Hedge funds are not perfect. They have their bad picks just like everyone else. Facebook, a stock hedge funds have loved dearly, lost nearly 40% of its value at one point in 2018. Although hedge funds are not perfect, their consensus picks do deliver solid returns, however. Our data show the top 20 S&P 500 stocks among hedge funds beat the S&P 500 Index by more than 8 percentage points so far in 2019. Because hedge funds have a lot of resources and their consensus picks do well, we pay attention to what they think. In this article, we analyze what the elite funds think of CarMax Inc (NYSE:KMX).

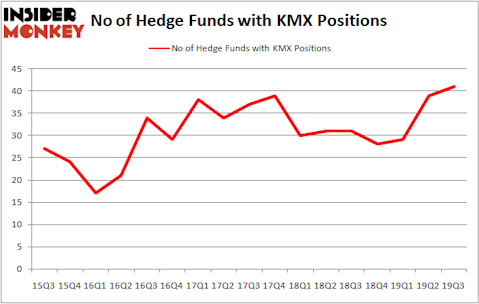

Is CarMax Inc (NYSE:KMX) the right investment to pursue these days? The smart money is turning bullish. The number of bullish hedge fund bets advanced by 2 recently. Our calculations also showed that KMX isn’t among the 30 most popular stocks among hedge funds. KMX was in 41 hedge funds’ portfolios at the end of the third quarter of 2019. There were 39 hedge funds in our database with KMX positions at the end of the previous quarter.

In today’s marketplace there are a large number of formulas stock traders have at their disposal to assess stocks. A pair of the less known formulas are hedge fund and insider trading moves. We have shown that, historically, those who follow the best picks of the best fund managers can outperform their index-focused peers by a healthy margin (see the details here).

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. Let’s view the key hedge fund action regarding CarMax Inc (NYSE:KMX).

What have hedge funds been doing with CarMax Inc (NYSE:KMX)?

Heading into the fourth quarter of 2019, a total of 41 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 5% from the previous quarter. On the other hand, there were a total of 31 hedge funds with a bullish position in KMX a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Akre Capital Management held the most valuable stake in CarMax Inc (NYSE:KMX), which was worth $553.1 million at the end of the third quarter. On the second spot was Markel Gayner Asset Management which amassed $432.4 million worth of shares. Palestra Capital Management, Giverny Capital, and D E Shaw were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Lansing Management allocated the biggest weight to CarMax Inc (NYSE:KMX), around 16.34% of its portfolio. Giverny Capital is also relatively very bullish on the stock, earmarking 10.73 percent of its 13F equity portfolio to KMX.

As aggregate interest increased, specific money managers were leading the bulls’ herd. Renaissance Technologies, created the most outsized position in CarMax Inc (NYSE:KMX). Renaissance Technologies had $40.9 million invested in the company at the end of the quarter. Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital also made a $25.8 million investment in the stock during the quarter. The other funds with brand new KMX positions are Peter Muller’s PDT Partners, Robert Pohly’s Samlyn Capital, and David E. Shaw’s D E Shaw.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as CarMax Inc (NYSE:KMX) but similarly valued. We will take a look at Brookfield Infrastructure Partners L.P. (NYSE:BIP), Genuine Parts Company (NYSE:GPC), Franklin Resources, Inc. (NYSE:BEN), and Darden Restaurants, Inc. (NYSE:DRI). This group of stocks’ market valuations are similar to KMX’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BIP | 7 | 54208 | 0 |

| GPC | 20 | 186065 | 0 |

| BEN | 35 | 604294 | 10 |

| DRI | 28 | 812020 | 4 |

| Average | 22.5 | 414147 | 3.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 22.5 hedge funds with bullish positions and the average amount invested in these stocks was $414 million. That figure was $1887 million in KMX’s case. Franklin Resources, Inc. (NYSE:BEN) is the most popular stock in this table. On the other hand Brookfield Infrastructure Partners L.P. (NYSE:BIP) is the least popular one with only 7 bullish hedge fund positions. Compared to these stocks CarMax Inc (NYSE:KMX) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 34.7% in 2019 through November 22nd and outperformed the S&P 500 ETF (SPY) by 8.5 percentage points. Hedge funds were also right about betting on KMX as the stock returned 10.9% during Q4 (through 11/22) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.