Does Cision Ltd. (NYSE:CISN) represent a good buying opportunity at the moment? Let’s quickly check the hedge fund interest towards the company. Hedge fund firms constantly search out bright intellectuals and highly-experienced employees and throw away millions of dollars on satellite photos and other research activities, so it is no wonder why they tend to generate millions in profits each year. It is also true that some hedge fund players fail inconceivably on some occasions, but net net their stock picks have been generating superior risk-adjusted returns on average over the years.

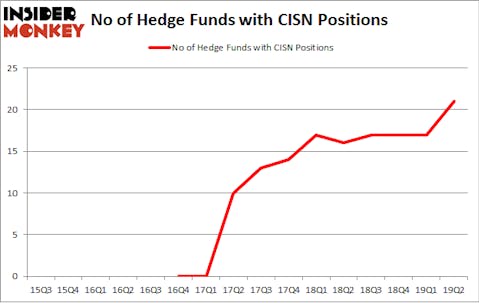

Cision Ltd. (NYSE:CISN) investors should be aware of an increase in activity from the world’s largest hedge funds in recent months. CISN was in 21 hedge funds’ portfolios at the end of June. There were 17 hedge funds in our database with CISN holdings at the end of the previous quarter. Our calculations also showed that CISN isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 25.7% through September 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to take a look at the new hedge fund action surrounding Cision Ltd. (NYSE:CISN).

Hedge fund activity in Cision Ltd. (NYSE:CISN)

Heading into the third quarter of 2019, a total of 21 of the hedge funds tracked by Insider Monkey were long this stock, a change of 24% from one quarter earlier. By comparison, 16 hedge funds held shares or bullish call options in CISN a year ago. With hedge funds’ positions undergoing their usual ebb and flow, there exists an “upper tier” of key hedge fund managers who were increasing their holdings considerably (or already accumulated large positions).

The largest stake in Cision Ltd. (NYSE:CISN) was held by Cardinal Capital, which reported holding $25.2 million worth of stock at the end of March. It was followed by Pennant Capital Management with a $17.9 million position. Other investors bullish on the company included Rubric Capital Management, Steadfast Capital Management, and Marshall Wace LLP.

Now, key hedge funds have been driving this bullishness. Cardinal Capital, managed by Amy Minella, assembled the most outsized position in Cision Ltd. (NYSE:CISN). Cardinal Capital had $25.2 million invested in the company at the end of the quarter. David Rosen’s Rubric Capital Management also made a $15.2 million investment in the stock during the quarter. The other funds with new positions in the stock are Genevieve Kahr’s Ailanthus Capital Management, Thomas Bailard’s Bailard Inc, and Matthew Hulsizer’s PEAK6 Capital Management.

Let’s now take a look at hedge fund activity in other stocks similar to Cision Ltd. (NYSE:CISN). We will take a look at Knowles Corporation (NYSE:KN), Mueller Industries, Inc. (NYSE:MLI), National Storage Affiliates Trust (NYSE:NSA), and Ironwood Pharmaceuticals, Inc. (NASDAQ:IRWD). This group of stocks’ market values are closest to CISN’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| KN | 22 | 264759 | 5 |

| MLI | 15 | 195723 | 2 |

| NSA | 18 | 131987 | 2 |

| IRWD | 21 | 305653 | -2 |

| Average | 19 | 224531 | 1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 19 hedge funds with bullish positions and the average amount invested in these stocks was $225 million. That figure was $103 million in CISN’s case. Knowles Corporation (NYSE:KN) is the most popular stock in this table. On the other hand Mueller Industries, Inc. (NYSE:MLI) is the least popular one with only 15 bullish hedge fund positions. Cision Ltd. (NYSE:CISN) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately CISN wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on CISN were disappointed as the stock returned -34.4% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Disclosure: None. This article was originally published at Insider Monkey.