Is Envestnet Inc (NYSE:ENV) a good investment right now? We check hedge fund and billionaire investor sentiment before delving into hours of research. Hedge funds spend millions of dollars on Ivy League graduates, expert networks, and get tips from investment bankers and industry insiders. Sure they sometimes fail miserably, but their consensus stock picks historically outperformed the market after adjusting for known risk factors.

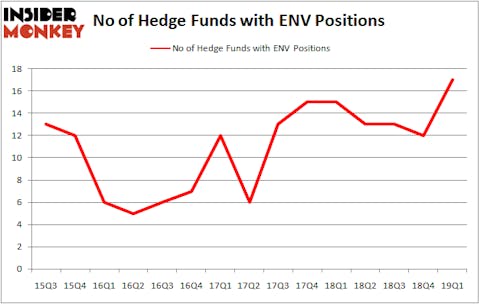

Envestnet Inc (NYSE:ENV) was in 17 hedge funds’ portfolios at the end of the first quarter of 2019. ENV shareholders have witnessed an increase in support from the world’s most elite money managers in recent months. There were 12 hedge funds in our database with ENV holdings at the end of the previous quarter. Our calculations also showed that ENV isn’t among the 30 most popular stocks among hedge funds.

To most market participants, hedge funds are seen as unimportant, old financial vehicles of years past. While there are over 8000 funds with their doors open at the moment, Our researchers hone in on the elite of this club, around 750 funds. Most estimates calculate that this group of people administer the lion’s share of the hedge fund industry’s total capital, and by watching their first-class investments, Insider Monkey has uncovered numerous investment strategies that have historically outpaced the market. Insider Monkey’s flagship hedge fund strategy outperformed the S&P 500 index by around 5 percentage points annually since its inception in May 2014 through June 18th. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 28.2% since February 2017 (through June 18th) even though the market was up nearly 30% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 8.2% in a month whereas our long picks outperformed the market by 2.5 percentage points in this volatile 5 week period (our long picks also beat the market by 15 percentage points so far this year).

Let’s check out the recent hedge fund action encompassing Envestnet Inc (NYSE:ENV).

What does smart money think about Envestnet Inc (NYSE:ENV)?

At Q1’s end, a total of 17 of the hedge funds tracked by Insider Monkey were long this stock, a change of 42% from the fourth quarter of 2018. The graph below displays the number of hedge funds with bullish position in ENV over the last 15 quarters. With the smart money’s sentiment swirling, there exists a select group of notable hedge fund managers who were adding to their holdings significantly (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Select Equity Group, managed by Robert Joseph Caruso, holds the most valuable position in Envestnet Inc (NYSE:ENV). Select Equity Group has a $48.2 million position in the stock, comprising 0.3% of its 13F portfolio. On Select Equity Group’s heels is Echo Street Capital Management, led by Greg Poole, holding a $24.6 million position; 0.5% of its 13F portfolio is allocated to the company. Remaining members of the smart money that hold long positions contain David Atterbury’s Whetstone Capital Advisors, Ian Simm’s Impax Asset Management and Noam Gottesman’s GLG Partners.

As one would reasonably expect, key money managers were leading the bulls’ herd. Renaissance Technologies, managed by Jim Simons, initiated the most valuable position in Envestnet Inc (NYSE:ENV). Renaissance Technologies had $2.4 million invested in the company at the end of the quarter. Brandon Haley’s Holocene Advisors also made a $0.6 million investment in the stock during the quarter. The other funds with brand new ENV positions are Bruce Kovner’s Caxton Associates LP, Guy Shahar’s DSAM Partners, and Paul Marshall and Ian Wace’s Marshall Wace LLP.

Let’s check out hedge fund activity in other stocks similar to Envestnet Inc (NYSE:ENV). These stocks are UMB Financial Corporation (NASDAQ:UMBF), Energizer Holdings, Inc. (NYSE:ENR), Urban Outfitters, Inc. (NASDAQ:URBN), and Five9 Inc (NASDAQ:FIVN). All of these stocks’ market caps match ENV’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| UMBF | 9 | 49060 | -2 |

| ENR | 24 | 254116 | 3 |

| URBN | 25 | 415387 | -3 |

| FIVN | 25 | 524383 | -3 |

| Average | 20.75 | 310737 | -1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 20.75 hedge funds with bullish positions and the average amount invested in these stocks was $311 million. That figure was $104 million in ENV’s case. Urban Outfitters, Inc. (NASDAQ:URBN) is the most popular stock in this table. On the other hand UMB Financial Corporation (NASDAQ:UMBF) is the least popular one with only 9 bullish hedge fund positions. Envestnet Inc (NYSE:ENV) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. A small number of hedge funds were also right about betting on ENV as the stock returned 7% during the same time frame and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.