Coronavirus is probably the #1 concern in investors’ minds right now. It should be. We estimate that COVID-19 will kill around 5 million people worldwide and there is a 3.3% probability that Donald Trump will die from the new coronavirus (read the details.). In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. We have processed the filings of the more than 835 world-class investment firms that we track and now have access to the collective wisdom contained in these filings, which are based on their December 31 holdings, data that is available nowhere else. Should you consider Johnson & Johnson (NYSE:JNJ) for your portfolio? We’ll look to this invaluable collective wisdom for the answer.

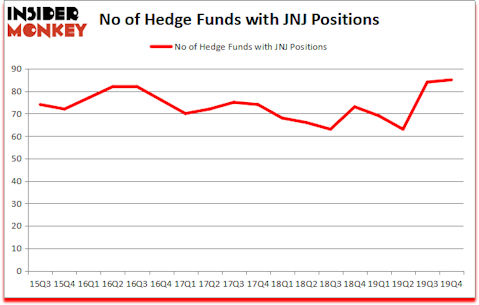

Is Johnson & Johnson (NYSE:JNJ) going to take off soon? The best stock pickers are buying. The number of long hedge fund bets rose by 1 in recent months. Our calculations also showed that JNJ ranks 27th among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video below for Q3 rankings). JNJ was in 85 hedge funds’ portfolios at the end of December. There were 84 hedge funds in our database with JNJ holdings at the end of the previous quarter.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that a select group of hedge fund holdings outperformed the S&P 500 ETFs by more than 41 percentage points since March 2017 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 35.3% through March 3rd. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Jeffrey Tannenbaum of Fir Tree

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences, and and go through short-term trade recommendations like this one. We even check out the recommendations of services with hard to believe track records. In January, we recommended a long position in one of the most shorted stocks in the market, and that stock returned nearly 50% despite the large losses in the market since our recommendation. Keeping this in mind we’re going to take a glance at the new hedge fund action encompassing Johnson & Johnson (NYSE:JNJ).

How have hedgies been trading Johnson & Johnson (NYSE:JNJ)?

Heading into the first quarter of 2020, a total of 85 of the hedge funds tracked by Insider Monkey were long this stock, a change of 1% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in JNJ over the last 18 quarters. With the smart money’s sentiment swirling, there exists a select group of key hedge fund managers who were increasing their holdings significantly (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Ken Fisher’s Fisher Asset Management has the largest position in Johnson & Johnson (NYSE:JNJ), worth close to $1.7646 billion, corresponding to 1.8% of its total 13F portfolio. The second largest stake is held by AQR Capital Management, managed by Cliff Asness, which holds a $1.0204 billion position; 1.2% of its 13F portfolio is allocated to the company. Remaining members of the smart money with similar optimism include D. E. Shaw’s D E Shaw, John Overdeck and David Siegel’s Two Sigma Advisors and Donald Yacktman’s Yacktman Asset Management. In terms of the portfolio weights assigned to each position Yacktman Asset Management allocated the biggest weight to Johnson & Johnson (NYSE:JNJ), around 6.86% of its 13F portfolio. Fir Tree is also relatively very bullish on the stock, setting aside 6.59 percent of its 13F equity portfolio to JNJ.

As one would reasonably expect, specific money managers were breaking ground themselves. Suvretta Capital Management, managed by Aaron Cowen, initiated the most valuable position in Johnson & Johnson (NYSE:JNJ). Suvretta Capital Management had $177.3 million invested in the company at the end of the quarter. Frank Brosens’s Taconic Capital also made a $72.9 million investment in the stock during the quarter. The following funds were also among the new JNJ investors: Jeffrey Tannenbaum’s Fir Tree, Steve Cohen’s Point72 Asset Management, and Justin John Ferayorni’s Tamarack Capital Management.

Let’s now review hedge fund activity in other stocks similar to Johnson & Johnson (NYSE:JNJ). These stocks are Walmart Inc. (NYSE:WMT), Bank of America Corporation (NYSE:BAC), Berkshire Hathaway Inc. (NYSE:BRK-B), and The Procter & Gamble Company (NYSE:PG). All of these stocks’ market caps resemble JNJ’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| WMT | 52 | 5252501 | -6 |

| BAC | 99 | 38412092 | -4 |

| BRK-B | 113 | 23616180 | 2 |

| PG | 79 | 10725870 | 5 |

| Average | 85.75 | 19501661 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 85.75 hedge funds with bullish positions and the average amount invested in these stocks was $19502 million. That figure was $8258 million in JNJ’s case. Berkshire Hathaway Inc. (NYSE:BRK-B) is the most popular stock in this table. On the other hand Walmart Inc. (NYSE:WMT) is the least popular one with only 52 bullish hedge fund positions. Johnson & Johnson (NYSE:JNJ) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks also gained 0.1% in 2020 through March 2nd and beat the market by 4.1 percentage points. A small number of hedge funds were also right about betting on JNJ, though not to the same extent, as the stock returned -3.4% during the same time period and outperformed the market.

Disclosure: None. This article was originally published at Insider Monkey.