At Insider Monkey, we pore over the filings of nearly 750 top investment firms every quarter, a process we have now completed for the latest reporting period. The data we’ve gathered as a result gives us access to a wealth of collective knowledge based on these firms’ portfolio holdings as of March 31. In this article, we will use that wealth of knowledge to determine whether or not Covetrus, Inc. (NASDAQ:CVET) makes for a good investment right now.

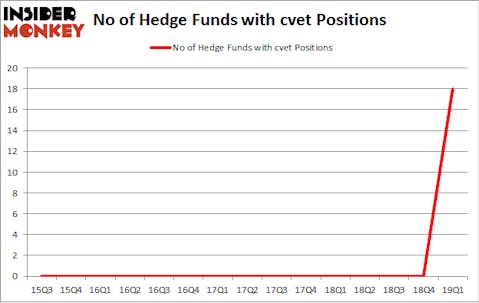

Is Covetrus, Inc. (NASDAQ:CVET) ready to rally soon? The best stock pickers are turning bullish. The number of bullish hedge fund positions inched up by 18 lately. Our calculations also showed that cvet isn’t among the 30 most popular stocks among hedge funds. CVET was in 18 hedge funds’ portfolios at the end of the first quarter of 2019. There were 0 hedge funds in our database with CVET positions at the end of the previous quarter.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to take a peek at the recent hedge fund action encompassing Covetrus, Inc. (NASDAQ:CVET).

How are hedge funds trading Covetrus, Inc. (NASDAQ:CVET)?

Heading into the second quarter of 2019, a total of 18 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 18 from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards CVET over the last 15 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Lei Zhang’s Hillhouse Capital Management has the number one position in Covetrus, Inc. (NASDAQ:CVET), worth close to $148.7 million, amounting to 6.2% of its total 13F portfolio. Coming in second is Viking Global, managed by Andreas Halvorsen, which holds a $123.9 million position; 0.7% of its 13F portfolio is allocated to the stock. Some other peers that hold long positions comprise David Blood and Al Gore’s Generation Investment Management, Robert Joseph Caruso’s Select Equity Group and Kris Jenner, Gordon Bussard, Graham McPhail’s Rock Springs Capital Management.

Now, key hedge funds have been driving this bullishness. Hillhouse Capital Management, managed by Lei Zhang, initiated the biggest position in Covetrus, Inc. (NASDAQ:CVET). Hillhouse Capital Management had $148.7 million invested in the company at the end of the quarter. Andreas Halvorsen’s Viking Global also initiated a $123.9 million position during the quarter. The other funds with brand new CVET positions are David Blood and Al Gore’s Generation Investment Management, Robert Joseph Caruso’s Select Equity Group, and Kris Jenner, Gordon Bussard, Graham McPhail’s Rock Springs Capital Management.

Let’s now take a look at hedge fund activity in other stocks similar to Covetrus, Inc. (NASDAQ:CVET). These stocks are Macquarie Infrastructure Corporation (NYSE:MIC), Blueprint Medicines Corporation (NASDAQ:BPMC), Liberty Latin America Ltd. (NASDAQ:LILAK), and Sinclair Broadcast Group, Inc. (NASDAQ:SBGI). This group of stocks’ market valuations match CVET’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MIC | 24 | 221709 | -4 |

| BPMC | 32 | 632126 | 10 |

| LILAK | 18 | 416954 | -1 |

| SBGI | 28 | 496817 | -5 |

| Average | 25.5 | 441902 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 25.5 hedge funds with bullish positions and the average amount invested in these stocks was $442 million. That figure was $537 million in CVET’s case. Blueprint Medicines Corporation (NASDAQ:BPMC) is the most popular stock in this table. On the other hand LiLAC Group (NASDAQ:LILAK) is the least popular one with only 18 bullish hedge fund positions. Compared to these stocks Covetrus, Inc. (NASDAQ:CVET) is even less popular than LILAK. Hedge funds dodged a bullet by taking a bearish stance towards CVET. Our calculations showed that the top 15 most popular hedge fund stocks returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately CVET wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was very bearish); CVET investors were disappointed as the stock returned -20.9% during the same time frame and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in the second quarter.

Disclosure: None. This article was originally published at Insider Monkey.