A whopping number of 13F filings filed with U.S. Securities and Exchange Commission has been processed by Insider Monkey so that individual investors can look at the overall hedge fund sentiment towards the stocks included in their watchlists. These freshly-submitted public filings disclose money managers’ equity positions as of the end of the three-month period that ended March 31, so let’s proceed with the discussion of the hedge fund sentiment on Gol Linhas Aereas Inteligentes SA (NYSE:GOL).

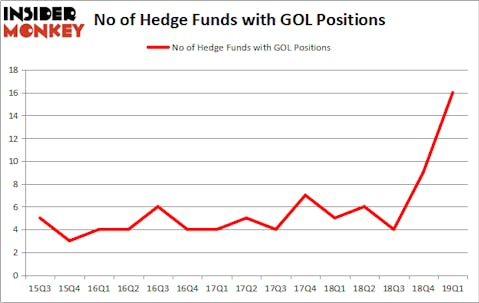

Is Gol Linhas Aereas Inteligentes SA (NYSE:GOL) ready to rally soon? Prominent investors are taking a bullish view. The number of long hedge fund positions increased by 7 lately. Our calculations also showed that GOL isn’t among the 30 most popular stocks among hedge funds. GOL was in 16 hedge funds’ portfolios at the end of the first quarter of 2019. There were 9 hedge funds in our database with GOL positions at the end of the previous quarter.

If you’d ask most investors, hedge funds are seen as unimportant, old financial tools of yesteryear. While there are greater than 8000 funds in operation at the moment, Our experts choose to focus on the top tier of this group, about 750 funds. These hedge fund managers manage the lion’s share of all hedge funds’ total capital, and by paying attention to their best investments, Insider Monkey has deciphered many investment strategies that have historically outperformed the market. Insider Monkey’s flagship hedge fund strategy surpassed the S&P 500 index by around 5 percentage points annually since its inception in May 2014 through June 18th. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 28.2% since February 2017 (through June 18th) even though the market was up nearly 30% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 8.2% in a month whereas our long picks outperformed the market by 2.5 percentage points in this volatile 5 week period (our long picks also beat the market by 15 percentage points so far this year).

We’re going to take a look at the new hedge fund action encompassing Gol Linhas Aereas Inteligentes SA (NYSE:GOL).

How have hedgies been trading Gol Linhas Aereas Inteligentes SA (NYSE:GOL)?

At Q1’s end, a total of 16 of the hedge funds tracked by Insider Monkey were long this stock, a change of 78% from the fourth quarter of 2018. Below, you can check out the change in hedge fund sentiment towards GOL over the last 15 quarters. With hedge funds’ capital changing hands, there exists a select group of key hedge fund managers who were upping their holdings meaningfully (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Contrarian Capital, managed by Jon Bauer, holds the largest position in Gol Linhas Aereas Inteligentes SA (NYSE:GOL). Contrarian Capital has a $91.1 million position in the stock, comprising 8.1% of its 13F portfolio. The second most bullish fund manager is Renaissance Technologies, led by Jim Simons, holding a $42.9 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Some other hedge funds and institutional investors that hold long positions consist of Israel Englander’s Millennium Management, Jonathan Barrett and Paul Segal’s Luminus Management and Ken Heebner’s Capital Growth Management.

With a general bullishness amongst the heavyweights, specific money managers have been driving this bullishness. Luminus Management, managed by Jonathan Barrett and Paul Segal, established the biggest position in Gol Linhas Aereas Inteligentes SA (NYSE:GOL). Luminus Management had $14.7 million invested in the company at the end of the quarter. Ken Heebner’s Capital Growth Management also made a $5.7 million investment in the stock during the quarter. The other funds with brand new GOL positions are Benjamin A. Smith’s Laurion Capital Management, Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital, and Ken Griffin’s Citadel Investment Group.

Let’s now review hedge fund activity in other stocks similar to Gol Linhas Aereas Inteligentes SA (NYSE:GOL). These stocks are The Geo Group, Inc. (NYSE:GEO), GreenSky, Inc. (NASDAQ:GSKY), Albany International Corp. (NYSE:AIN), and Oi SA (NYSE:OIBR). This group of stocks’ market values match GOL’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GEO | 18 | 117240 | 0 |

| GSKY | 15 | 68872 | -5 |

| AIN | 16 | 87031 | 5 |

| OIBR | 21 | 826627 | 0 |

| Average | 17.5 | 274943 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17.5 hedge funds with bullish positions and the average amount invested in these stocks was $275 million. That figure was $194 million in GOL’s case. Oi SA (NYSE:OIBR) is the most popular stock in this table. On the other hand GreenSky, Inc. (NASDAQ:GSKY) is the least popular one with only 15 bullish hedge fund positions. Gol Linhas Aereas Inteligentes SA (NYSE:GOL) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. A small number of hedge funds were also right about betting on GOL as the stock returned 30.6% during the same time frame and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.