Concerns over rising interest rates and expected further rate increases have hit several stocks hard during the fourth quarter. Trends reversed 180 degrees during the first quarter amid Powell’s pivot and optimistic expectations towards a trade deal with China. Hedge funds and institutional investors tracked by Insider Monkey usually invest a disproportionate amount of their portfolios in smaller cap stocks. We have been receiving indications that hedge funds were increasing their overall exposure in the first quarter and this is one of the factors behind the recent movements in major indices. In this article, we will take a closer look at hedge fund sentiment towards Front Yard Residential Corporation (NYSE:RESI).

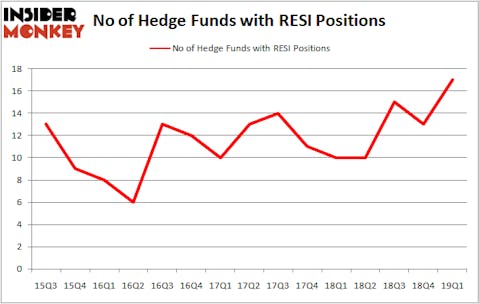

Is Front Yard Residential Corporation (NYSE:RESI) a healthy stock for your portfolio? Prominent investors are becoming more confident. The number of bullish hedge fund bets inched up by 4 lately. Our calculations also showed that RESI isn’t among the 30 most popular stocks among hedge funds. RESI was in 17 hedge funds’ portfolios at the end of the first quarter of 2019. There were 13 hedge funds in our database with RESI positions at the end of the previous quarter.

In today’s marketplace there are a lot of signals stock market investors use to appraise their holdings. Two of the most useful signals are hedge fund and insider trading indicators. Our researchers have shown that, historically, those who follow the top picks of the best hedge fund managers can trounce their index-focused peers by a solid margin (see the details here).

Noam Gottesman, GLG Partners

Let’s take a look at the new hedge fund action encompassing Front Yard Residential Corporation (NYSE:RESI).

What does the smart money think about Front Yard Residential Corporation (NYSE:RESI)?

At Q1’s end, a total of 17 of the hedge funds tracked by Insider Monkey were long this stock, a change of 31% from the previous quarter. On the other hand, there were a total of 10 hedge funds with a bullish position in RESI a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Snow Park Capital Partners held the most valuable stake in Front Yard Residential Corporation (NYSE:RESI), which was worth $5.4 million at the end of the first quarter. On the second spot was Millennium Management which amassed $3.6 million worth of shares. Moreover, Citadel Investment Group, Ellington, and GLG Partners were also bullish on Front Yard Residential Corporation (NYSE:RESI), allocating a large percentage of their portfolios to this stock.

As industrywide interest jumped, key hedge funds were breaking ground themselves. Millennium Management, managed by Israel Englander, initiated the largest position in Front Yard Residential Corporation (NYSE:RESI). Millennium Management had $3.6 million invested in the company at the end of the quarter. Mike Vranos’s Ellington also initiated a $2.5 million position during the quarter. The other funds with brand new RESI positions are Noam Gottesman’s GLG Partners, Leon Cooperman’s Omega Advisors, and Jim Simons’s Renaissance Technologies.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Front Yard Residential Corporation (NYSE:RESI) but similarly valued. We will take a look at Amalgamated Bank (NASDAQ:AMAL), Chico’s FAS, Inc. (NYSE:CHS), Intrepid Potash, Inc. (NYSE:IPI), and Mesoblast Limited (NASDAQ:MESO). This group of stocks’ market caps match RESI’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AMAL | 9 | 54058 | 3 |

| CHS | 15 | 57902 | 1 |

| IPI | 14 | 33819 | -3 |

| MESO | 1 | 663 | 0 |

| Average | 9.75 | 36611 | 0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 9.75 hedge funds with bullish positions and the average amount invested in these stocks was $37 million. That figure was $26 million in RESI’s case. Chico’s FAS, Inc. (NYSE:CHS) is the most popular stock in this table. On the other hand Mesoblast Limited (NASDAQ:MESO) is the least popular one with only 1 bullish hedge fund positions. Compared to these stocks Front Yard Residential Corporation (NYSE:RESI) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on RESI as the stock returned 23.9% during the same period and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.