Out of thousands of stocks that are currently traded on the market, it is difficult to identify those that will really generate strong returns. Hedge funds and institutional investors spend millions of dollars on analysts with MBAs and PhDs, who are industry experts and well connected to other industry and media insiders on top of that. Individual investors can piggyback the hedge funds employing these talents and can benefit from their vast resources and knowledge in that way. We analyze quarterly 13F filings of nearly 750 hedge funds and, by looking at the smart money sentiment that surrounds a stock, we can determine whether it has the potential to beat the market over the long-term. Therefore, let’s take a closer look at what smart money thinks about Integer Holdings Corporation (NYSE:ITGR).

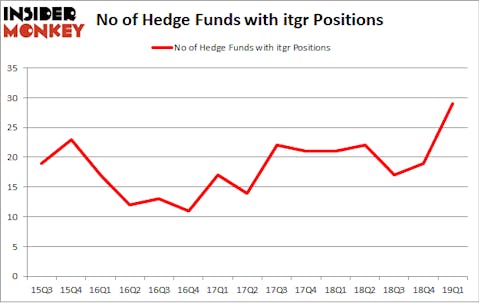

Integer Holdings Corporation (NYSE:ITGR) investors should be aware of an increase in hedge fund interest recently. Our calculations also showed that itgr isn’t among the 30 most popular stocks among hedge funds.

In today’s marketplace there are a large number of tools stock traders have at their disposal to assess publicly traded companies. A couple of the less known tools are hedge fund and insider trading activity. We have shown that, historically, those who follow the best picks of the top money managers can outclass their index-focused peers by a healthy margin (see the details here).

We’re going to view the key hedge fund action encompassing Integer Holdings Corporation (NYSE:ITGR).

What does the smart money think about Integer Holdings Corporation (NYSE:ITGR)?

At Q1’s end, a total of 29 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 53% from one quarter earlier. On the other hand, there were a total of 21 hedge funds with a bullish position in ITGR a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Ken Fisher’s Fisher Asset Management has the largest position in Integer Holdings Corporation (NYSE:ITGR), worth close to $91.7 million, amounting to 0.1% of its total 13F portfolio. The second largest stake is held by GLG Partners, managed by Noam Gottesman, which holds a $43.9 million position; the fund has 0.2% of its 13F portfolio invested in the stock. Remaining members of the smart money that are bullish include Israel Englander’s Millennium Management, Joel Greenblatt’s Gotham Asset Management and Paul Marshall and Ian Wace’s Marshall Wace LLP.

As one would reasonably expect, key money managers have been driving this bullishness. Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, initiated the most outsized position in Integer Holdings Corporation (NYSE:ITGR). Arrowstreet Capital had $2 million invested in the company at the end of the quarter. Matthew Hulsizer’s PEAK6 Capital Management also made a $1.3 million investment in the stock during the quarter. The following funds were also among the new ITGR investors: John Overdeck and David Siegel’s Two Sigma Advisors, Michael Gelband’s ExodusPoint Capital, and Mike Vranos’s Ellington.

Let’s now review hedge fund activity in other stocks similar to Integer Holdings Corporation (NYSE:ITGR). These stocks are Triton International Limited (NYSE:TRTN), Acceleron Pharma Inc (NASDAQ:XLRN), American Equity Investment Life Holding Company (NYSE:AEL), and Greif, Inc. (NYSE:GEF). This group of stocks’ market valuations are closest to ITGR’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TRTN | 18 | 59347 | 7 |

| XLRN | 21 | 356860 | 2 |

| AEL | 17 | 84260 | 0 |

| GEF | 21 | 141411 | 1 |

| Average | 19.25 | 160470 | 2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 19.25 hedge funds with bullish positions and the average amount invested in these stocks was $160 million. That figure was $242 million in ITGR’s case. Acceleron Pharma Inc (NASDAQ:XLRN) is the most popular stock in this table. On the other hand American Equity Investment Life Holding Company (NYSE:AEL) is the least popular one with only 17 bullish hedge fund positions. Compared to these stocks Integer Holdings Corporation (NYSE:ITGR) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately ITGR wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on ITGR were disappointed as the stock returned -5.8% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market in Q2.

Disclosure: None. This article was originally published at Insider Monkey.