Hedge funds and other investment firms run by legendary investors like Israel Englander, Jeffrey Talpins and Ray Dalio are entrusted to manage billions of dollars of accredited investors’ money because they are without peer in the resources they use to identify the best investments for their chosen investment horizon. Moreover, they are more willing to invest a greater amount of their resources in small-cap stocks than big brokerage houses, and this is often where they generate their outperformance, which is why we pay particular attention to their best ideas in this space.

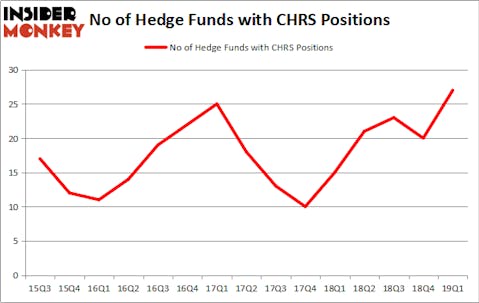

Is Coherus Biosciences Inc (NASDAQ:CHRS) a sound stock to buy now? Prominent investors are becoming more confident. The number of long hedge fund positions inched up by 7 lately. Our calculations also showed that CHRS isn’t among the 30 most popular stocks among hedge funds.

If you’d ask most market participants, hedge funds are perceived as unimportant, old investment vehicles of years past. While there are over 8000 funds in operation at present, We choose to focus on the aristocrats of this club, approximately 750 funds. These hedge fund managers orchestrate the majority of all hedge funds’ total capital, and by monitoring their unrivaled stock picks, Insider Monkey has determined numerous investment strategies that have historically outstripped the broader indices. Insider Monkey’s flagship hedge fund strategy outpaced the S&P 500 index by around 5 percentage points per annum since its inception in May 2014 through the end of May. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 30.9% since February 2017 (through May 30th) even though the market was up nearly 24% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 11.9% in less than a couple of weeks whereas our long picks outperformed the market by 2 percentage points in this volatile 2 week period.

Let’s review the new hedge fund action regarding Coherus Biosciences Inc (NASDAQ:CHRS).

Hedge fund activity in Coherus Biosciences Inc (NASDAQ:CHRS)

Heading into the second quarter of 2019, a total of 27 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 35% from the fourth quarter of 2018. On the other hand, there were a total of 15 hedge funds with a bullish position in CHRS a year ago. With hedge funds’ sentiment swirling, there exists an “upper tier” of notable hedge fund managers who were increasing their holdings considerably (or already accumulated large positions).

Of the funds tracked by Insider Monkey, David Rosen’s Rubric Capital Management has the biggest position in Coherus Biosciences Inc (NASDAQ:CHRS), worth close to $36 million, accounting for 3.4% of its total 13F portfolio. The second most bullish fund manager is Citadel Investment Group, managed by Ken Griffin, which holds a $34.3 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Other peers with similar optimism consist of Jonathan Auerbach’s Hound Partners, Phill Gross and Robert Atchinson’s Adage Capital Management and Christopher James’s Partner Fund Management.

With a general bullishness amongst the heavyweights, some big names were breaking ground themselves. Partner Fund Management, managed by Christopher James, assembled the most valuable position in Coherus Biosciences Inc (NASDAQ:CHRS). Partner Fund Management had $12.9 million invested in the company at the end of the quarter. Steve Cohen’s Point72 Asset Management also made a $12.5 million investment in the stock during the quarter. The other funds with brand new CHRS positions are Israel Englander’s Millennium Management, Ken Greenberg and David Kim’s Ghost Tree Capital, and Krishen Sud’s Sivik Global Healthcare.

Let’s go over hedge fund activity in other stocks similar to Coherus Biosciences Inc (NASDAQ:CHRS). These stocks are CONSOL Energy Inc. (NYSE:CEIX), Denbury Resources Inc. (NYSE:DNR), Rhythm Pharmaceuticals, Inc. (NASDAQ:RYTM), and Knoll Inc (NYSE:KNL). This group of stocks’ market values are similar to CHRS’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CEIX | 19 | 130215 | -6 |

| DNR | 17 | 43885 | -4 |

| RYTM | 11 | 188006 | 1 |

| KNL | 19 | 55434 | -3 |

| Average | 16.5 | 104385 | -3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.5 hedge funds with bullish positions and the average amount invested in these stocks was $104 million. That figure was $199 million in CHRS’s case. CNX Resources Corporation (NYSE:CEIX) is the most popular stock in this table. On the other hand Rhythm Pharmaceuticals, Inc. (NASDAQ:RYTM) is the least popular one with only 11 bullish hedge fund positions. Compared to these stocks Coherus Biosciences Inc (NASDAQ:CHRS) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on CHRS as the stock returned 42.9% during the same period and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.