Hedge Funds and other institutional investors have just completed filing their 13Fs with the Securities and Exchange Commission, revealing their equity portfolios as of the end of March. At Insider Monkey, we follow nearly 750 active hedge funds and notable investors and by analyzing their 13F filings, we can determine the stocks that they are collectively bullish on. One of their picks is Exantas Capital Corp. (NYSE:XAN), so let’s take a closer look at the sentiment that surrounds it in the current quarter.

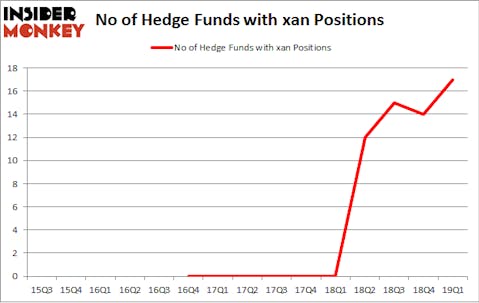

Exantas Capital Corp. (NYSE:XAN) investors should pay attention to an increase in hedge fund interest recently. XAN was in 17 hedge funds’ portfolios at the end of the first quarter of 2019. There were 14 hedge funds in our database with XAN positions at the end of the previous quarter. Our calculations also showed that xan isn’t among the 30 most popular stocks among hedge funds.

At the moment there are tons of indicators shareholders have at their disposal to analyze stocks. Some of the most innovative indicators are hedge fund and insider trading sentiment. We have shown that, historically, those who follow the best picks of the top money managers can trounce the market by a significant margin (see the details here).

Let’s go over the fresh hedge fund action regarding Exantas Capital Corp. (NYSE:XAN).

How are hedge funds trading Exantas Capital Corp. (NYSE:XAN)?

Heading into the second quarter of 2019, a total of 17 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 21% from the fourth quarter of 2018. The graph below displays the number of hedge funds with bullish position in XAN over the last 15 quarters. With hedge funds’ capital changing hands, there exists a select group of notable hedge fund managers who were upping their holdings substantially (or already accumulated large positions).

Among these funds, HBK Investments held the most valuable stake in Exantas Capital Corp. (NYSE:XAN), which was worth $16.3 million at the end of the first quarter. On the second spot was Indaba Capital Management which amassed $10.1 million worth of shares. Moreover, Forward Management, Ancora Advisors, and Millennium Management were also bullish on Exantas Capital Corp. (NYSE:XAN), allocating a large percentage of their portfolios to this stock.

As industrywide interest jumped, key hedge funds have jumped into Exantas Capital Corp. (NYSE:XAN) headfirst. Marshall Wace LLP, managed by Paul Marshall and Ian Wace, created the biggest position in Exantas Capital Corp. (NYSE:XAN). Marshall Wace LLP had $1.3 million invested in the company at the end of the quarter. Bruce Kovner’s Caxton Associates LP also initiated a $0.5 million position during the quarter. The following funds were also among the new XAN investors: Anand Parekh’s Alyeska Investment Group and Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital.

Let’s now take a look at hedge fund activity in other stocks similar to Exantas Capital Corp. (NYSE:XAN). These stocks are Kezar Life Sciences, Inc. (NASDAQ:KZR), Macatawa Bank Corporation (NASDAQ:MCBC), West Bancorporation, Inc. (NASDAQ:WTBA), and Oppenheimer Holdings Inc. (NYSE:OPY). This group of stocks’ market valuations are similar to XAN’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| KZR | 8 | 52697 | 4 |

| MCBC | 5 | 22822 | -1 |

| WTBA | 2 | 7728 | -1 |

| OPY | 9 | 35085 | 1 |

| Average | 6 | 29583 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 6 hedge funds with bullish positions and the average amount invested in these stocks was $30 million. That figure was $62 million in XAN’s case. Oppenheimer Holdings Inc. (NYSE:OPY) is the most popular stock in this table. On the other hand West Bancorporation, Inc. (NASDAQ:WTBA) is the least popular one with only 2 bullish hedge fund positions. Compared to these stocks Exantas Capital Corp. (NYSE:XAN) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on XAN as the stock returned 4.1% during the same period and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.