than to follow their lead into their best ideas. While not all of these picks will be winners, our research shows that these picks historically outperformed the market when we factor in known risk factors.

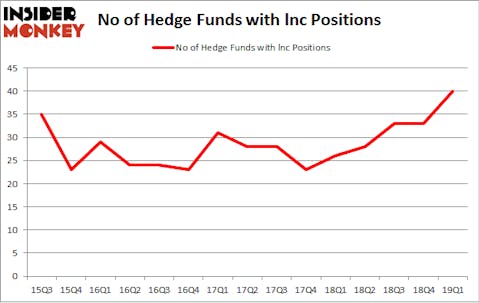

Is Lincoln National Corporation (NYSE:LNC) going to take off soon? Money managers are getting more optimistic. The number of long hedge fund bets moved up by 7 recently. Our calculations also showed that lnc isn’t among the 30 most popular stocks among hedge funds. LNC was in 40 hedge funds’ portfolios at the end of March. There were 33 hedge funds in our database with LNC holdings at the end of the previous quarter.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

Noam Gottesman, GLG Partners

Let’s check out the new hedge fund action surrounding Lincoln National Corporation (NYSE:LNC).

How have hedgies been trading Lincoln National Corporation (NYSE:LNC)?

Heading into the second quarter of 2019, a total of 40 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 21% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards LNC over the last 15 quarters. With hedgies’ positions undergoing their usual ebb and flow, there exists an “upper tier” of key hedge fund managers who were increasing their holdings considerably (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Millennium Management, managed by Israel Englander, holds the number one position in Lincoln National Corporation (NYSE:LNC). Millennium Management has a $93.9 million position in the stock, comprising 0.1% of its 13F portfolio. The second largest stake is held by Peter Rathjens, Bruce Clarke and John Campbell of Arrowstreet Capital, with a $88.8 million position; the fund has 0.2% of its 13F portfolio invested in the stock. Other members of the smart money that hold long positions encompass Noam Gottesman’s GLG Partners, Steven Richman’s East Side Capital (RR Partners) and Cliff Asness’s AQR Capital Management.

Consequently, key money managers have been driving this bullishness. Gillson Capital, managed by Daniel Johnson, initiated the most valuable position in Lincoln National Corporation (NYSE:LNC). Gillson Capital had $11.8 million invested in the company at the end of the quarter. Bruce Kovner’s Caxton Associates LP also initiated a $10.3 million position during the quarter. The other funds with brand new LNC positions are John Thiessen’s Vertex One Asset Management, Dmitry Balyasny’s Balyasny Asset Management, and Joe DiMenna’s ZWEIG DIMENNA PARTNERS.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Lincoln National Corporation (NYSE:LNC) but similarly valued. These stocks are The AES Corporation (NYSE:AES), Wabtec Corporation (NYSE:WAB), Norwegian Cruise Line Holdings Ltd (NYSE:NCLH), and Noble Energy, Inc. (NYSE:NBL). All of these stocks’ market caps match LNC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AES | 24 | 525751 | -5 |

| WAB | 36 | 783264 | 26 |

| NCLH | 35 | 1020481 | -5 |

| NBL | 24 | 615273 | -2 |

| Average | 29.75 | 736192 | 3.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 29.75 hedge funds with bullish positions and the average amount invested in these stocks was $736 million. That figure was $564 million in LNC’s case. Wabtec Corporation (NYSE:WAB) is the most popular stock in this table. On the other hand The AES Corporation (NYSE:AES) is the least popular one with only 24 bullish hedge fund positions. Compared to these stocks Lincoln National Corporation (NYSE:LNC) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on LNC as the stock returned 5.8% during the same period and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.