Looking for stocks with high upside potential? Just follow the big players within the hedge fund industry. Why should you do so? Let’s take a brief look at what statistics have to say about hedge funds’ stock picking abilities to illustrate. The Standard and Poor’s 500 Index returned approximately 12.1% in 2019 (through May 30th). Conversely, hedge funds’ 20 preferred S&P 500 stocks generated a return of 18.7% during the same period, with the majority of these stock picks outperforming the broader market benchmark. Coincidence? It might happen to be so, but it is unlikely. Our research covering the last 18 years indicates that hedge funds’ stock picks generate superior risk-adjusted returns. That’s why we believe it is wise to check hedge fund activity before you invest your time or your savings on a stock like Home Bancshares, Inc. (Conway, AR) (NASDAQ:HOMB).

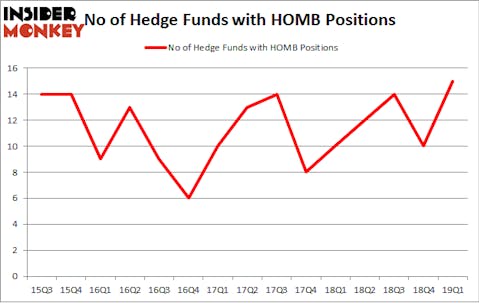

Is Home Bancshares, Inc. (Conway, AR) (NASDAQ:HOMB) an exceptional investment now? Investors who are in the know are taking a bullish view. The number of bullish hedge fund bets rose by 5 recently. Our calculations also showed that homb isn’t among the 30 most popular stocks among hedge funds. HOMB was in 15 hedge funds’ portfolios at the end of March. There were 10 hedge funds in our database with HOMB positions at the end of the previous quarter.

In the 21st century investor’s toolkit there are many methods stock market investors can use to appraise stocks. A couple of the most underrated methods are hedge fund and insider trading signals. Our researchers have shown that, historically, those who follow the best picks of the best fund managers can outperform their index-focused peers by a very impressive amount (see the details here).

We’re going to take a peek at the fresh hedge fund action surrounding Home Bancshares, Inc. (Conway, AR) (NASDAQ:HOMB).

How are hedge funds trading Home Bancshares, Inc. (Conway, AR) (NASDAQ:HOMB)?

Heading into the second quarter of 2019, a total of 15 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 50% from the previous quarter. By comparison, 10 hedge funds held shares or bullish call options in HOMB a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Home Bancshares, Inc. (Conway, AR) (NASDAQ:HOMB) was held by Balyasny Asset Management, which reported holding $9.9 million worth of stock at the end of March. It was followed by Basswood Capital with a $4.1 million position. Other investors bullish on the company included Citadel Investment Group, Renaissance Technologies, and GLG Partners.

As aggregate interest increased, key hedge funds have jumped into Home Bancshares, Inc. (Conway, AR) (NASDAQ:HOMB) headfirst. GLG Partners, managed by Noam Gottesman, established the most valuable position in Home Bancshares, Inc. (Conway, AR) (NASDAQ:HOMB). GLG Partners had $2 million invested in the company at the end of the quarter. Benjamin A. Smith’s Laurion Capital Management also initiated a $1.3 million position during the quarter. The other funds with new positions in the stock are Steve Cohen’s Point72 Asset Management, D. E. Shaw’s D E Shaw, and Roger Ibbotson’s Zebra Capital Management.

Let’s now review hedge fund activity in other stocks similar to Home Bancshares, Inc. (Conway, AR) (NASDAQ:HOMB). We will take a look at South Jersey Industries Inc (NYSE:SJI), Novanta Inc. (NASDAQ:NOVT), Federated Investors Inc (NYSE:FII), and CVB Financial Corp. (NASDAQ:CVBF). This group of stocks’ market valuations match HOMB’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SJI | 11 | 60289 | -1 |

| NOVT | 17 | 122951 | -2 |

| FII | 13 | 131316 | -2 |

| CVBF | 12 | 41422 | 3 |

| Average | 13.25 | 88995 | -0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13.25 hedge funds with bullish positions and the average amount invested in these stocks was $89 million. That figure was $30 million in HOMB’s case. Novanta Inc. (NASDAQ:NOVT) is the most popular stock in this table. On the other hand South Jersey Industries Inc (NYSE:SJI) is the least popular one with only 11 bullish hedge fund positions. Home Bancshares, Inc. (Conway, AR) (NASDAQ:HOMB) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Hedge funds were also right about betting on HOMB as the stock returned 7.7% during the same period and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.