A whopping number of 13F filings filed with U.S. Securities and Exchange Commission has been processed by Insider Monkey so that individual investors can look at the overall hedge fund sentiment towards the stocks included in their watchlists. These freshly-submitted public filings disclose money managers’ equity positions as of the end of the three-month period that ended March 31, so let’s proceed with the discussion of the hedge fund sentiment on Invitation Homes Inc. (NYSE:INVH).

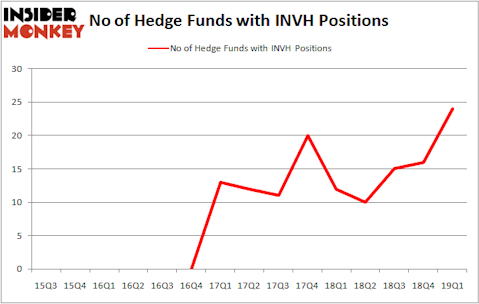

Invitation Homes Inc. (NYSE:INVH) was in 24 hedge funds’ portfolios at the end of March. INVH has experienced an increase in activity from the world’s largest hedge funds of late. There were 16 hedge funds in our database with INVH holdings at the end of the previous quarter. Our calculations also showed that INVH isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 30.9% through May 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s take a glance at the latest hedge fund action encompassing Invitation Homes Inc. (NYSE:INVH).

How are hedge funds trading Invitation Homes Inc. (NYSE:INVH)?

At the end of the first quarter, a total of 24 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 50% from the fourth quarter of 2018. By comparison, 12 hedge funds held shares or bullish call options in INVH a year ago. With hedgies’ capital changing hands, there exists a few key hedge fund managers who were adding to their stakes significantly (or already accumulated large positions).

The largest stake in Invitation Homes Inc. (NYSE:INVH) was held by Zimmer Partners, which reported holding $97.3 million worth of stock at the end of March. It was followed by Renaissance Technologies with a $50.4 million position. Other investors bullish on the company included Millennium Management, AEW Capital Management, and Laurion Capital Management.

With a general bullishness amongst the heavyweights, key hedge funds were breaking ground themselves. Laurion Capital Management, managed by Benjamin A. Smith, assembled the largest position in Invitation Homes Inc. (NYSE:INVH). Laurion Capital Management had $42.1 million invested in the company at the end of the quarter. Jeffrey Talpins’s Element Capital Management also made a $25.7 million investment in the stock during the quarter. The following funds were also among the new INVH investors: Jonathan Litt’s Land & Buildings Investment Management, Eduardo Abush’s Waterfront Capital Partners, and Simon Sadler’s Segantii Capital.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Invitation Homes Inc. (NYSE:INVH) but similarly valued. These stocks are Centrais Eletricas Brasileiras SA – Eletrobras (NYSE:EBR), Vistra Energy Corp. (NYSE:VST), HEICO Corporation (NYSE:HEI), and Celanese Corporation (NYSE:CE). This group of stocks’ market valuations match INVH’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| EBR | 8 | 22778 | 3 |

| VST | 48 | 3073385 | 4 |

| HEI | 26 | 744050 | -5 |

| CE | 21 | 594377 | -5 |

| Average | 25.75 | 1108648 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 25.75 hedge funds with bullish positions and the average amount invested in these stocks was $1109 million. That figure was $426 million in INVH’s case. Vistra Energy Corp. (NYSE:VST) is the most popular stock in this table. On the other hand Centrais Eletricas Brasileiras SA – Eletrobras (NYSE:EBR) is the least popular one with only 8 bullish hedge fund positions. Invitation Homes Inc. (NYSE:INVH) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. A small number of hedge funds were also right about betting on INVH as the stock returned 5% during the same time frame and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.