You probably know from experience that there is not as much information on small-cap companies as there is on large companies. Of course, this makes it really hard and difficult for individual investors to make proper and accurate analysis of certain small-cap companies. However, well-known and successful hedge fund managers like Jeff Ubben, George Soros and Seth Klarman hold the necessary resources and abilities to conduct an extensive stock analysis on small-cap stocks, which enable them to make millions of dollars by identifying potential winners within the small-cap galaxy of stocks. This represents the main reason why Insider Monkey takes notice of the hedge fund activity in these overlooked stocks.

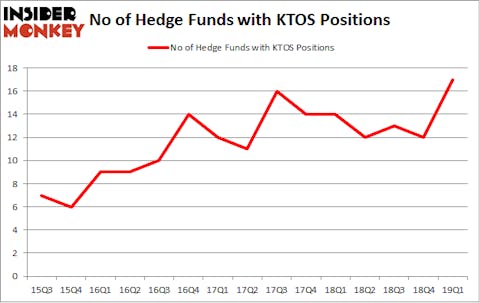

Is Kratos Defense & Security Solutions, Inc (NASDAQ:KTOS) undervalued? Prominent investors are getting more optimistic. The number of long hedge fund positions improved by 5 in recent months. Our calculations also showed that ktos isn’t among the 30 most popular stocks among hedge funds.

In the eyes of most investors, hedge funds are seen as unimportant, outdated investment tools of the past. While there are more than 8000 funds with their doors open today, Our researchers choose to focus on the aristocrats of this club, approximately 750 funds. These hedge fund managers command the majority of the hedge fund industry’s total capital, and by keeping an eye on their unrivaled picks, Insider Monkey has unsheathed many investment strategies that have historically outstripped Mr. Market. Insider Monkey’s flagship hedge fund strategy outstripped the S&P 500 index by around 5 percentage points annually since its inception in May 2014 through June 18th. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 28.2% since February 2017 (through June 18th) even though the market was up nearly 30% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 8.2% in a month whereas our long picks outperformed the market by 2.5 percentage points in this volatile 5 week period (our long picks also beat the market by 15 percentage points so far this year).

Let’s go over the fresh hedge fund action regarding Kratos Defense & Security Solutions, Inc (NASDAQ:KTOS).

What have hedge funds been doing with Kratos Defense & Security Solutions, Inc (NASDAQ:KTOS)?

At Q1’s end, a total of 17 of the hedge funds tracked by Insider Monkey were long this stock, a change of 42% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards KTOS over the last 15 quarters. With the smart money’s capital changing hands, there exists an “upper tier” of noteworthy hedge fund managers who were increasing their stakes significantly (or already accumulated large positions).

Among these funds, Daruma Asset Management held the most valuable stake in Kratos Defense & Security Solutions, Inc (NASDAQ:KTOS), which was worth $32.6 million at the end of the first quarter. On the second spot was Impala Asset Management which amassed $24.9 million worth of shares. Moreover, Royce & Associates, Driehaus Capital, and Millennium Management were also bullish on Kratos Defense & Security Solutions, Inc (NASDAQ:KTOS), allocating a large percentage of their portfolios to this stock.

As industrywide interest jumped, key money managers were leading the bulls’ herd. Renaissance Technologies, managed by Jim Simons, initiated the largest position in Kratos Defense & Security Solutions, Inc (NASDAQ:KTOS). Renaissance Technologies had $4.2 million invested in the company at the end of the quarter. Cliff Asness’s AQR Capital Management also initiated a $0.5 million position during the quarter. The other funds with new positions in the stock are Michael Platt and William Reeves’s BlueCrest Capital Mgmt., Paul Marshall and Ian Wace’s Marshall Wace LLP, and Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Kratos Defense & Security Solutions, Inc (NASDAQ:KTOS) but similarly valued. These stocks are Qudian Inc. (NYSE:QD), Cardtronics plc (NASDAQ:CATM), AeroVironment, Inc. (NASDAQ:AVAV), and Shutterstock Inc (NYSE:SSTK). This group of stocks’ market values are similar to KTOS’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| QD | 18 | 52281 | 3 |

| CATM | 18 | 402332 | 0 |

| AVAV | 13 | 40715 | 4 |

| SSTK | 17 | 111417 | 1 |

| Average | 16.5 | 151686 | 2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.5 hedge funds with bullish positions and the average amount invested in these stocks was $152 million. That figure was $113 million in KTOS’s case. Qudian Inc. (NYSE:QD) is the most popular stock in this table. On the other hand AeroVironment, Inc. (NASDAQ:AVAV) is the least popular one with only 13 bullish hedge fund positions. Kratos Defense & Security Solutions, Inc (NASDAQ:KTOS) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Hedge funds were also right about betting on KTOS as the stock returned 40.9% during the same period and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.